Murphy Oil (MUR) Reports Narrower-Than-Expected Loss for Q2

Murphy Oil Corporation MUR incurred second-quarter 2020 adjusted loss of 71 cents per share, which is narrower than the Zacks Consensus Estimate of a loss of $1.05. However, the company delivered earnings of 21 cents in the year-ago quarter.

On a GAAP basis, net loss was $2.06 against an income of 54 cents per share in the prior-year quarter.

Revenues

In the quarter under review, Murphy Oil’s revenues of $211.5 million missed the Zacks Consensus Estimate of $386 million by 45.2%. Also, the top line fell 71.6% from the prior-year quarter’s $744 million.

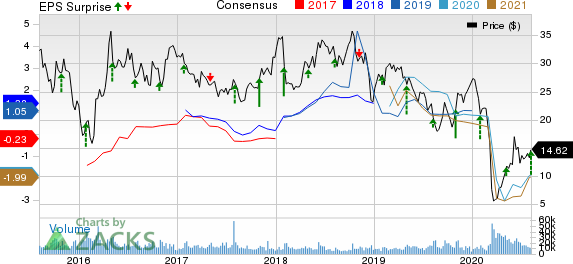

Murphy Oil Corporation Price, Consensus and EPS Surprise

Murphy Oil Corporation price-consensus-eps-surprise-chart | Murphy Oil Corporation Quote

Operational Highlights

The company received $109 million of cash crude oil hedge settlements and recorded a $146-million non-cash mark-to-market loss on crude oil derivative contracts in the second quarter.

The company produced 168,000 barrels of oil equivalent per day (boe/d) in the second quarter comprising 58% of oil and 65% of liquids.

Moreover, it announced that the fabrication of King’s Quay Floating Production System remains on track and is expected to close in the third quarter of 2020.

In the quarter under review, Murphy Oil’s total costs and expenses amounted to $585.7 million, up 2.2% from $572.9 million in the prior-year quarter.

Operating loss from continuing operations came in at $374.1 million against operating income of $171 million in the prior-year quarter.

The company incurred interest charges of $38.6 million, down 28.7% from $54.1 million in the prior-year quarter.

Financial Condition

Murphy Oil had cash and cash equivalents of $145.5 million as of Jun 30, 2020 compared with $306.8 million as of Dec 31, 2019. At the end of second quarter, total liquidity of the company was $1.6 billion.

Long-term debt, including capital lease obligation amounted to $2,956.4 million on Jun 30, 2020 compared with $2,803.4 million as of Dec 31, 2020.

Net cash provided by continuing operations activities at the end of the first six months of 2020 was $369.4 million compared with $655.4 million at the end of the first half of 2019.

It further reduced its planned capital expenditures to the $680-$720 million range or slashed more than 50% from the original 2020 guidance.

Zacks Rank

Murphy Oil currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Devon Energy Corp. DVN reported second-quarter 2020 adjusted loss per share of 18 cents, narrower than the Zacks Consensus Estimate of a loss of 26 cents.

Noble Energy, Inc. NBL reported second-quarter adjusted loss of 24 cents per share, narrower than the Zacks Consensus Estimate of a loss of 39 cents.

Concho Resources Inc. CXO reported second-quarter 2020 net income per share (excluding special items) of $1.13, outperforming the Zacks Consensus Estimate of 33 cents.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Noble Energy Inc. (NBL) : Free Stock Analysis Report

Murphy Oil Corporation (MUR) : Free Stock Analysis Report

Concho Resources Inc. (CXO) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance