The Mirati Therapeutics (NASDAQ:MRTX) Share Price Has Gained 287%, So Why Not Pay It Some Attention?

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. For example, the Mirati Therapeutics, Inc. (NASDAQ:MRTX) share price has soared 287% in the last half decade. Most would be very happy with that. Also pleasing for shareholders was the 91% gain in the last three months. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

See our latest analysis for Mirati Therapeutics

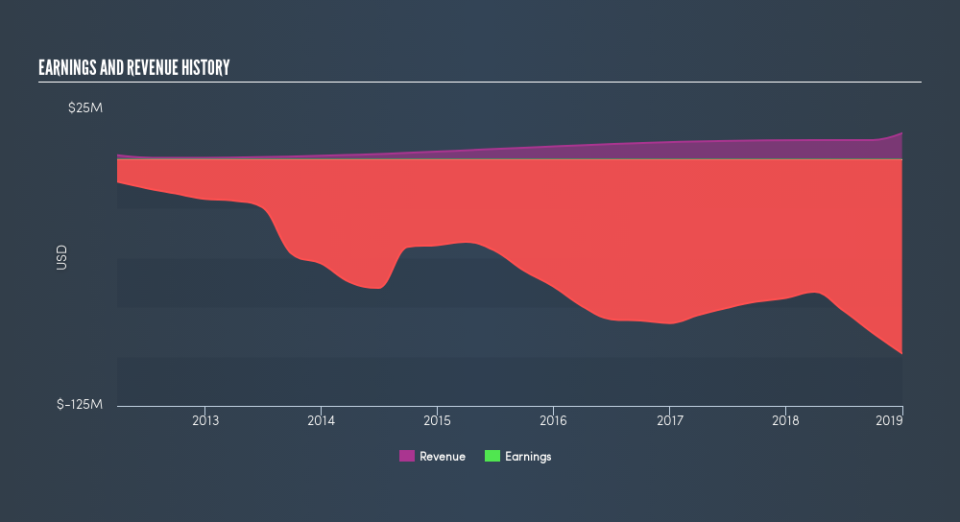

Mirati Therapeutics isn’t a profitable company, so it is unlikely we’ll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn’t make profits, we’d generally expect to see good revenue growth. That’s because it’s hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

It’s probably worth noting that the CEO is paid less than the median at similar sized companies. It’s always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It’s good to see that Mirati Therapeutics has rewarded shareholders with a total shareholder return of 154% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 31% per year), it would seem that the stock’s performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research Mirati Therapeutics in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Mirati Therapeutics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance