Naturally Splendid Enterprises (CVE:NSP) Is Carrying A Fair Bit Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Naturally Splendid Enterprises Ltd. (CVE:NSP) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Naturally Splendid Enterprises

How Much Debt Does Naturally Splendid Enterprises Carry?

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Naturally Splendid Enterprises had CA$500.0k of debt, an increase on CA$409.6k, over one year. However, it also had CA$237.1k in cash, and so its net debt is CA$262.9k.

How Healthy Is Naturally Splendid Enterprises's Balance Sheet?

The latest balance sheet data shows that Naturally Splendid Enterprises had liabilities of CA$2.33m due within a year, and liabilities of CA$1.57m falling due after that. Offsetting these obligations, it had cash of CA$237.1k as well as receivables valued at CA$615.4k due within 12 months. So its liabilities total CA$3.04m more than the combination of its cash and short-term receivables.

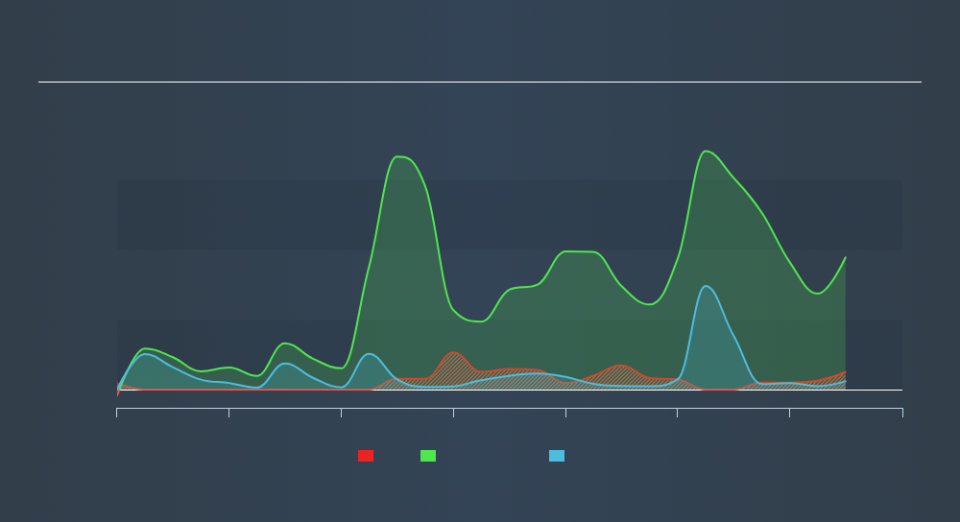

Naturally Splendid Enterprises has a market capitalization of CA$11.1m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. There's no doubt that we learn most about debt from the balance sheet. But it is Naturally Splendid Enterprises's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Naturally Splendid Enterprises reported revenue of CA$3.0m, which is a gain of 133%. So there's no doubt that shareholders are cheering for growth

Caveat Emptor

Even though Naturally Splendid Enterprises managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost a very considerable CA$5.5m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through CA$3.6m of cash over the last year. So suffice it to say we consider the stock very risky. For riskier companies like Naturally Splendid Enterprises I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance