MPLX LP Surpasses Analyst Revenue Forecasts in Q1 2024, Demonstrates Robust Financial Health

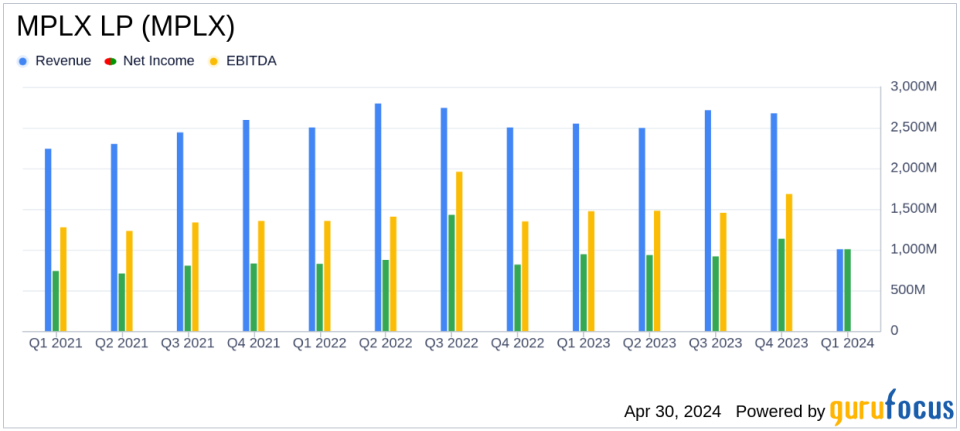

Net Income: Reported $1.005 billion, up from $943 million in the previous year, exceeding the estimate of $987.60 million.

Revenue: Total revenue reached $2.846 billion, surpassing the estimated $2.899 billion.

Earnings Per Share (EPS): Achieved $0.98 per common unit, meeting the estimated EPS of $0.98.

Adjusted EBITDA: Increased to $1.635 billion from $1.519 billion year-over-year, indicating strong operational performance.

Distributable Cash Flow: Grew to $1.370 billion, up from $1.268 billion in the prior year, supporting a solid distribution coverage ratio of 1.6x.

Capital Returns: Returned $951 million to unitholders and repurchased $75 million of common units, demonstrating commitment to shareholder returns.

Strategic Growth: Advanced in the Marcellus and Permian basins, including the acquisition of partner's interest in Utica G&P joint ventures and startup of the Harmon Creek II plant.

MPLX LP (NYSE:MPLX) released its 8-K filing on April 30, 2024, revealing a strong financial performance for the first quarter of the year. The company reported a net income of $1.0 billion, surpassing the estimated $987.6 million, and total revenues of $2.846 billion, which also exceeded the forecasted $2.899 billion. This performance underscores MPLX's effective management and strategic operations in the oil and gas sector, particularly in pipeline and processing assets.

MPLX LP, a key player in the midstream energy sector, operates a diverse array of infrastructure and logistics assets, including pipelines and gathering and processing facilities. These assets are crucial for the transportation and processing of oil and natural gas, primarily in the Appalachian region. The company's growth strategy includes significant acquisitions and expansions, such as the recent integration of assets from Marathon Petroleum and the expansion in the Marcellus and Permian basins.

Financial and Operational Highlights

The first quarter of 2024 saw MPLX achieving a net income attributable to MPLX of $1,005 million, an increase from $943 million in the previous year. The adjusted EBITDA also rose to $1,635 million from $1,519 million in the first quarter of 2023. These improvements reflect higher rates and growth from equity affiliates, despite a decrease in total pipeline throughputs by 6% year-over-year.

MPLX's strategic initiatives, including the acquisition of additional interests in Utica G&P joint ventures and a dry gas gathering system, have bolstered its operational capacity. The company also reported a distributable cash flow of $1.4 billion and maintained a solid distribution coverage ratio of 1.6x, demonstrating its ability to generate substantial cash flows and return capital to unitholders.

Challenges and Strategic Developments

Despite its strong performance, MPLX faces challenges such as fluctuations in commodity prices and operational risks associated with managing extensive pipeline networks. However, the company is actively managing these risks through strategic expansions and technological upgrades. For instance, MPLX is enhancing its presence in the Permian Basin and advancing its natural gas strategy with new processing plants expected to come online in the coming years.

Financial Position and Outlook

As of March 31, 2024, MPLX reported having $385 million in cash and a stable leverage ratio of 3.2x. The company's financial health is supported by a robust liquidity position, with $2.0 billion available on its bank revolving credit facility and $1.5 billion through an intercompany loan agreement with Marathon Petroleum Corp.

The company's forward-looking statements suggest continued focus on growth and efficiency, aiming to enhance shareholder value and maintain strong distribution coverage. MPLX's strategic investments and operational enhancements are likely to sustain its competitive edge in the midstream sector.

For a deeper dive into MPLX's financial details and future prospects, stakeholders and interested parties are encouraged to view the full earnings release and join the upcoming webcast for further discussions.

Explore the complete 8-K earnings release (here) from MPLX LP for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance