Murray Stahl Adjusts Portfolio, Trims Texas Pacific Land Corp Stake by 1.51%

Horizon Kinetics' Murray Stahl (Trades, Portfolio) Reveals Q4 2023 Investment Moves

Murray Stahl (Trades, Portfolio), the seasoned investment guru at the helm of Horizon Kinetics, has made notable changes to his investment portfolio in the fourth quarter of 2023. With over three decades of experience, Stahl is known for his contrarian investment approach and long-term value investing strategy. As the Chief Investment Officer of Horizon Kinetics, he oversees the firm's proprietary research and manages a range of investment vehicles. Stahl's recent 13F filing sheds light on his latest stock picks, sales, and position adjustments, offering valuable insights to value investors.

Summary of New Buys

Murray Stahl (Trades, Portfolio)'s portfolio welcomed 15 new stocks in the latest quarter. Noteworthy additions include:

Eagle Materials Inc (NYSE:EXP), with 20,126 shares valued at approximately $4.08 million, making up 0.09% of the portfolio.

Horizon Kinetics Blockchain Development ETF (BCDF), comprising 74,777 shares, which account for 0.04% of the portfolio and are worth around $1.84 million.

Brookfield Reinsurance Ltd (NYSE:BNRE.A), with 19,454 shares valued at $778,160, representing 0.02% of the portfolio.

Key Position Increases

Stahl also ramped up his stakes in 46 stocks, with significant increases in:

Bakkt Holdings Inc (NYSE:BKKT), where he added 410,687 shares, bringing the total to 927,042 shares. This represents a 79.54% increase in share count and a 0.02% impact on the portfolio, valued at approximately $2.07 million.

Vanguard Extended Market Index ETF (VXF), with an additional 4,594 shares, resulting in a total of 10,197 shares. This marks an 81.99% increase in share count, with a total value of $1.68 million.

Summary of Sold Out Positions

The fourth quarter also saw Stahl exit 23 positions entirely, including:

CBRE Group Inc (NYSE:CBRE), where all 277,434 shares were sold, impacting the portfolio by -0.41%.

Bel Fuse Inc (NASDAQ:BELFB), with the liquidation of all 28,988 shares, causing a -0.03% impact on the portfolio.

Key Position Reductions

Reductions were made in 179 stocks, with the most significant being:

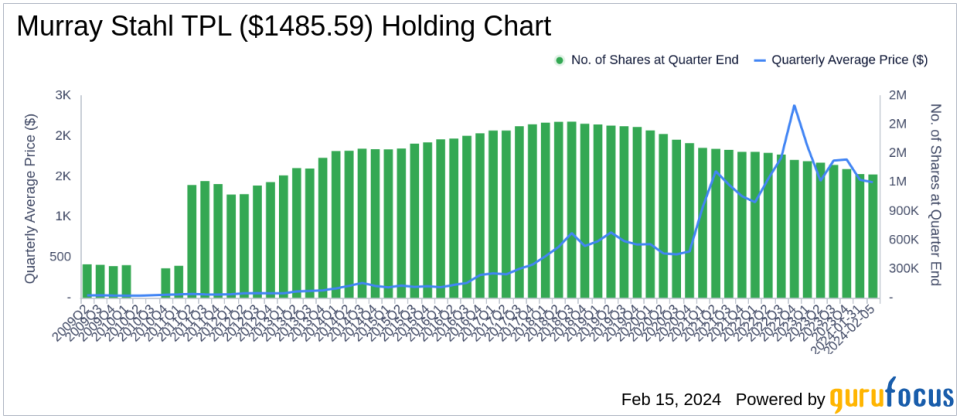

Texas Pacific Land Corp (NYSE:TPL), reduced by 41,716 shares, leading to a -3.02% decrease in shares and a -1.51% impact on the portfolio. The stock traded at an average price of $1,710.23 during the quarter and has seen a -12.44% return over the past three months and -6.49% year-to-date.

Cheniere Energy Inc (NYSE:LNG), reduced by 103,600 shares, resulting in a -17.27% reduction in shares and a -0.34% impact on the portfolio. The stock's average trading price was $171.83 during the quarter, with a -7.71% return over the past three months and -7.13% year-to-date.

Portfolio Overview

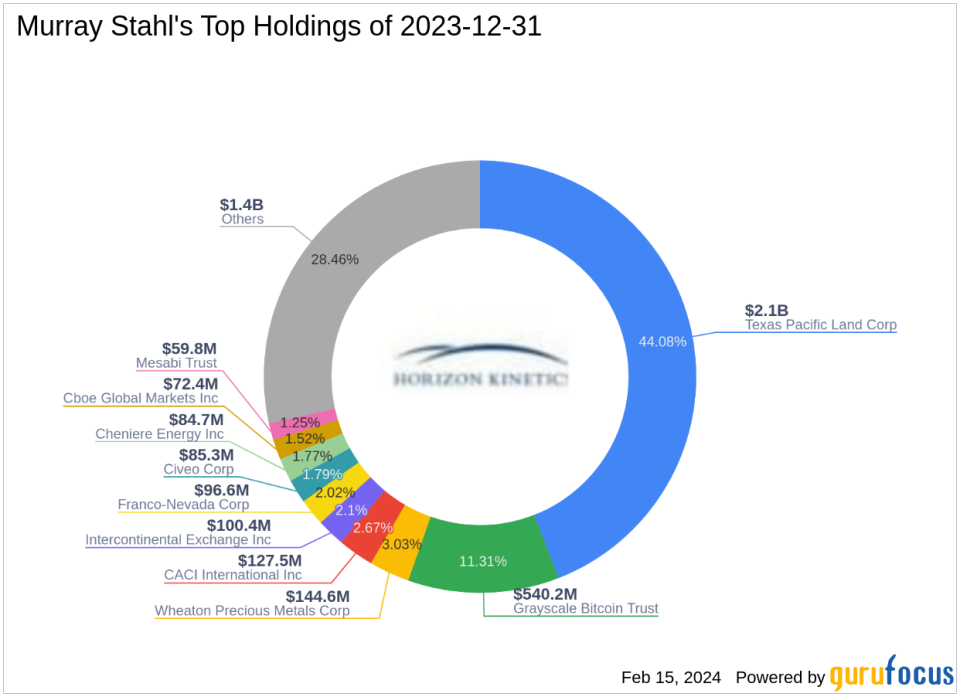

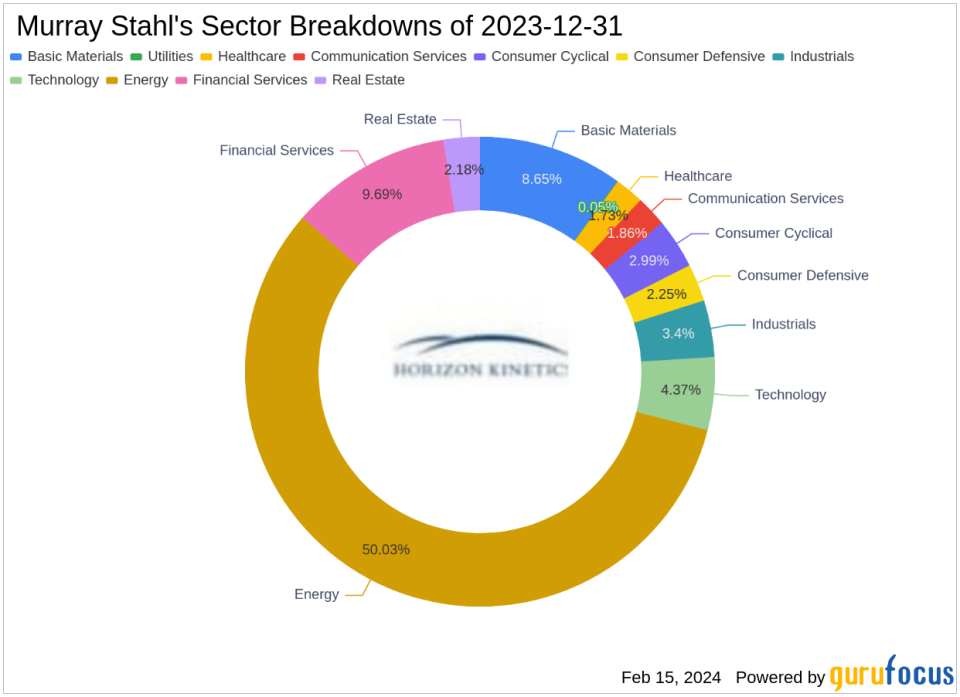

As of the fourth quarter of 2023, Murray Stahl (Trades, Portfolio)'s portfolio is composed of 325 stocks. The top holdings include 44.08% in Texas Pacific Land Corp (NYSE:TPL), 11.31% in Grayscale Bitcoin Trust (GBTC), 3.03% in Wheaton Precious Metals Corp (NYSE:WPM), 2.67% in CACI International Inc (NYSE:CACI), and 2.1% in Intercontinental Exchange Inc (NYSE:ICE). The investments are predominantly concentrated across 11 industries, reflecting a diverse yet focused approach to value investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance