Nelson Peltz Adjusts Portfolio, Major Reduction in Ferguson PLC Shares

Insights from the Latest 13F Filing for Q1 2024

Nelson Peltz (Trades, Portfolio), renowned for his strategic investment approaches through Trian, where he serves as CEO and Founding Partner, recently disclosed his first quarter 2024 portfolio adjustments via a 13F filing. Peltz, who also holds significant roles at The Wendys Company, Procter & Gamble, Invesco Ltd., and Madison Square Garden Sports Corp., focuses on acquiring substantial stakes in undervalued and underperforming companies to enhance shareholder value. His investment strategy emphasizes long-term, operational improvements and collaborative engagement with company management, underpinned by a strong commitment to ESG principles.

Portfolio Overview

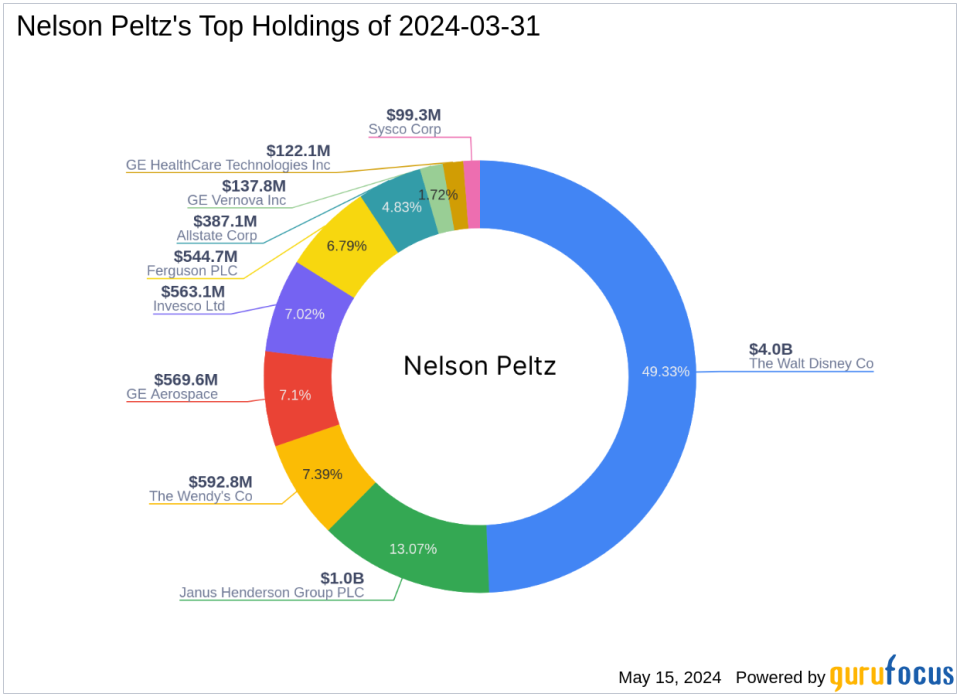

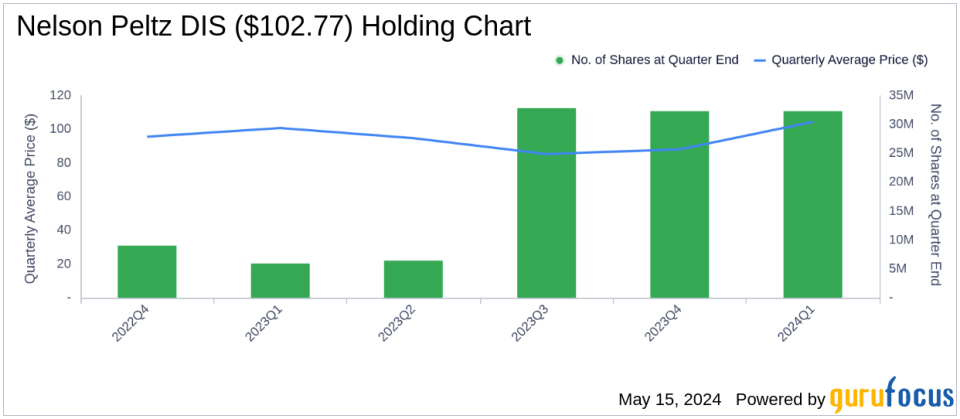

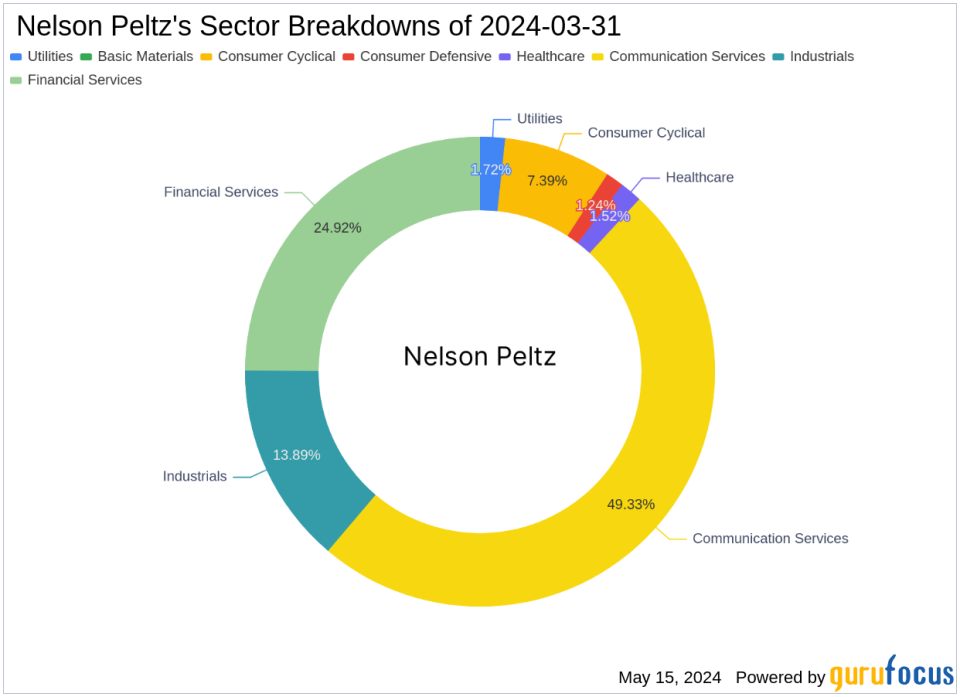

As of the first quarter of 2024, Nelson Peltz (Trades, Portfolio)s investment portfolio included 10 stocks. The major holdings were 49.33% in The Walt Disney Co (NYSE:DIS), followed by 13.07% in Janus Henderson Group PLC (NYSE:JHG), and 7.39% in The Wendys Co (NASDAQ:WEN). Other significant investments include GE Aerospace (NYSE:GE) and Invesco Ltd (NYSE:IVZ), showcasing a diverse portfolio spread across several key industries including Communication Services, Financial Services, and Industrials.

Key Position Reduces

Nelson Peltz (Trades, Portfolio) made notable reductions in his portfolio this quarter, particularly in Ferguson PLC and Allstate Corp. The adjustments are as follows:

Reduced Ferguson PLC (NYSE:FERG) by 1,696,565 shares, resulting in a -40.49% decrease in shares and a -4.68% impact on the portfolio. The stock traded at an average price of $199.25 during the quarter and has returned 11.69% over the past 3 months and 14.77% year-to-date.

Reduced Allstate Corp (NYSE:ALL) by 555,829 shares, resulting in a -19.9% reduction in shares and a -1.11% impact on the portfolio. The stock traded at an average price of $157.85 during the quarter and has returned 3.36% over the past 3 months and 19.53% year-to-date.

The strategic reductions in Ferguson PLC and Allstate Corp reflect Peltzs ongoing portfolio optimization efforts, aligning with his investment philosophy of fostering long-term value creation through active engagement and operational enhancements in his holdings.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance