Mohnish Pabrai Buys Alibaba, Curbs Micron Stake

- By Sydnee Gatewood

Renowned investor Mohnish Pabrai (Trades, Portfolio), who is the managing partner of Pabrai Funds, disclosed in his portfolio for the first quarter that he entered a position in Alibaba Group Holding Ltd. (NYSE:BABA) and trimmed his Micron Technology Inc. (NASDAQ:MU) stake.

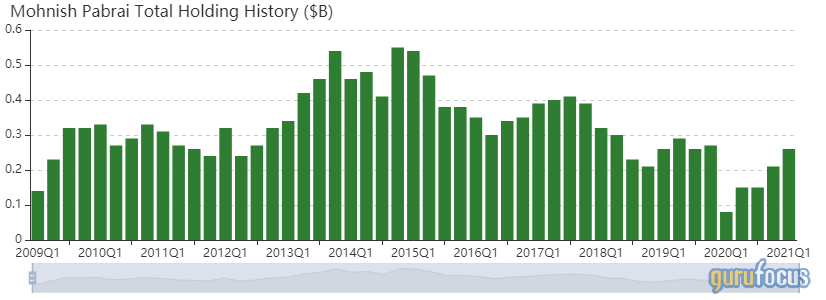

As a result of not being able to find good opportunities in the U.S. market, the guru, who oversees an extremely concentrated portfolio of discounted, out-of-favor stocks, told GuruFocus in a 2019 interview that he moved the vast majority of his portfolio into India, Turkey and South Korea. The U.S.-based portfolio, which is valued at $206 million, represents a small fraction of the California-based firm's assets under management.

Alibaba

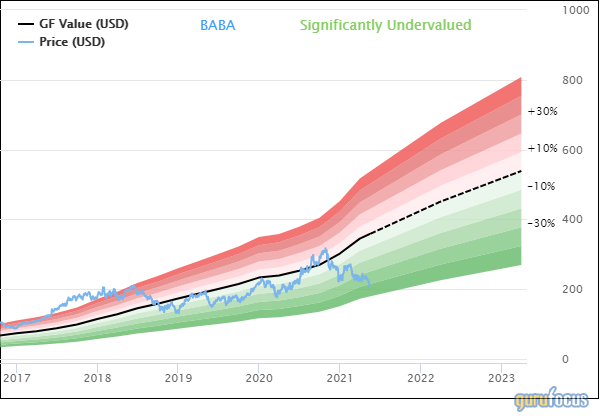

Pabrai invested in 168,843 shares of Alibaba (NYSE:BABA), allocating 14.61% of the equity portfolio to the holding. During the quarter, the stock traded for an average price of $245.98 per share.

The Chinese e-commerce company has a $565.42 billion market cap; its shares were trading around $208.31 on Friday with a price-earnings ratio of 24.34, a price-book ratio of 3.95 and a price-sales ratio of 6.06.

The GF Value Line suggests the stock is significantly undervalued currently based on its historical ratios, past performance and future earnings projections.

Driven by a good cash-debt ratio, a comfortable level of interest coverage and a robust Altman Z-Score of 5.29, Alibaba's financial strength was rated 7 out of 10 by GuruFocus. The return on invested capital also surpasses the weighted average cost of capital, indicating good value creation.

The company's profitability scored an 8 out of 10 rating. Although the operating margin is in decline, Alibaba has strong returns on equity, assets and capital that outperform a majority of competitors as well as a moderate Piotroski F-Score of 4, indicating business conditions are stable. Despite recording consistent earnings and revenue growth, the 2.5-star predictability rank is on watch. According to GuruFocus, companies with this rank return an average of 7.3% annually.

Baillie Gifford (Trades, Portfolio) is Alibaba's largest guru shareholder with a 0.98% stake. Ken Fisher (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio), Frank Sands (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Chase Coleman (Trades, Portfolio), Chris Davis (Trades, Portfolio), Dodge & Cox, Sarah Ketterer (Trades, Portfolio), Ron Baron (Trades, Portfolio), David Tepper (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Al Gore (Trades, Portfolio), Daniel Loeb (Trades, Portfolio), Philippe Laffont (Trades, Portfolio), Tom Russo (Trades, Portfolio), Tweedy Browne (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio) also have significant positions in the stock.

Micron Technology

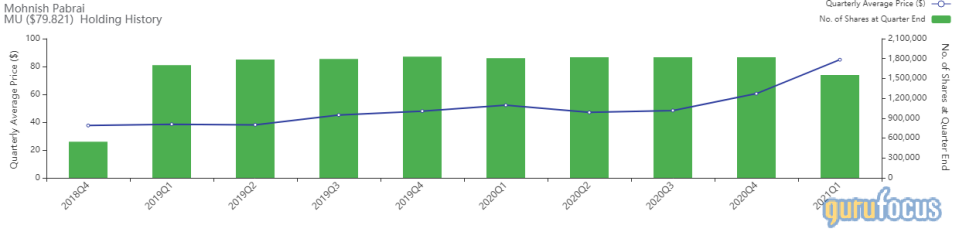

With an impact of -9.78% on the equity portfolio, the guru curbed his Micron Technology (NASDAQ:MU) stake by 14.74%, selling 268,322 shares. Shares traded for an average price of $84.89 each during the quarter.

Pabrai now holds 1.5 million shares total, which make up 52.25% of the equity portfolio. GuruFocus data shows he has gained an estimated 108.21% on the investment since establishing it in the fourth quarter of 2018.

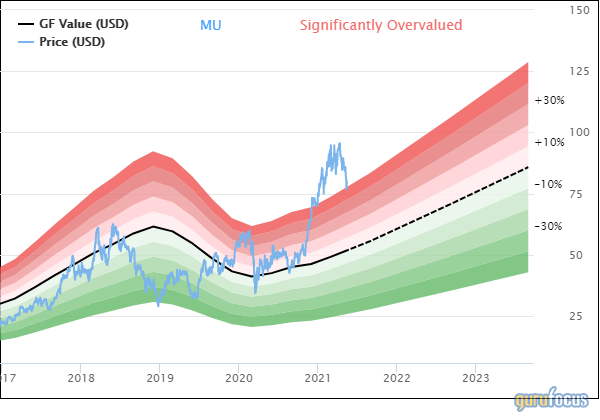

The semiconductor chip manufacturer, which is headquartered in Boise, Idaho, has a market cap of $89.52 billion; its shares were trading around $79.95 on Friday with a price-earnings ratio of 28.3, a price-book ratio of 2.2 and a price-sales ratio of 3.85.

According to the GF Value Line, the stock is significantly overvalued currently.

GuruFocus rated Micron's financial strength 7 out of 10. In addition to solid interest coverage, the company has a robust Altman Z-Score of 5.67, indicating it is in good standing even though assets are building up at a faster rate than revenue is growing. The ROIC, however, is eclipsed by the WACC, indicating struggles with creating value.

The company's profitability scored an 8 out of 10 rating, driven by an expanding operating margin, strong returns that outperform over half of its industry peers and a high Piotroski F-Score of 7, which implies business conditions are healthy. On the back of consistent earnings and revenue growth, Micron also has a 3.5-star predictability rank. GuruFocus data shows companies with this rank return, on average, 9.3% annually.

Of the gurus invested in Micron, Primecap has the largest stake with 4.05% of outstanding shares. Other top guru shareholders include Li Lu (Trades, Portfolio), Tepper, Pioneer, Seth Klarman (Trades, Portfolio), Andreas Halvorsen (Trades, Portfolio), Steven Cohen (Trades, Portfolio), the Parnassus Endeavor Fund (Trades, Portfolio) and Laffont.

Portfolio composition

The investor manages roughly $1 billion across all of his funds. Unlike other well-known investors, U.S.-listed stocks make up a tiny fraction of his overall holdings, with international stocks making up the majority.

Pabrai's final holding is Seritage Growth Properties (NYSE:SRG), which he did not make any changes to during the three-month period ended March 31.

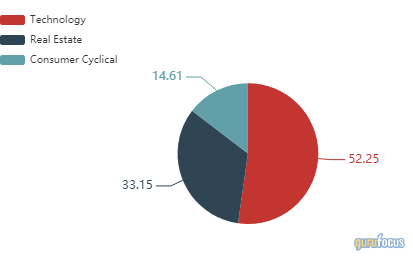

The technology sector has the largest representation in the guru's equity portfolio with a 52.25% weight, followed by real estate with representation of 33.15% and the consumer cyclical space with 14.61% exposure.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance