Here Are the Most and Least Tax-Friendly Countries

As tax season all-too-quickly approaches, you might find yourself thinking how unfairly high your taxes here in the U.S. seem and wishing you could pay what people in other countries do. However, you might be surprised to learn that by certain measures, the U.S. actually has among the lower taxes in the world.

More: Pros and Cons of Living in a State With No Income Tax

Related: 3 Signs You're Serious About Raising Your Credit Score

GOBankingRates compiled a list of the best and worst countries for taxes to give you a feel for where our own taxes fall in comparison to other countries. The countries on this list were ranked solely based on tax revenue as a percentage of gross domestic product, as reported by the World Bank and other sources. Note that certain countries were excluded from the list, such as those from war-torn areas, those with a minimal population -- which skew results -- or those with data older than 2016.

See the best and worst countries for taxes, starting with the least tax-friendly countries.

10 Least Tax-Friendly Countries

America's top tax rate of 37% might seem high, but when it comes to tax revenue as a percentage of a country's GDP, there are plenty of other countries with a higher tax burden than the United States.

Check Out: This Secret IRS Loophole Lets You Reduce Your Retirement Taxes

Similar: 8 Best States To Move to if You Don't Want To Pay Taxes on Social Security

10. Greece

The land of ancient philosophers, the birthplace of democracy, the home of the Parthenon and the fabled Greek Islands -- to many, Greece seems like paradise. Some residents may disagree, however, as tax rates are high. In spite of tourist dollars that prop up some of the country's economy, Greece still tags its citizens with a whopping 44% top personal tax rate. Value-added tax and employee social security tax rates are also high, at 24% and 15.75%, respectively. All taxes combined make up 28.3% of Greece's total GDP as of Sep 2022.

Capital Gains Tax on Stocks: What It Is and How To Minimize It

9. Malta

Many Americans overlook Malta, but the island nation offers some of the world's best diving in addition to historic temples, UNESCO world heritage sites and colorful fiestas. For residents, however, taxes are a burden. Individual income tax rates top out at 35%, while tax revenue as a percentage of overall GDP reaches 23.6%.

8. South Africa

South Africa isn't often mentioned as one of the most tax-unfriendly nations in the world, but perhaps it's being overlooked. Located at the very bottom of Africa's continent, this country, known for its safaris, minerals and beautiful landscapes, taxes its citizens 45% on the high end. However, there are no employee social security taxes. Overall, taxes contribute 25.1% to South Africa's GDP.

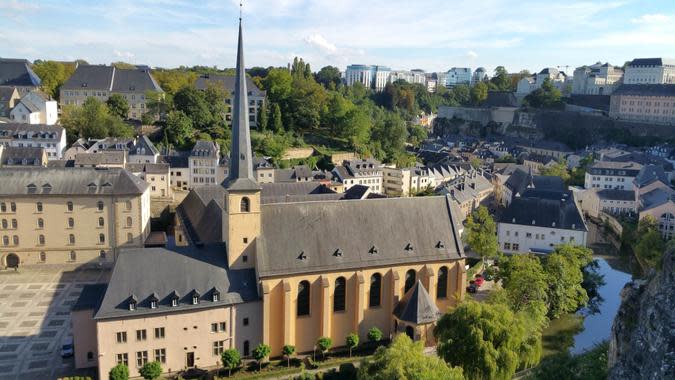

7. Luxembourg

Luxembourg is one of the smallest nations in the world, but its citizens pay an outsized tax bite. Individual income tax rates are among the highest in the world, with the top bracket reaching 42%. This is on top of an 11.05% employee social security plus pension tax rate. Still, Luxembourg remains the wealthiest country in the European Union per capita, even though taxes comprise 25.13% of the country's GDP.

6. Jamaica

Jamaica is a paradise for some, but not necessarily for its residents -- at least when it comes to taxes. The home of reggae, beautiful beaches and an amazing culture nets 27.7% of its GDP from taxes. Rather than relying solely on tourist revenue, Jamaica's personal rates hit 30%.

More: These Are the 10 Most Overpriced Housing Markets in the US -- 5 Are in Florida

5. Sweden

Like its fellow Scandinavian country Denmark, Sweden has a society built on high social taxes and extensive government benefits. Although most Swedes are happy with this arrangement, these benefits do come at a cost. Sweden's top personal tax rate is not as high as some suspect, reaching just 32%, but indirect taxes of 25% help push the country into the upper echelon when it comes to global tax rates. Overall, World Bank data indicates that taxes comprise 26.6% of GDP in Sweden -- one of the highest rates in the world.

4. Namibia

Namibia is another African nation that has a host of natural attractions but doesn't fare as well when it comes to its national tax situation. Namibians contribute 31.2% to the country's GDP in the form of taxes, in part due to the 37% personal income tax. As Namibia is one of the most sparsely populated countries on Earth, each individual taxpayer plays a big role in sustaining the country's tax revenues, which include 15% in value-added taxes.

3. Macao

Macao is a dynamic city-state with a fascinating history and modern towers of gold. This former Portuguese colony was turned over to mainland China in 1999 and has since experienced an incredible boom in casinos and resorts. Many Americans consider Las Vegas to be the world's gambling capital, but in terms of revenue, Vegas can't hold a candle to Macao. The country generated over $34 billion in gaming revenue in the first few months of 2023 alone, making it the largest casino gambling jurisdiction in the world.

Residents of Macao benefit from the taxes on these enormous gaming revenues, as personal income tax rates top out at just 12% and there are no indirect or employee social security taxes. However, overall tax revenue amounts to 21.7% of the total GDP in Macao.

2. Lesotho

Lesotho is a landlocked African country that flies under the radar of many tourists, even though perennial tourist heavyweight South Africa surrounds it. Perhaps because it lacks a significant influx of tourist dollars, Lesotho is one of Earth's most highly taxed countries. Although the World Bank doesn't provide data on personal income tax rates in the country, the overall contribution of taxes to the country's GDP stands at 18.5%.

Check Out: 7 Florida Cities That Could Be Headed for a Housing Crisis

1. Denmark

Denmark, along with its Scandinavian brethren, has the reputation of being a high-tax region, thanks in no small part to its social programs. In this case, the reputation proves accurate. In addition to beautiful landscapes, fascinating history and a happy society, there's no denying that Denmark has high taxes. In fact, according to the World Bank data, Denmark's taxes contribute the highest percentage to the GDP of any country, at 32.27%. Personal tax rates peak at a whopping 55.90%, with indirect taxes that vary by municipalities reaching an additional 25%.

10 Most Tax-Friendly Countries

It may be hard to believe for American taxpayers, but the U.S. lands on the list of most tax-friendly countries. According to data from the World Bank, the U.S. is actually one of the nations paying the smallest proportion of its GDP in taxes. Here's a look at America's colleagues on the list of countries with the lowest taxes when analyzed as a percentage of GDP.

10. Madagascar

The tiny island nation of Madagascar also has one of the smallest tax burdens in the world. Although the World Bank doesn't offer any data on individual income tax rates, the net contribution of taxes to Madagascar's GDP is 9.5%. According to PriceWaterhouse Cooper, the highest tax rate for the top income bracket is 20%. This leaves its residents with more money in their pockets to explore the country's beautiful landscapes and exotic wildlife.

9. Switzerland

The mere name of Switzerland likely conjures up many images in the minds of most Americans, such as chocolate, the Alps, neutrality and bank accounts. And, as far as its reputation as being a tax haven, the rumors aren't too far from the truth. Taxes in Switzerland fall into three categories: the federal level, which is 11.5%, at the cantonal level, 13%, and at the municipal level, which can be as high as 51%. However, as a percentage of GDP, tax revenue in Switzerland only reaches 9.4%.

See: 10 US Cities With Plenty of Jobs and Cheap Housing

8. Paraguay

Paraguay may not be a country you've heard of, though it's very close to tourist havens of Brazil and Argentina known for a wonderful mix of jungle, wilderness, and city life. The small country suffered significantly in the pandemic but bounced back. The tax burden on Paraguay's residents amounts to only 9.5% of the country's GDP.

