High mortgage rates pricing out buyers, says Nationwide

High mortgage rates mean affordability is still "stretched" for many home buyers, according to the Nationwide.

The building society said that while earnings had been rising faster than house prices in recent years, this had not been enough to offset the impact of more expensive mortgages.

Its comments came as it said house price growth had been "broadly stable" in June, with prices up 0.2% from the previous month.

The average house price is now £266,064, the lender said.

Prices were up 1.5% from a year earlier, but Nationwide said activity in the housing market had been "broadly flat" over the past 12 months, with transactions down by about 15% compared with 2019.

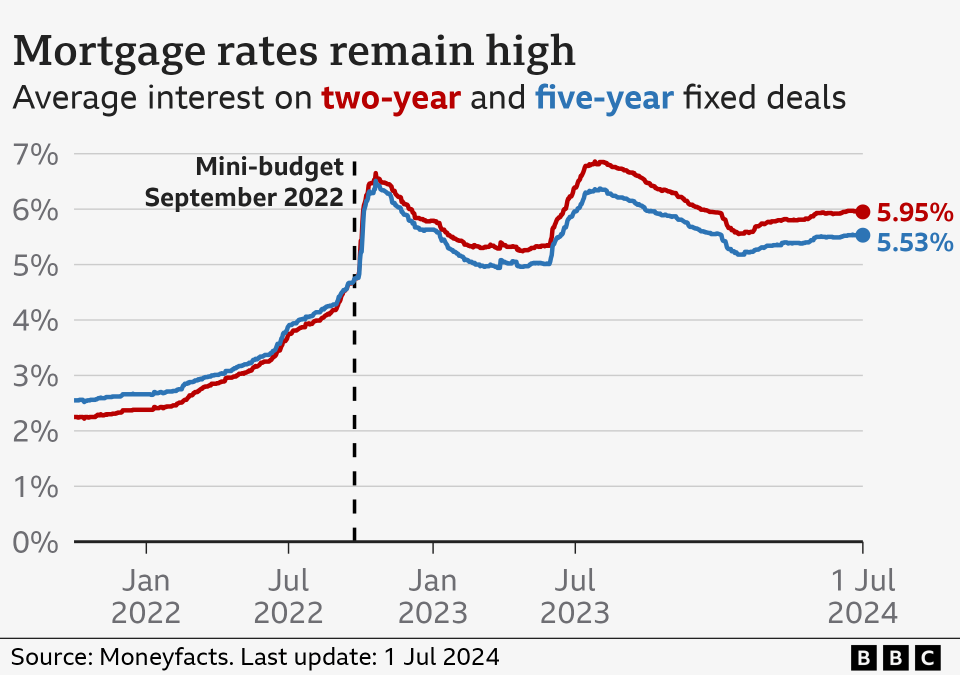

The lender said the market was still being affected by the increase in mortgage rates, which started climbing after the Bank of England began to raise its key interest rate in late 2021.

Robert Gardner, Nationwide's chief economist, said that mortgage rates are "still well above the record lows prevailing in 2021 in the wake of the pandemic".

"For example, the interest rate on a five-year fixed rate mortgage for a borrower with a 25% deposit was 1.3% in late 2021, but in recent months this has been nearer to 4.7%.

"As a result, housing affordability is still stretched."

Nationwide's figures are based on the building society's own mortgage lending, which does not include buyers who purchase homes with cash, or buy-to-let deals. Cash buyers account for about a third of housing sales.

The impact of higher borrowing costs can be seen in the fact that transactions involving a mortgage are down by nearly 25% over the past year, Nationwide said.

Meanwhile the number of cash transactions for properties is about 5% higher than pre-pandemic levels.

Across the UK, Northern Ireland saw the biggest price increases, up 4.1% from a year earlier.

Wales and Scotland both saw a 1.4% annual rise. Prices in England climbed by 0.6%, with northern regions seeing bigger increases in general than the south.

Despite some major lenders cutting their mortgage rates last week, home loan costs remain far higher than pre-pandemic levels.

According to financial information service Moneyfacts, the average rate on a two-year fixed mortgage deal stands at 5.95%, while for a five-year deal the average is 5.53%.

The focus is now on the Bank of England's Monetary Policy Committee (MPC), which sets interest rates, to see if it decides to cut at its next meeting on 1 August.

June's MPC meeting saw a change in tone from policymakers, with suggestions that the Bank could vote for a rate cut next month.

"Buyers may find their mojo again when we get a rate cut from the Bank of England," said Sarah Coles, head of personal finance at Hargreaves Lansdown.

"This could come as early as August, although sticky services inflation and higher wages could mean we need to wait until the autumn.

"Either way, we’re not expecting massive overnight drops in mortgage rates, so the reaction is more likely to be a muted upturn in sentiment than an overwhelming wave of optimism."

Last week, the Bank said that about three million households are set to see their mortgage payments rise in the next two years.

These are homeowners who arranged mortgage deals before the Bank started to lift rates in 2021.

These deals are now expiring, and the Bank said the majority will finish before the end of 2026.

For the typical household looking for a new deal, monthly mortgage repayments are forecast to increase by about £180, or about 28%, the Bank said.

However, for around 400,000 households, monthly payments could jump by 50% or more.

Bank of England figures released on Monday showed a small fall in the number of mortgages approved in May, down to 60,000 from 60,800 in April.

However, the data also showed the amount borrowed through mortgages dropped sharply to £1.2bn in May, from £2.2bn the month before, although this does not include those remortgaging with the same lender.

Ways to make your mortgage more affordable

Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

Move to an interest-only mortgage. It can keep your monthly payments affordable although you won't be paying off the debt accrued when purchasing your house.

Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.

Yahoo Finance

Yahoo Finance