This is How You Make Money on Gold

This is how you make gold great again for investors...

You find the next company that’s building up a mid-tier producer from scratch with existing cash flow and huge growth potential, and then you look at where it is and who’s behind it.

In this case, we’re looking at Latin America—the best gold venue of the decade.

And who’s behind it? Well, this is where it gets exciting. When you see names like legendary mining financier Frank Giustra and General Wesley Clark, you know you’re on the right track to outsized gains.

Meet Leagold Mining (TSX:LMC; OTC:LMCNF), a company that seems to be on the fast-track to becoming a mid-tier gold miner that could easily turn into one of those fantastic plays that go from single digit share prices to double digits in record time.

This is a management bet on gold, and it looks like a good one because even beyond Giustra and the General, the board of directors reads like a Who’s Who of success.

And it wouldn’t be the first time this team has done it: They built up Endeavor Mining into the one of the most promising growth stories in West African gold. Now it’s even challenging giant Randgold Resources (LON:RRS) in terms of valuation.

And it doesn’t hurt that the past week saw gold rally to test $1260 per ounce.

Here are 5 reasons to keep a very close eye on Leagold Mining (TSX:LMC; OTC:LMCNF)

#1 Leagold is the Who’s Who of Legendary Success

Leagold has Frank Giustra as its chairman of the board - a business and mining strategist and financier extraordinaire who seems to have the Midas touch.

After all, Giustra has created tens of billions in shareholder value. He built up giant Goldcorp. (NYSE:GG) in 2000 and today it trades at a market cap of nearly $11 billion, and is one of the largest gold-mining companies in the world. He was also behind Silver Wheaton, which is now Wheaton Precious Metals Corp. (NYSE:WPM), the biggest silver and gold streaming company in the world.

Giustra’s 20-oscar-winning entertainment behemoth, Lion’s Gate, also took in $2.4 billion in revenue in 2015. And these are just a few of his multi-billion-dollar companies.

He also financed Pacific Stratus Energy, which then grew into Pacific Rubiales Energy, the biggest non-state-owned oil company in Colombia worth $6.4 billion.

The bottom line: There is no mining financier in the world who has raised more money than Giustra. And in Latin America, Giustra is a household name in the industry because he always seems to get to the sweet spots before everyone else.

Still, he’s just one big name on this fantastic BOD:

- CEO Neil Woodyer is a mining veteran with a brilliant track record in creating growth strategies, and he was a founder of Endeavor (below), one of the best shareholder-value stories of the decade. Woodyer was named Mining Journal’s CEO of the year last year as a result.

- General Wesley K. Clark is an independent director and it’s not likely that he needs an introduction as a retired 4-star U.S. Army General. But for our purposes, what we really liked here is that he served as Commander of the U.S. Southern Command for South America and Central America, right where Leagold needs his knowledge and relationships.

And in terms of relationships and connections in all the right places, the rest of the BOD is about as high-level as it gets:

- Gordon Campbell, a Canadian diplomat, politician and former Premier of British Columbia

- Miguel Rodriguez, former Economic Minister of Venezuela and former President of the Central Bank of Venezuela

- Russell Ball, giant Goldcorp’s Executive VP and CFO, and also the former Executive VP of Newmont Mining Corporation

- Rt Hon. Lord Garel-Jones, the Chairmen of UBS Latin America, and a former UK Minister of State and Controller of the Household and Treasurer for the British Crown.

If this list doesn’t spell investor confidence, then nothing will.

#2 They’ve Done it Before

The same team behind Leagold (TSX:LMC; OTC:LMCNF) also built up Endeavor Mining, which is now the darling of low-cost gold production in West Africa. Shareholders are loving it because what is now a mid-tier producer could easily become the next Randgold Resources in terms of valuation.

This would mean huge gains for shareholders. But shareholders are already enjoying this one immensely.

Woodyer and Giustra built Endeavour into a $2-billion gold producing monster, and early-in investors made millions. First, they acquired the Youga Gold Mine in Burkina Faso in 2010 and then Nzema in Ghana in 2011. They started building the Agbaou Gold Mine in Côte d’Ivoire and at the same time they acquired Tabakoto in Mali in 2013. After that they acquired the Ity Gold Mine in Cote d’Ivoire and then they moved to acquire True Gold in 2016, giving it a another production-ready play in Burkina Faso. This year, Endeavour should produce more than 600,000 ounces of gold, worth $720 million annually.

They are applying the same strategy to Leagold.

#3 Immediate Producer Status After Goldcorp Asset Buy

Right out of the starting gate, Leagold is sitting on 1.7 million ounces of gold.

Giustra gets all the good buys. It’s not a coincidence that he built up GoldCorp and Leagold now owns one of Goldcorp’s assets in its fast and furious entrance into the market.

Leagold’s strategy is ‘buy, build, repeat’. And it’s not wasting any time. It’s targeting many assets across Latin America, looking for a “universe” of small and medium-sized dislocated or non-core gold assets with real value, existing or near-term cash flow and existing or near-term production.

Its first seized target was a fantastic one: Goldcorp’s Filos Gold Mine in Mexico. This was a $350-million acquisition in April that makes Leagold a producer instantly.

Leagold (TSX:LMC; OTC:LMCNF) is already producing more than 200,000 ounces of gold per year. That means at least $240 million in annual revenue.

In 2016 alone, Los Filos produced 231,000 ounces of gold at an all-in sustaining cost of $878/ounce. That’s a value of around $275 million. But that’s just the surface of this first play.

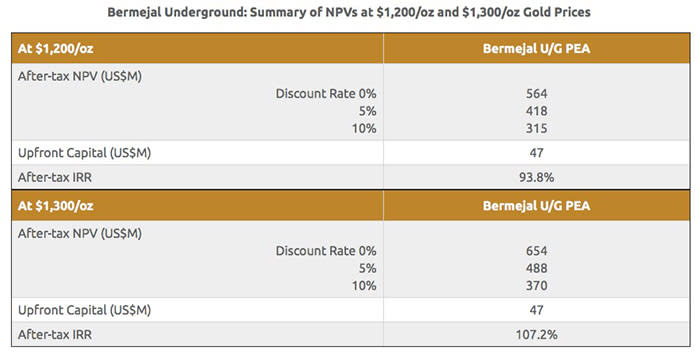

The El Bermejal underground deposit sits below Los Filos, and Leagold is now looking at the potential to produce another 1.39 million ounces of gold over a period of 8 years. And more significantly, this huge deposit of gold can be produced at half the cost of the gold coming out of the two open pit mines on the surface. For El Bermejal, Leagold is looking at production costs of only $439/ounce.

On 13 July, Leagold reported positive drill results for El Bermejal Underground, with 18 of the first 20 holes intercepting high-grade mineralization.

Now, this new production is slated to start in just 18-24 months. So, while Goldcorp was looking for even bigger things, Giustra and Woodyer swept in to scoop up these lucrative assets with an eye to turning Leagold into a mid-tier producer.

#4 This is Just the Beginning

Los Filos Gold Mine is just the start of the Leagold mid-tier build-up. This team is on the prowl for a major Latin American gold project acquisitions in the near-term.

Latin America’s giant gold miners are burdened with debt, and they’re getting rid of their non-core assets right now, for great prices.

Leagold (TSX:LMC; OTC:LMCNF) is on the hunt for more offerings like Los Filos from Goldcorp., as well as lucrative non-core assets from giants like Barrick Gold Corp. (NYSE:ABX) and Kinross Gold Corporation (NYSE:KGC).

#5 $2 Billion in Gold, Right Out of the Gate

The bottom line here is that we have the best value-creating mining crew in the world working quickly toward their next big coup.

- Right from the start, they’ve got 1.7 million ounces in gold reserves worth over $2 billion at today’s prices. And it comes from one of the largest and richest gold mines in the Americas. To wit: Mexico’s 31-million-ounce Guerrero Gold Belt.

- The mine they just acquired from Goldcorp is already producing 231,000 ounces per year, and the deep-down phase to get at another 1.3 million ounces is expected to start production in 18-24 months.

- This is poised to be a repeat of the wild success of Endeavor in West Africa—but it could very well go beyond this. After all, Los Filos is twice the size of the first asset that Endeavor launched with, so we expect an even more explosive story here.

- It’s headed by the greatest name in mining finance in the world, and the entire board of directors is an investor’s dream.

Leagold’s entire management were involved in the successful growth of Endeavour Mining into a leading West African gold producer, and in identifying and acquiring gold mines and attractive development projects. With Leagold, the team intends to replicate the ‘buy and build’ strategy and repeat its success.

Leagold is well-positioned to achieve its plans with a strong shareholder base, a motivated management team, and deep relationships in the gold mining sector.

At the beginning of this report, I talked about Leagold as an heirloom stock opportunity. What I mean by that is…Leagold (TSX:LMC; OTC:LMCNF) has all the earmarks of a stock you can own today and then watch grow year after year.

Other companies to watch in the space:

IAMGOLD (IMG.TO): IAMGOLD is a fast growing mid-tier gold miner with the ambition to become a major gold miner. The company produced some 214,000 ounces in Q1 2017 from its operations in South America and Africa. In June, this promising miner closed a deal with Japanese commodity giant Sumimoto to develop an Ontario gold project. The company saw its stock price fall earlier this year, but is poised for gains as gold is rallying.

Yamana Gold (YRI.TO): Yamana, a significant gold miner is about to complete its Cerro Moro project in Argentina, giving its investors something major to look out for. The company plans to ramp up its gold production by 20% through 2019 and its silver production by a whopping 200%. Investors can expect a serious increase in free cash flow if precious metal prices remain stable.

Eldorado Gold Corp. (ELD.TO): This Canadian mid-cap miner has assets in Europe and Brazil and has managed to cut cost per ounce significantly last year. Due to a steep loss in 2016, the company has seen its share price tank this year. Analysts, however, are getting bullish on this stock again as gold prices are rising.

Centerra Gold (CG.TO): This big mid-tier gold Canadian miner realized a very competitive cost per ounce in 2016 and expects to cut costs even further in 2017. Its Kyrgyzstan operation yielded a very strong result in 2016. Next to gold, Centerra’s copper production is worth noting as prices for this metal just leapt to two-year highs, providing a nice extra income for Centerra this year.

Pretium Resources (TSX:PVG): This promising miner is building out its British-Colombia-based Brucejack gold project, with its Valley of Kings deposit, counting over 8 million ounces of gold in proven/probable reserves. Pretium expects to start commercial production at the end of this year. The company could hand investors significant returns as soon as it starts operations on the major project.

Legal Disclaimer/Disclosure: This piece is an advertorial. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Baystreet.ca only and are subject to change without notice. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Yahoo Finance

Yahoo Finance