7. The United States of America

Would you believe that the good ol' United States of America is one of the least-taxed countries in the world when it comes to tax revenue as a percentage of GDP? Perhaps this is a little misleading, as the U.S. is by far the largest economy in the world in terms of GDP. The top bracket now reaches 37% for individuals, with the overall contribution of taxes to GDP at just 9.9%.

6. Equatorial Guinea

Equatorial Guinea is the only former Spanish colony in sub-Saharan Africa. The country is blessed with an abundance of arable land and valuable minerals and commodities, ranging from diamonds and gold to oil and uranium. Over the past decade, the country has been one of the fastest-growing in Africa. Its residents have benefited on the tax front, as tax revenue as a percentage of GDP sits at a very low 7.8%.

5. Saudi Arabia

Saudi Arabia is one of the few countries in the world with no personal income tax, although it does have a 10% social security tax and indirect taxes of 20%. Yet, even this oil-rich country has struggled during the pandemic. Falling oil revenues forced the nation to implement a value-added tax that went up to 15%. If things continue to get worse, the Kingdom may see its tax revenue rise to more than the current 8.6% of GDP.

I'm a Self-Made Millionaire: These Are the 6 Investments Everyone Should Make During an Economic Downturn

4. Argentina

Argentina has a top personal income tax rate of 35%, with Social Security taxes at 17%. Taxes as a percentage of GDP, however, sit at a low 10.9%. Argentina has one of the biggest economies in Latin America, relying on vast energy and agriculture resources as primary contributors.

3. Ethiopia

Ethiopia has a 35% top personal income tax rate, but overall tax revenues comprise just 6.2% [x] of GDP. Although Ethiopia is regularly mentioned as one of the world's most impoverished nations -- which it still remains -- the country has some of the highest income equality in the world. The Ethiopian economy has also been growing sharply for years. The state is actively engaged in Ethiopia's economy, pumping money into it via infrastructure and other projects.

2. Myanmar

For a low-tax country, Myanmar has a relatively high top personal tax rate of 25%. However, employee social security tax rates are just 2%, and tax revenue as a percentage of GDP is a meager 6.4%. Formerly known as Burma, the country is still struggling to free itself of its authoritarian past, with its first free elections only held in 2015.

How To Buy ChatGPT Stock: Your 2023 Guide to AI Investing

1. United Arab Emirates

The United Arab Emirates is at the top of this list for one good reason: The country enforces neither a personal nor a corporate income tax. This is due in no small part to the immense oil and gas revenues generated by the country. The country did enact a 5% value-added tax in 2018 for the first time, which remains in effect. Overall, tax revenues accounted for just 0.7% of the UAE economy.

Countries With Lowest Taxes

Like all statistics, the results can vary based on how you interpret them. Some countries on this list, like the United Arab Emirates, have low taxes, with neither personal nor income taxes. Others may have high individual tax rates but still have low tax revenues as a percentage of their GDP, partly due to the size of their economies. While Americans paying the top 37% tax rate may find it high, it's not near the highest rate in the world, and rates on lower-earning taxpayers are significantly lower. However you slice it, the bottom line is that many more countries worldwide are more tax-unfriendly than the United States.

More From GOBankingRates

Joel Anderson and Jordan Rosenfeld contributed to the reporting for this article.

GOBankingRates ranked the most and least tax-friendly countries using the most recent available data from The World Bank on tax revenue as a percentage of GDP. The most tax-friendly countries are those with the lowest tax revenue compared to GDP and the least tax-friendly are those with the highest. Countries for which the most recent available data was from 2019 or earlier, countries with a population of less than 500,000, and countries which are currently experiencing civil unrest or war which could interfere with reporting were excluded from the list. For supplemental data, GOBankingRates also provided the highest 2022 tax rate in each country for individual income tax, indirect tax, and employee social security contributions tax from KPMG. All data was gathered on and up to date as of March 29, 2023.

This article originally appeared on GOBankingRates.com: Here Are the Most and Least Tax-Friendly Countries

Yahoo Finance

Yahoo Finance