Mondelez (MDLZ) Navigates Hurdles Through Portfolio Strength

Mondelez International, Inc. MDLZ is operating in a challenging and dynamic operating environment, with shoppers becoming increasingly price-sensitive.

In several markets, this is leading consumers to choose smaller pack sizes in both biscuits and chocolates. In its first-quarter 2024 earnings release, management stated that consumer confidence varied by region, with North America and Australia/New Zealand displaying mixed signals, Europe seeing improvement and emerging markets remaining robust.

However, snacking category consumers remain extremely loyal to the brands they love. Additionally, favorable trends in emerging markets and a robust brand portfolio have been working well for this Zacks Rank #3 (Hold) company.

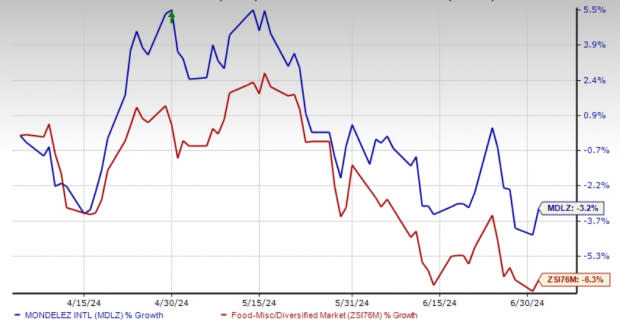

Image Source: Zacks Investment Research

Category & Brand Strength

Mondelez continues to reinvest in its brands and capabilities alongside significant portfolio-reshaping efforts, positioning the company strongly for future growth. With a strategic focus on core categories like chocolates, biscuits and baked snacks, the company enhances brand appeal. The latest example in this regard is MDLZ’s collaboration with Lotus Bakeries, aimed at expanding the Biscoff brand in India and developing co-branded chocolate products in Europe.

Apart from this, the past acquisitions of Ricolino, Clif Bar, Grenade, Gourmet Food Holdings and Hu Master Holdings have strengthened Mondelez’s portfolio and helped it expand its reach and customer base.

As consumers prefer snacking over traditional meals, the company’s core categories — chocolates and biscuits — have historically depicted resilience to economic downturns and pricing actions. This was witnessed in the first quarter of 2024, wherein its core categories of chocolates, biscuits and baked snacks continued to show significant resilience and lower elasticity compared to the broader food universe.

Management is focused on expanding its chocolate, biscuit and baked snacks categories as they present opportunities for solid growth and profitability. The company is on track to generate around 90% of its revenues through these categories by 2030.

Emerging Market Growth

Mondelez remains encouraged by the underlying emerging market strength. During the first quarter of 2024, MDLZ continued to witness strength in emerging markets, wherein consumer confidence remained solid, and categories stayed resilient. In the quarter, revenues from emerging markets increased 3.8% to $3,733 million while rising 8.3% on an organic basis due to growth in several key markets. The continuation of these trends bodes well.

Let’s Conclude

Shares of Mondelez have declined 3.2% in the past three months compared with the industry’s fall of 6.3%.

The abovementioned upsides place Mondelez well for growth. The company is also making investments aimed at empowering consumers to make careful snacking decisions that align with their health-conscious and active lifestyles. MDLZ expects 2024 organic net revenue growth in the upper range of 3-5%.

The company remains on track with its pricing strategies to counter input cost inflation by leveraging the headline price as well as revenue growth management. Mondelez envisions high-single-digit adjusted earnings per share growth on a constant currency basis.

Key Staple Picks

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings indicates growth of 22.6% and 62.7%, respectively, from year-ago reported numbers.

Freshpet, Inc. FRPT, a pet food company, has a trailing four-quarter earnings surprise of 118.2%, on average. FRPT currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for Freshpet’s current financial-year sales and earnings suggests growth of 24.8% and 177.1%, respectively, from the prior-year reported level.

Utz Brands Inc. UTZ, which manufactures a diverse range of salty snacks, currently carries a Zacks Rank #2 (Buy). UTZ has a trailing four-quarter earnings surprise of 2%, on average.

The consensus estimate for Utz Brands’ current financial-year earnings calls for growth of 26.3% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Freshpet, Inc. (FRPT) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance