Muni Market Faces Early Credit Problems as Covid Aid Sunsets

(Bloomberg) -- Credit quality in the $4 trillion municipal bond market is showing early signs of pressure as federal pandemic aid winds down, spurring expectations that the rapid pace of rating upgrades over downgrades in recent years will ease.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

Modi’s Embrace of Putin Irks Biden Team Pushing Support for Kyiv

NATO Singles Out China Over Its Support for Russia in Ukraine

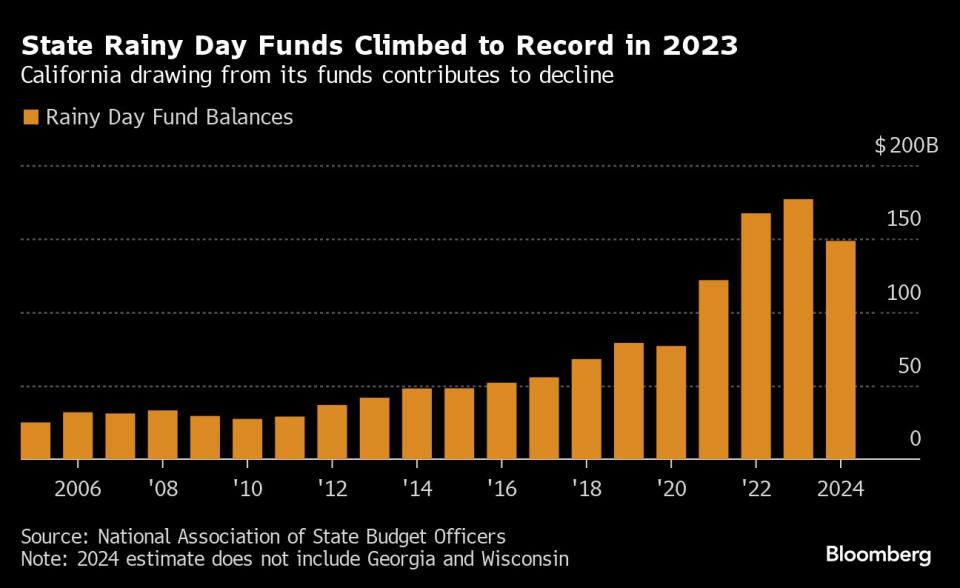

Revenue growth is slowing, and in states such as California tax and fee collections are dropping. Rainy day funds are forecast to show declines after reaching record levels from strong economies and US stimulus money.

“Going into fiscal 2024, we were coming into all-time highs of reserve funds, and the economy had proven to be resilient,” Lisa Washburn, a managing director of Municipal Market Analytics, said in an interview. “If you look into fiscal 2025, you have draw down of reserves and softening of revenue growth.”

While no deep or broad plunge in credit quality is expected, Washburn sees bifurcation within some sectors including higher education. Municipal Market Analytics lowered its outlook for charter schools from neutral to negative, according to a report on Tuesday.

The firm’s analysts also cautioned that 40% of hospitals were still losing money earlier this year, though MMA raised its stance to neutral from negative on the sector.

Conversely, the airport sector is showing strength, as are essential service providers such as water, sewer and electric utilities, said Peter Block, managing director for credit strategy at Ramirez & Co. He anticipates pockets of credit stress will arrive.

“The vast majority of credit sectors are stable, although this could change gradually or sharply, especially for lower-rated issuers if the US economy enters a recessionary period,” Block said.

The Federal Reserve is trying to avoid weakening the economy as it tries to bring down inflation to its 2% target. While the job market remains strong, a slight slowdown has led to some pressure to cut interest rates.

READ: Powell Says More Good Inflation Data Would Boost Fed Confidence

Credit rating upgrades outpaced downgrades by almost four-to-one in 2023, but should normalize in 2024, according to a report last month by Nuveen. The ratio of upgrades to downgrades will move toward levels seen in years such as 2015, 2016 and 2018, Margot Kleinman, director of research for municipals at Nuveen, said in an email. Through the first quarter, the pace of upgrades to downgrades has slowed to 2 to 1, she said.

“We would anticipate that the pace of upgrades will slow this year and next, as federal stimulus funding rolls-off and the potential for economic slowdown in the second half of the year persists,” Kleinman said.

Upgrades Slowing

In recent months, the pace of upgrades appears to be slowing but they still outpace downgrades in 2024 by a three-to-two ratio, according to Nick Kraemer, head of ratings performance analytics at S&P Global Ratings. Local governments make up the biggest number of downgrades, though the sector still has a two-to-one upgrade ratio, he said.

Utilities have seen “a lot of downgrades,” while education, including charter schools, and healthcare currently have net downgrades by S&P, he said.

Lower inflation could improve the outlooks for sectors such as not-for-profit hospitals, life-plan communities and higher education, while a return to higher costs “could worsen expenditure pressure and, in time, exacerbate pressure on municipal bond ratings,” said Arlene Bohner, head of US public finance at Fitch Ratings.

Moody’s Ratings expects the trend of upgrades outpacing downgrades likely will continue this year, but the ratio may decline as US assistance shrinks and some states face budget constraints, Susan Fitzgerald, managing director for public finance for Moody’s Ratings, said in an email. Sectors such as health care and higher education will face continued credit challenges, she said.

The vast majority of issuers “are well positioned to weather an economic downturn,” and more upgrades may occur given rating actions often lag, Nathan Will, head of municipal credit research at Vanguard Fixed Income Group, said in an email. Vanguard “would expect that the upgrade trend will slow as the economy cools and the remainder of pandemic aid is spent.”

--With assistance from Boris Korby.

(Updates with additional comment from Nuveen in 9th and 10th paragraphs.)

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance