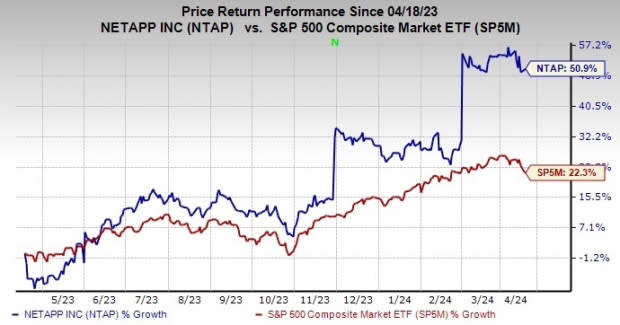

NetApp (NTAP) Up 51% in a Year: Will the Rally Continue?

NetApp NTAP is continuing its upward trajectory, with a gain of 50.9% in the past year compared with the S&P 500 Composite’s 22.3% growth.

NetApp provides enterprise storage as well as data management software and hardware products, and services. The San Jose, CA-based company assists enterprises in managing multiple clouds environments, adopting next-generation technologies like artificial intelligence (AI), Kubernetes and contemporary databases, and navigating the complexity brought about by the quick development of data and cloud usage.

With healthy fundamentals and strong growth opportunities, this Zacks Rank #1 (Strong Buy) stock appears to be a solid investment option at the moment.

Image Source: Zacks Investment Research

Factors Fueling Growth

NetApp is gaining from data-driven digital and cloud transformations involving business analytics, artificial intelligence, data security and application modernization.

Frequent product launches, strengthening go-to-market activities and various cloud collaborations remain major positives. Extensive cost discipline is boosting margin performance.

In the last reported quarter, revenues came in at $1.61 billion, increasing 5.2% year over year. NTAP projected revenues in the $1.51-$1.67 billion range. The uptick was driven by solid demand across the latest all-flash products. Also, revenues beat the consensus mark by 0.9%.

Management expects strength in all-flash products, and hyper-scaler first-party and marketplace services to drive revenues. NetApp now anticipates fiscal 2024 revenues in the band of $6.185-$6.335 billion.

The company now projects non-GAAP earnings per share (EPS) in the range of $6.40-$6.50 (previous prediction: $6.05-$6.25) for fiscal 2024.

For fiscal 2024, NetApp estimates non-GAAP gross margin to be 71-72% compared with 71% anticipated earlier. Non-GAAP operating margin is forecast to be nearly 27% compared with 26% projected earlier.

Healthy Capital Allocation Strategy

NTAP exited the quarter ending Jan 26, 2024, with $2.917 billion in cash, cash equivalents and investments compared with $2.620 billion as of Oct 27, 2023. Long-term debt was $1.991 billion, which remained unchanged as of Oct 27. Net cash from operations was $484 million compared with $377 million in the previous quarter. Free cash flow was $448 million (free cash flow margin was 27.9%) compared with $319 million in the prior-year quarter (20.9%).

A strong balance sheet helps the company to continue shareholder-friendly initiatives via dividend payouts and share buybacks. In third-quarter fiscal 2024, it returned $203 million to shareholders as dividend payouts and share repurchases. It has $1 billion worth of shares remaining under its existing authorization. In fiscal 2023, the company returned $1.28 billion to shareholders in the form of dividends and share repurchases.

Estimates Activity

NTAP’s fiscal 2025 revenues are anticipated to rise 4% from the year-ago levels to $6.51 billion. EPS is expected to climb 15.7% and 2.8% from the prior-year actuals to $6.47 and $6.65 in fiscal 2024 and 2025, respectively.

The Zacks Consensus Estimate for fiscal 2024 and 2025 earnings has increased 5% and 4.2%, respectively, in the past 60 days, reflecting analysts’ optimism.

The long-term earnings growth rate is 8.8%. NTAP beat estimates in each of the last four quarters, delivering an average earnings surprise of 12.3%.

NetApp’s PE ratio is pegged at 15.86, lower than the industry’s ratio of 25.4.

Apart from a favorable rank, NTAP has a Growth Score of B. Per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 or 2 (Buy) and a VGM Score of A or B offer solid investment opportunities.

The stock is down 8.8% from its 52-week high level of $112.48, making it relatively affordable for investors.

Headwinds Persist

Uncertainty prevailing over macroeconomic conditions and high interest rates continue to weigh on the company’s performance. Also, price increases on NAND from suppliers are likely to affect 2024 product gross margins. Stiff competition is another concern.

Other Stocks to Consider

Some other top-ranked stocks worth consideration in the broader technology space are Synopsys SNPS, Iridium Communications IRDM and Cadence Design Systems CDNS. While SNPS and IRDM sport a Zacks Rank #1 each, CDNS carries a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for SNPS’ fiscal 2024 EPS is pegged at $13.28. The long-term earnings growth rate is 17.5%. Synopsys’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 4.1%. Shares of SNPS have soared 42.2% in the past year.

The Zacks Consensus Estimate for IRDM’s 2024 EPS has increased 89.5% in the past 60 days to 72 cents. Iridium’s earnings beat the Zacks Consensus Estimate in two of the last four quarters and missed twice. The average earnings surprise is 91.7%.

The Zacks Consensus Estimate for CDNS’ 2024 EPS has increased 1.2% in the past 60 days to $5.94. Cadence’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 3.4%. Shares of CDNS have gained 40.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Iridium Communications Inc (IRDM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance