Nasdaq QQQ ETF Needs Apple to Rebound

The Nasdaq-100 PowerShares QQQ (QQQ), one of the most actively traded ETFs, has been lagging way behind the market ever since top holding Apple (AAPL) began its sharp pullback after topping out just above $700 a share in September 2012.

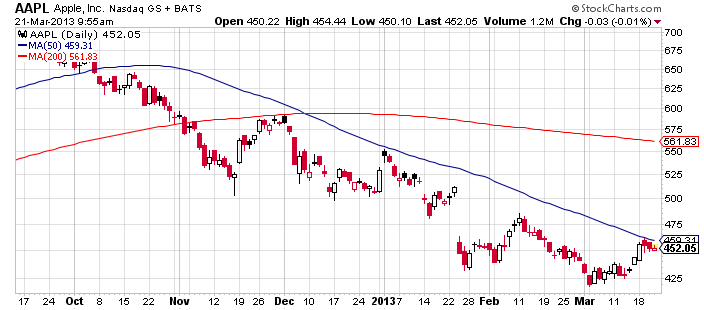

The Nasdaq-100 ETF is down 1% the past six months, versus a 7.5% advance for SPDR S&P 500 (SPY). Apple shares are down about 36% from their all-time high set last year.

Apple is still the largest stock in QQQ, which weights its holdings by market cap, at 13% of the portfolio. The ETF is comprised of the 100 largest nonfinancial stocks listed on the Nasdaq Stock Market and is seen as a liquid proxy to trade the tech sector.

Shares of Apple are higher for March and are testing the 50-day simple moving average, which has been a strong resistance line the past several months. If the stock can get back on track, it would provide a boost to QQQ given Apple’s large weighting in the ETF.

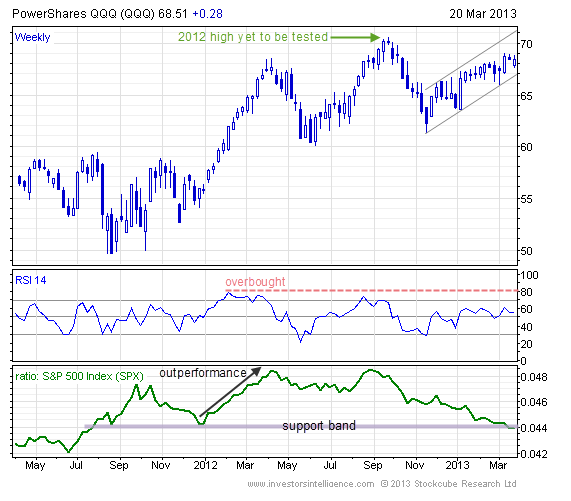

On a positive note, Tarquin Coe, technical analyst at Investors Intelligence, points out the Nasdaq-100 fund has maintained a steady uptrend off its November low.

“We continue to see the fund as a catch-up candidate,” he wrote in a newsletter. “The relative chart versus the S&P 500 is well positioned as it trades across a band which provided support in 2011. Turning up would kick off an outperformance run, something which could last weeks.”

PowerShares QQQ

Apple

Full disclosure: Tom Lydon’s clients own QQQ, SPY and AAPL.

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.

Yahoo Finance

Yahoo Finance