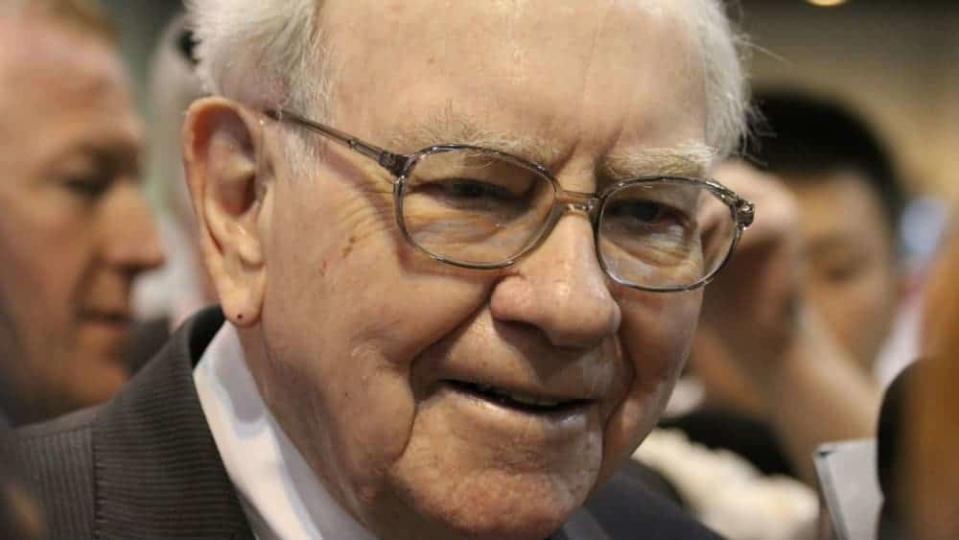

Mirror Warren Buffett’s Recent Buys With These 2 Underrated TSX Stocks

The big takeaway from the 2020 Berkshire Hathaway annual shareholders meeting was the fact that Warren Buffett was a net seller of equities in April, as he threw in the towel on his airline stocks.

What few people are talking about is the fact that Berkshire had purchased around $4 billion worth of stocks in the first quarter. We won’t know for sure what Berkshire bought and when they bought it (was it before or after the coronavirus-induced market crash?) until the 13F filings are released to the general public.

But we do know that Buffett and company have been nibbling away at businesses that they believe to be undervalued, even in the face of great uncertainty.

For now, we’ll have to look back to the fourth quarter when Buffett picked up shares of grocer Kroger and added to upscale furniture firm RH. To mirror these two bets the Canadian way, consider shares of Canadian grocer Loblaw (TSX:L) and furniture mart Leon’s Furniture (TSX:LNF).

Leon’s Furniture

Warren Buffett’s affinity for furniture stores is nothing new given Berkshire’s ownership of Nebraska Furniture Mart, but his new stake in upscale furniture retail firm RH definitely raised some eyebrows late last year.

Home furnishings are undoubtedly a discretionary spend, and with a coronavirus-induced recession likely on the way, it may seem as though his small stake in RH may be another poorly-timed investment.

From a longer-term perspective however, there are massive tailwinds to be had in the space. And given that the coronavirus crash has allowed better entry points into the discretionaries such as Leon’s, now is looking like a terrific chance to play the role of contrarian for those willing to hang onto shares for decades at a time.

So, what’s the bull thesis on Leon’s and other furniture firms?

“Over the next decade and beyond, I see furnishers (notably upscale ones) as riding massive tailwinds as millennials, a generation that hasn’t been big into homeownership due to financial reasons, finally save enough to get a mortgage on a home and with that the necessary furnishings,” I wrote in a prior piece.

While the coronavirus could severely delay big-ticket discretionary purchases over the next few years, the long-term risk/reward to be had at these depths is highly favourable, with Leon’s stock down around 23% from pre-pandemic levels.

The well-run furniture firm is highly liquid and trades at just over 1.1 times book. For those looking to play the next economic expansion, Leon’s is looking like a terrific value bet for those looking to follow in Buffett’s footsteps.

Loblaw

Loblaw is one of few TSX stocks that held its own amid the coronavirus pandemic. As an essential business, the firm will continue to operate, even if another wave of outbreaks spark further lockdowns over the next year and beyond.

Given that the pandemic could spill into 2021, it’d only be prudent to own shares of a company that won’t see its sales numbers fall off a cliff should things take a turn for the worse. Moreover, Loblaw is also a great defensive way to ride out the post-pandemic recessionary environment.

As a rare consumer staple on the TSX Index, investors should seek to pick up shares of the Canadian grocer if their portfolios are lacking in defensive positions.

The stock trades at a mere 0.5 times sales, 2.1 times book, and 5.1 times cash flow, all of which are lower than Loblaw’s five-year historical average multiples of 0.6, 2.2, and 8.6, respectively.

The post Mirror Warren Buffett’s Recent Buys With These 2 Underrated TSX Stocks appeared first on The Motley Fool Canada.

More reading

Why the Canada Revenue Agency Might Ask You for Those CERB Payments Back

Canada Revenue Agency: How to Generate $418 in Extra Monthly Pension Income and Avoid OAS Clawbacks

Fool contributor Joey Frenette owns shares of Berkshire Hathaway (B shares). The Motley Fool owns shares of and recommends Berkshire Hathaway (B shares). The Motley Fool recommends LEONS FURNITURE and RH and recommends the following options: long January 2021 $200 calls on Berkshire Hathaway (B shares), short January 2021 $200 puts on Berkshire Hathaway (B shares), and short June 2020 $205 calls on Berkshire Hathaway (B shares).

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2020

Yahoo Finance

Yahoo Finance