Misconceptions about costs discourage sustainable investing

New survey from Co-operators finds that Canadians want to act sustainably but are concerned about the price of going "green"

TORONTO, Nov. 7, 2023 /CNW/ - The perceived cost of going "green" has many Canadians wondering if they can afford to invest sustainably, despite their interest in doing so. A new survey from Co-operators reveals three-quarters (73%) of Canadians believe that products and services from sustainable companies cost more, and over half of survey respondents (53%) say they were interested in supporting sustainable companies before rising inflation, living costs and interest rates "made things too expensive." Younger Canadians appear most offput, as the latter figure rises to 62% among those aged 18 to 24.

The findings perpetuate a misconception that sustainable investing – also called ethical or socially responsible investing – equates to financial concessions. According to the survey, despite widespread agreement on the importance of sustainability (73%) and the importance of supporting sustainable companies (62%), less than a quarter of Canadians (23%) say they are willing to pay a premium for sustainable investment products.

"The survey results are enlightening," says Rob Wesseling, President and CEO of Co-operators. "While Canadians clearly understand the need to support sustainable initiatives, misleading information about the costs could be holding some investors back. It's critical that Canadians are educated about the availability of investment products and solutions that enable them to make a substantive social difference, alongside compelling financial returns. At its core, sustainable investing ensures that financial security and societal betterment go hand in hand."

"As an investor, it's important that you're empowered with the information you need to align your investment strategy with your values", says Jessica Baker, Co-operators EVP of Retail Wealth. And access to the right information is even more crucial. "The idea that investors have to sacrifice performance or pay more to go 'green' with their investment portfolios simply isn't true," Baker adds. "How much or how little investors pay in fees or generate in returns, depends on their risk appetite and investment strategy."

Some funds with ESG or sustainability mandates perform as well or better than those without the sustainable label and the costs associated with sustainable investing – like any other type of investment strategy – vary based on the fund company, portfolio, asset class and management structure.

"I encourage you, no matter where you are on your financial path, to take advantage of tools and resources to discover how you can realize your financial goals with an approach that doesn't come at the expense of future generations."

This Financial Literacy Month, Co-operators is highlighting the importance of savings and investing education through a sustainability lens. Baker offers the following tips for Canadians who want to invest using a sustainable investment strategy, but aren't sure where to start:

Review ESG and sustainability reports: Many companies publish stand-alone sustainability reports and disclose ESG information within their corporate filings, which you can find on their websites. Review these documents for companies you want to invest in (or are invested in) to ensure you support those that share your values.

Seek out sustainability-focused funds: Choose investment products that give you access to pre-vetted companies with strong sustainability track records. This is a simpler approach if you don't have time to review corporate filings. However, it's still a good idea to look at a prospective fund's portfolio holdings, performance history and management expense ratio – the amount an investment manager takes from your returns – to ensure it aligns with both your values and financial goals.

Consult a financial professional: A trusted financial professional can help you achieve the best balance between supporting companies that share your sustainable views while also achieving your long-term financial goals. If you're looking for an experienced financial representative, visit cooperators.ca to find one in your community.

As a financial services co-operative committed to creating financial security for Canadians and their communities, Co-operators believes that sustainable investing is a pathway to long-term financial growth for their client's portfolios and their corporate holdings. By the end of 2022, nearly 24% ($2.69 billion) of Co-operators total portfolio was in impact investments – an institutional investment strategy that aims to create both compelling financial returns and positive social and/or environmental impact.

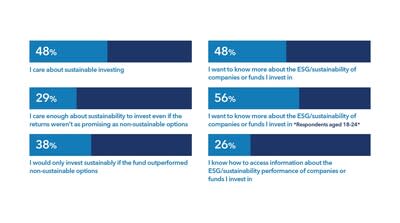

Additional survey findings – Canadians' attitudes toward sustainable investing

About the survey

The national online survey of 1,500 adult residents of Canada was conducted between July 19 and 24, 2023. The sample was randomly drawn from a panel of potential survey respondents (Leger Opinion). Post-stratification weights were applied to the sample based on 2021 census population parameters to ensure representation by province, age and gender. An associated margin of error for a probability-based sample of this size would be ± 3%, 19 times out of 20.

About Co-operators

Co-operators is a leading Canadian financial services co-operative, offering multi-line insurance and investment products, services, and personalized advice to help Canadians build their financial strength and security. The company has more than $59 billion in assets under administration. Co-operators has been providing trusted guidance to Canadians for the past 78 years. The organization is well known for its community involvement and its commitment to sustainability. Achieving carbon neutral equivalency in 2020, the organization is committed to net-zero emissions in its operations and investments by 2040 and 2050, respectively.

Co-operators is also ranked as a Corporate Knights' Best 50 Corporate Citizen in Canada. For more information, visit cooperators.ca.

Media Contact:

media@cooperators.ca

Mutual funds are offered through Co-operators Financial Investment Services Inc. to Canadian residents except those in Québec and the territories. Segregated funds and annuities are administered by Co-operators Life Insurance Company. Terms and conditions apply. Please refer to cooperators.ca/mutualfunddisclosure for details.

Co-operators Financial Investment Services Inc. is committed to protecting the privacy, confidentiality, accuracy and security of the personal information that we collect, use, retain and disclose in the course of conducting our business. Please refer to our privacy policy for more information.

The information contained in this report was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds. The views expressed are those of the author and not necessarily those of Co-operators Financial Investment Services Inc.

Co-operators® is a registered trademark of The Co-operators Group Limited. © 2023 Co-operators Financial Investment Services Inc. © 2023 Co-operators Life Insurance Company.

SOURCE The Co-operators Group Limited

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2023/07/c4433.html

Yahoo Finance

Yahoo Finance