Mondelez (MDLZ) Lifts View on Q3 Earnings & Revenue Beat

Mondelez International, Inc. MDLZ reported third-quarter 2019 results, wherein both earnings and sales improved year over year and surpassed estimates. Favorable pricing and volumes aided results, though adverse currency movements were a hurdle. Following the solid results, management raised its full-year guidance.

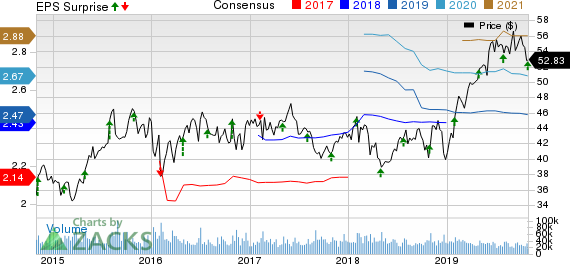

This Zacks Rank #3 (Hold) stock has surged 34% so far this year, outpacing the industry’s growth of 14.5%.

Q3 Performance

Adjusted earnings of 64 cents per share surpassed the Zacks Consensus Estimate of 61 cents. On a constant-currency (cc) basis, adjusted earnings improved 9.7% year over year, courtesy of operating gains, share repurchases, reduced taxes and increased joint venture income.

Net revenues advanced 1.1% year over year to $6,355 million and surpassed the Zacks Consensus Estimate of $6,312 million. The upside was backed by organic net revenues, which grew 4.2% on favorable pricing and volume/mix in emerging and developed markets. However, currency headwinds were a deterrent.

Revenues from emerging markets rose 1.6% to $2,363 million, while the same increased 6.6% on an organic basis. Revenues from developed markets inched up 0.7% to $3,992 million, while the same grew 2.9% on an organic basis.

Regionally, revenues in Latin America dropped 4.9% year over year but climbed 1.5%, 0.7% and 3.9% in Asia, Middle East & Africa; Europe; and North America, respectively. Nonetheless, on an organic basis, revenues increased a respective 4.3%, 5.3%, 5% and 2.5% in Latin America; Asia, Middle East & Africa; Europe; and North America.

Adjusted gross profit edged down 0.8% to $2,525 million (up 2.6% on at cc). Adjusted gross margin contracted 100 basis points, owing to plant transition hurdles in Brazil and increased inflation in Argentina.

Also, the company’s adjusted operating income declined 0.3% to $1,065 million (up 4.3% on at cc) from the prior-year quarter. Further, adjusted operating margin fell 30 bps to 16.8% due to lower gross margin, which was somewhat compensated by SG&A cost leverage.

Other Financials

Mondelez ended the quarter with cash and cash equivalents of $1,537 million, long-term debt of $12,593 million and total equity of $26,874 million.

During the first three quarters of 2019, the company generated cash from operating activities of $1,882 million. Free cash flow was nearly $1.2 billion year to date. The company continues to expect 2019 free cash flow of approximately $2.8 billion.

During the quarter, the company distributed around $600 million to shareholders through share repurchases and cash dividends. Year to date, Mondelez returned nearly $2.3 billion to shareholders.

Guidance

Mondelez is pleased with its quarterly performance. The company is on track with growth strategies, which include expansion across core markets and channels; investments in local and global brands; enhancing the supply chain, and undertaking marketing and sales initiatives, among others.

Given a strong year-to-date performance, management raised its outlook for 2019. The company now expects organic net revenue growth of more than 3.5% compared with more than 3% growth guided earlier. Management anticipates currency fluctuations to negatively impact net revenues by nearly 4%.

Currency-neutral adjusted earnings per share are likely to grow 5-7%, with currency headwinds expected to have a 14-cent impact. The company earlier guided currency-neutral adjusted earnings per share to improve about 5%.

Don’t Miss These Solid Food Stocks

US Foods Holding Corp USFD, with a Zacks Rank #1 (Strong Buy), has a long-term earnings per share growth rate of 9.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

J&J Snack Foods JJSF, with a Zacks Rank #2 (Buy), has an impressive earnings surprise record.

McCormick & Company MKC, with a Zacks Rank #2, has a long-term earnings per share growth rate of 8%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Click to get this free report J & J Snack Foods Corp. (JJSF) : Free Stock Analysis Report McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report US Foods Holding Corp. (USFD) : Free Stock Analysis Report Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance