Moonbirds NFT Collection Takes the Top Spot as Secondary Sales Surge

Key Insights:

A new Moonbirds NFT collection takes the top spot by trading volume as demand soars in the secondary market.

After a mint price of 2.5 ETH, the floor price has jumped to 18.9 ETH.

The upside comes despite lackluster trading volumes across major NFT marketplaces.

Broader investor interest in NFTs has been unwavering despite falling NFT trading volumes since January’s bumper start to the year.

In February and March, OpenSea NFT trading volumes fell before a pickup in activity this month.

Earlier this month, we reported the downward trend in OpenSea trading volumes since January’s all-time high.

This month, NFT activity has improved, with NFT newcomers driving trading volumes.

New Moobirds Collection Gives OpenSea NFT a Much-Needed Boost

On Saturday, April 16, a new NFT collection took the NFT markets by storm. PROOF launched the Moonbirds project, featuring 10,000 NFTs, with a mint price of 2.5 ETH.

Moonbirds are a collection of 10,000 Ethereum-based, utility-enabled PFPs. Through nesting, each Moonbird unlocks private club membership and additional benefits. The longer a holder nests a Moonbird, the more benefits are unlocked.

In addition to nesting benefits, Moonbird holders also gain access to the PROOF Discord channel.

Kevin Rose and Ryan Carson behind Proof Collective are running the project. The team is working on other projects, including Project Highrise, a metaverse-linked project. In Project Highrise, Moonbird nesters will gain first access to the PROOF metaverse.

The statistics are impressive.

Over the last seven days, the Moonbirds collection sits at the top of the OpenSea rankings, with a trading vol of 72,625 ETH.

According to CryptoSlam, Moonbirds ranked first by trading volume over 7-days and 30-days, with a total sales volume of $290.95m.

Over 24-hours, CryptoSlam ranks Moobirds second, however, behind MurakamiFlowers Seed, which takes the top spot following a 7,000% surge in sales.

ETH Price Action

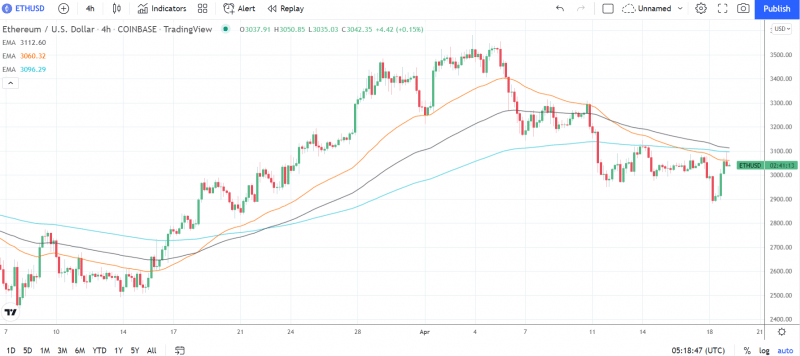

At the time of writing, ETH was down by 0.48% to $3,042. A range-bound start to the day saw ETH rise to an early high of $3,095 before falling to a low of $3,035.

Technical Indicators

ETH will need to avoid the $3,002 pivot to make a run on the First Major Resistance Level at $3,125. ETH would need broader crypto market support to bring $3,100 into play.

Another extended rally would test the Second Major Resistance Level at $3,193 and resistance at $3,200. The Third Major Resistance Level sits at $3,384.

A fall through the pivot would test the First Major Support Level at $2,934. Barring an extended sell-off throughout the day, ETH should avoid a sub-$2,900. The Second Major Support Level sits at $2,811.

Looking at the EMAs and the 4-hourly candlestick chart (above), it is a bearish signal. ETH sits below the 50-day EMA at $3,060. This morning, we saw a bearish signals. The 50-day EMA pulled back from the 200-day EMA. The 100-day EMA narrowed to the 200-day EMA.

A further narrowing of the 100-day EMA on the 200-day EMA would bring the First Major Support at $2,934 into play.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance