Netflix and Apple Spar Over India's Video Streaming Market

Netflix NFLX and Apple AAPL are aggressively working toward strengthening their footprint in India’s rapidly-growing video streaming market. While Los Gatos-based streaming giant is focused on expanding its regional programming content, the iPhone maker is relying on an aggressive pricing strategy to reach a wider audience.

Reportedly, Netflix has inked a deal with India’s well-known filmmaker Karan Johar-owned Dharma Productions to develop original shows and movies. Johar’s association with the company dates back to Lust Stories, in which he directed one of the four short stories.

Meanwhile, Apple announced that its upcoming Apple TV+ will be available to Indian users for INR99 or $1.40 a month, much lower than $4.99 set for the U.S. audience. Apple TV+ will be exclusively available to its device users beginning Nov 1.

Apart from the rock-bottom pricing, the company’s partnership with ErosNow is expected to widen Apple’s prospects in India.

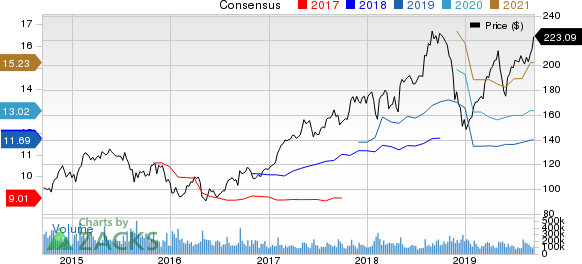

Apple Inc. Price and Consensus

Apple Inc. price-consensus-chart | Apple Inc. Quote

India a Hotbed for Streaming Content

India’s rapidly-expanding video streaming user base presents strong prospects for service providers like Netflix, Apple, Amazon AMZN, Disney DIS, Zee5, Alt Balaji, Voot and MX Player. Notably, the number of service providers has risen from nine to 30 over the last five years, thanks to the availability of cheaper data plans, improved Internet penetration and enhanced connectivity.

A recent KPMG India study estimates India to have 500 million streaming subscribers by 2023, up from the current 300 million. This will make India the second-biggest streaming market trailing China, where Netflix has no official present and Apple is struggling owing to the trade tussle with the United States.

The said report also stated that an Indian user is spending 70 minutes a day on online video platforms. Kantar IMRB expects India to have an Internet user base of 627 million and Google estimates 650 million users in 2019, opening up significant opportunity for streaming platforms like Netflix, Apple, Disney-owned Hotstar and Amazon Prime Video.

Notably, according to a Counterpoint Research survey, Hotstar leads the video streaming market in India trailed by Amazon Prime Video, SonyLiv, Netflix and Voot.

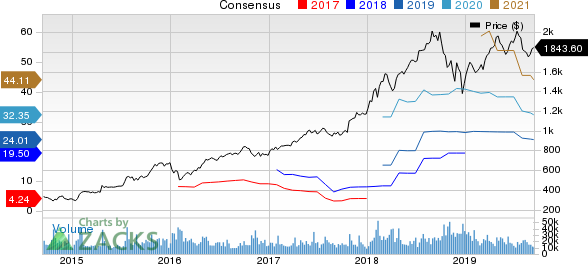

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

Moreover, Netflix along with Amazon Prime Video are highly popular in Indian metros. The countries top five metros account for more than 65% users of these platforms.

Hotstar Leads on Content Strength

Hotstar, currently owned by Disney after its acquisition of Fox, launched Hotstar Specials, to showcase its original programming content. Moreover, the Hotstar VIP is one of the cheapest OTT service (INR365/year) showcasing live sports, local content from Star India and web originals.

Hotstar’s focus on expanding original production is a key catalyst. The company, reportedly having 150 million users, has signed content deals with well-known directors including Shekhar Kapur, Neeraj Pandey and Kabir Khan.

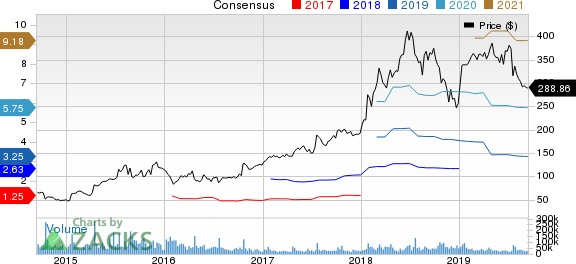

The Walt Disney Company Price and Consensus

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

Further, Hotstar may hog more attention if Disney decides to shift its popular content to the platform from Pixar, Marvel, Disney and Lucasfilm.

Netflix Gaining on Content Strength, Partnerships

Netflix tasted success with Sacred Games in India. Its shows like Ghoul, Selection Day, Little Things, Lust Stories and Delhi Crime was well-received by the audience as well as critics in India.

The company has announced new Hindi-language original series to be developed in collaboration with Bollywood stars Shah Rukh Khan and Anushka Sharma-headed Red Chillies Entertainment and Clean Slate Films, respectively. These shows will fall under genres such as young adult, drama, thriller, horror and comedy.

Netflix, Inc. Price and Consensus

Netflix, Inc. price-consensus-chart | Netflix, Inc. Quote

The slate of new shows is expected to help Netflix achieve its goal of 100 million customers in India, which is almost 25 times its current estimated subscriber base, per a Bloomberg article.

Netflix has also launched more affordable mobile-only plans — INR65 weekly or INR260 monthly — which however is quite pricey compared to Disney-owned Hotstar’s INR199 monthly pack.

Zacks Rank

Apple, Amazon and Netflix currently have a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

However, Hotstar-parent Disney has a Zacks Rank #5 (Strong Sell).

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance