How Much Is CaNickel Mining's (CVE:CML) CEO Getting Paid?

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

This article will reflect on the compensation paid to Kevin Zhu who has served as CEO of CaNickel Mining Limited (CVE:CML) since 2014. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for CaNickel Mining.

View our latest analysis for CaNickel Mining

How Does Total Compensation For Kevin Zhu Compare With Other Companies In The Industry?

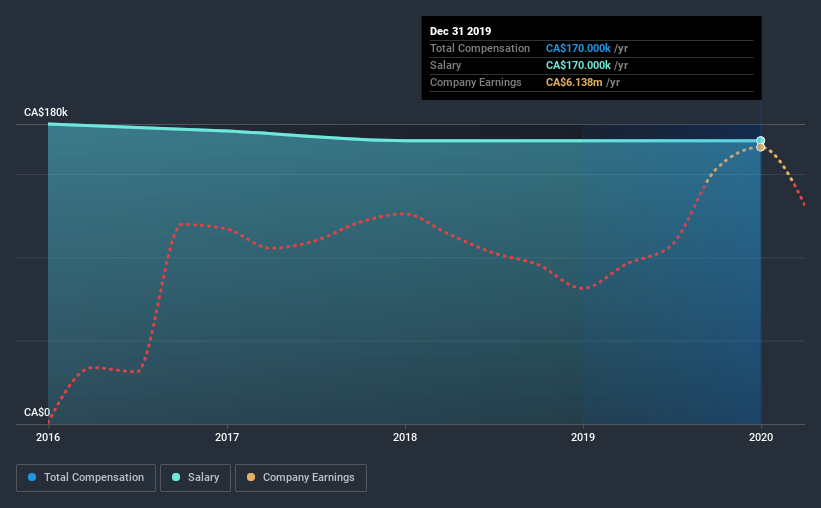

At the time of writing, our data shows that CaNickel Mining Limited has a market capitalization of CA$3.0m, and reported total annual CEO compensation of CA$170k for the year to December 2019. This means that the compensation hasn't changed much from last year. It is worth noting that the CEO compensation consists entirely of the salary, worth CA$170k.

For comparison, other companies in the industry with market capitalizations below CA$271m, reported a median total CEO compensation of CA$160k. So it looks like CaNickel Mining compensates Kevin Zhu in line with the median for the industry.

Component | 2019 | 2018 | Proportion (2019) |

Salary | CA$170k | CA$170k | 100% |

Other | - | - | - |

Total Compensation | CA$170k | CA$170k | 100% |

On an industry level, roughly 84% of total compensation represents salary and 16% is other remuneration. At the company level, CaNickel Mining pays Kevin Zhu solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

CaNickel Mining Limited's Growth

CaNickel Mining Limited's earnings per share (EPS) grew 30% per year over the last three years. In the last year, the company lost virtually all of its revenue.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has CaNickel Mining Limited Been A Good Investment?

Since shareholders would have lost about 41% over three years, some CaNickel Mining Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

CaNickel Mining pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As previously discussed, Kevin is compensated close to the median for companies of its size, and which belong to the same industry. At the same time, the company has logged negative shareholder returns over the last three years. But earnings growth is moving in a favorable direction, certainly a positive sign. It's tough for us to say CEO compensation is too generous when earnings growth is positive, but negative investor returns will irk shareholders and reduce any chances of a raise.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 3 warning signs for CaNickel Mining that investors should be aware of in a dynamic business environment.

Important note: CaNickel Mining is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance