Mordy: Bearish On Russia? Buy Palladium

Being bearish on Russia doesn’t mean there’s no Russia-related play.

[This article previously appeared on ETF.com and is republished here with permission.]

This article is part of a regular series of thought leadership pieces from some of the more influential ETF strategists in the money management industry. Today’s article features Tyler Mordy, president and co-chief investment strategist of Toronto-based Hahn Investment Stewards.

There’s an old Russian proverb: “The church is near, but the road is icy. The bar is far, but we will walk carefully."

Global investors should also tread cautiously with Russian assets. The country’s economic outlook has been passionately debated this year (even within our firm’s investment committee), and the recent crisis in Ukraine has uncorked a flood of volatility in Russia’s capital markets.

To be sure, President Putin’s political agenda has created a veritable wasteland of investment land mines. The annexation of Ukraine’s appendage called Crimea will almost certainly be a Pyrrhic victory. The West continues to denounce it as a violation of international law, and collateral damage to Russia’s reputation as a place to do business has been widespread.

Yet many argue that Russia’s dirt-cheap stock market—now the cheapest country stock market in the world—already prices in these policy risks. Better to observe Sir John Templeton’s advice and “buy when there’s blood in the streets.”

We get it. Russia is in the bargain bin. I’m not particularly comfortable with Russia’s prospects, but as the title of this piece suggests, we see palladium and an ETF like the ETFS Physical Palladium Shares (PALL | A-100) as worth looking at in connection with Russia’s outlook.

But let’s return first to Russia’s macroeconomic picture before discussing to PALL.

We see Russia as classic “value trap”—a cheap market that could stay inexpensive for some time.

Why? Consider the primary reason for Russia’s recent multiyear boom: China. In the years spanning 2002 through 2011, China’s average annual real gross domestic product growth rate was 10 percent. The labor force grew by an astonishing 200 million people (for perspective, the entire U.S. labor force is just 159 million).

Consequently, commodity prices reached stratospheric levels and boosted asset markets of all EM resource exporters, not least of which was Russia’s commodity-stuffed stock market.

Russia’s Hangover After The Commodity Party

China’s rapid industrialization era is now over. Policymakers are now rebalancing away from investment-intensive growth and the labor force will start shrinking in 2016. Unsurprisingly, broad commodity indexes have been lackluster.

What does all of this mean?

First, yesteryear’s winners are unlikely to provide tomorrow’s market leadership. In general, commodity-exporting EM countries face deteriorating terms of trade, capital outflows and contracting liquidity. For global ETF tactical asset allocators, these countries should remain secular “underweights” relative to global benchmarks.

The second lesson is that in a “G zero” world, where there is a lack of cooperative international political power, economics trumps politics (regardless of how belligerent or bullying leaders may become). While Putin’s style is a growing anachronism in modern politics, and certainly hasn’t won Russian any new friends, macroeconomics will dictate future shifts in country alliances.

As an example, both Russia and China have ambitions to increase their influence in Central Asia. The Kremlin plans to establish a Eurasian Economic Union—critics call it a “Soviet Union-lite”—while Beijing is building a new “Silk Road” to Europe.

Clearly, both have big ambitions. However, China is far more likely to displace Russian’s traditional influence in the region simply because it has the financial and economic power to do so.

Since the global financial crisis, China has aggressively purchased energy assets and financed infrastructure investments in Central Asia. By contrast, Russia is steadily losing both its energy monopoly and its political clout in the region—regardless of Putin’s geopolitical maneuvering.

Finally, as the EM boom moderates and corporate earnings growth rates converge with developed markets, investors should scrap the broad EM versus developed market divide. Individual country or sector dynamics are now more important. Similarly, commodity exposures should be targeted instead of broad-based.

Crimean Clouds Over Palladium

All of the above leads us back to Russia. How best to play it? While Russia’s equity market is oversold and may be on the cusp of a sharp countertrend rally (Gazprom’s recent signing of a natural gas deal with China may just be the catalyst), our view is that better longer-term opportunities lie elsewhere.

Going long PALL is one idea. Consider the investment case:

Palladium is used heavily in the automotive industry, being a key component in the production of catalytic converters. Global demand has been robust in recent years, driven by global vehicle sales reaching record highs. Worldwide sales are predicted to reach 72.2 million this year, up from 68.7 million last year.

China is again a key factor here. Gasoline engines in China currently employ catalytic technology that use less than 10 percent of palladium and platinum loadings compared with Western vehicles. It’s no secret that air quality conditions in China’s urban cores are poor.

The Chinese government is now proposing air quality targets over five years that would quintuple the loadings of platinum and palladium in gasoline engines in China. The increasing trend in Chinese automobile sales coupled with the pending tightening of emissions standards creates a strong demand outlook for several years.

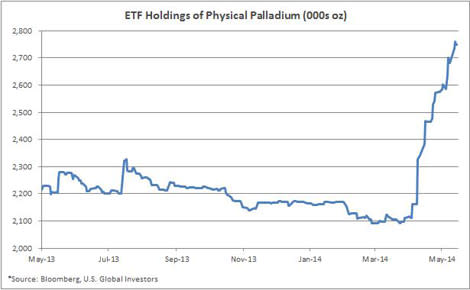

Additionally, the advent of two new palladium ETFs in South Africa has lifted investment demand. Aggregate ETF holdings of physical palladium have reached 584 thousand ounces so far in 2014, as the new ETFs (both launched in late March) now hold a combined total of 552 thousand ounces.

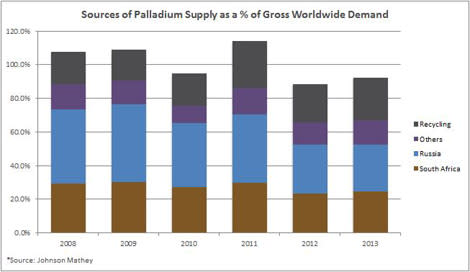

The supply side is where Russia’s dynamics come into play for palladium. The country is the world’s largest palladium producer, accounting for about 42 percent of supply (excluding recycling).

In the short term, any sanctions on Russian palladium exports would exacerbate what is already expected to be a large deficit in 2014. Even if industry-specific sanctions are not initiated (they have already been proposed), the mere threat of restrictions and the uncertain outlook will surely curtail investment.

And if sanctions don’t limit investment, then Russia’s increasing borrowing costs will provide a head wind.

This is the key longer-running risk: If Russian investment continues to sag—nationally, fixed-capital investment dropped 4.2 percent in the first quarter of 2014—the supply of palladium will surely fall further and prices will adjust higher.

Of course, there are risks. Palladium is overly reliant on one demand stream, and over time, technological advances may very well displace it.

PALL has also already done well this year, in part driven by striking workers in South Africa, which is the second-largest supplier of palladium in the world. If mining companies are successful at bypassing unions and bringing workers back to the mines, the price of palladium would undoubtedly fall.

Further, auto industry inventories are bearish for short-term demand. As of March 2014, U.S. inventory-to-sales data are at 1.32 times—the highest level since the financial crisis.

Still, many of these are transitory risks. Palladium’s longer-term supply/demand outlook remains strong, and the price continues to rally on Russia’s deteriorating outlook.

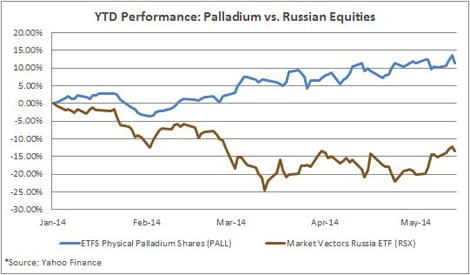

In fact, PALL has shown a negative correlation to the Market Vectors Russia ETF (RSX | C-64). Year-to-date, the running correlation stands at -0.71, as of May 15.

Looking ahead, Russia’s roads are indeed icy. The thrill of investing in volatile and ultra-cheap markets can be intoxicating.

Contrary to the Russian proverb, it’s now best to stay sober and near the church. Vodka cocktails will have to wait until another time.

Tyler Mordy, president and co-chief investment officer of Hahn Investment Stewards, is a recognized innovator in the design and application of global macro ETF managed portfolios. He is widely interviewed by the financial media for his global investment strategy views, as well as ETF trends. CNBC has called him one of the “best independent ETF experts.”

Recommended Stories

Smaller Inventory Withdrawal Still Bullish For Natural Gas As Price Rally Pauses

NatGas In Early Stages Of Rebalancing Process, Prices To Fall Further

Six Regions Drive 90% Of US Oil Production Growth, 100% Of NatGas Growth

The Commodity Investor: Here’s What To Buy To Profit From The Coming Rebound In Gold Miners

Yahoo Finance

Yahoo Finance