Nasdaq (NDAQ) Q1 Earnings Top Estimates, Revenues Increase Y/Y

Nasdaq, Inc. NDAQ reported first-quarter 2023 adjusted earnings per share of 69 cents, beating the Zacks Consensus Estimate by 6.1% as well as our estimate of 62 cents. The bottom line improved 4.5% year over year. The improvement was mainly driven by organic growth and solid results at the Solutions segment and the Trading Services segment.

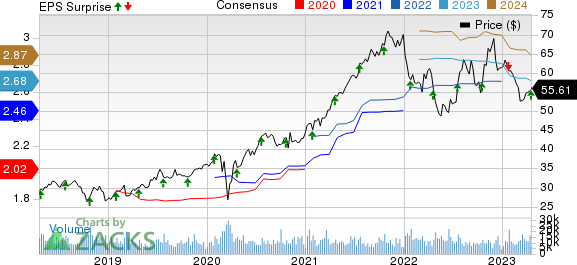

Nasdaq, Inc. Price, Consensus and EPS Surprise

Nasdaq, Inc. price-consensus-eps-surprise-chart | Nasdaq, Inc. Quote

Performance in Detail

Nasdaq’s revenues of $914 million increased 2% year over year. The upside can primarily be attributed to 4% positive impact from organic growth, including contributions from all segments. It was partially offset by an $11 million decrease from the impact of changes in FX rates and a $3 million decrease from the net impact of an acquisition and divestiture. The top line beat the Zacks Consensus Estimate by 0.2%.

Annualized Recurring Revenue (ARR) increased 7% year over year. Annualized SaaS revenues increased 11% and represented 36% of ARR.

Revenues at Trading Services increased 1% year over year to $267 million. The increase reflects 3% positive impact from organic growth, partially offset by a $4 million decrease from the impact of changes in FX rates.

Revenues at the Solutions segment increased 4% year over year to $646 million, driven by a 5% positive impact from organic growth, partially offset by a $7 million decrease from the impact of changes in FX rates.

Adjusted operating expenses were $436 million, up 1.8% from the year-ago period. The improvement primarily reflects increased expenses associated with the continued investment in our people and our businesses to drive long-term growth, partially offset by changes in FX rates. Our estimate was $457.4 million.

The operating margin of 52% remained unchanged year over year.

The Nasdaq stock market welcomed 81 new company listings in the first quarter of 2023, including 40 initial public offerings. The number of listed companies was 4,163 at the quarter end.

Financial Update

Nasdaq had cash and cash equivalents of $373 million as of Mar 31, 2023, down 25.6% from the 2022-end level. Long-term debt increased 0.5% from the 2022-end level to $4.7 billion as of Mar 31, 2023.

Capital Deployment

Nasdaq returned $257 million to shareholders in the reported quarter, including $159 million in share repurchases and $98 million in dividends.

The board of directors approved a 10% hike in its dividend to 22 cents per share. The dividend will be paid out on Jun 30, 2023 to shareholders of record at the close of Jun 16, 2023.

As of Mar 31, 2023, $491 million remained under the board authorized share repurchase program.

Guidance

Nasdaq expects 2023 non-GAAP operating expenses in the range of $1.78 billion to $1.84 billion compared with the prior expectation of $1.77 billion to $1.85 billion.

Nasdaq forecasts non-GAAP tax rate in the range of 24-26% in 2023.

Zacks Rank

Nasdaq currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

CME Group Inc. CME is slated to release first-quarter 2023 earnings on Apr 26. The Zacks Consensus Estimate for the first quarter is pegged at $2.29 per share, indicating an increase of 8.5% from the year-ago reported figure.

CME Group delivered an earnings surprise in each of the last four reported quarters.

American International Group, Inc. AIG is scheduled to release first-quarter 2023 earnings on May 4. The Zacks Consensus Estimate for the first quarter is pegged at $1.46 per share, indicating a decrease of 12.3% from the year-ago reported figure.

AIG delivered an earnings surprise in three of the last four reported quarters, while missing in one.

Cboe Global Markets, Inc. CBOE is set to release first-quarter 2023 earnings on May 5. The Zacks Consensus Estimate for the first quarter is pegged at $1.82, indicating an increase of 5.2% from the year-ago reported figure.

CBOE delivered an earnings surprise in three of the last four reported quarters, while missing in one.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CME Group Inc. (CME) : Free Stock Analysis Report

Nasdaq, Inc. (NDAQ) : Free Stock Analysis Report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Cboe Global Markets, Inc. (CBOE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance