Mirati (MRTX) Surges 45% as Sanofi Reportedly Eyes Buyout

Shares of small-biotech Mirati Therapeutics MRTX surged 45.4% on Oct 5, following a report issued by Bloomberg, which stated that Sanofi SNY is interested in acquiring the company. Mirati is a commercial-stage biotechnology company developing kinase and KRAS inhibitors.

Though neither Mirati nor Sanofi issued any comments on the rumor, the Bloomberg article suggests that deliberations are still ongoing and other suitors may also be interested in acquiring Mirati. Since August, the company also parted ways with its chief financial officer (CFO) Laurie Stelzer and chief executive officer (CEO) David Meek.

Mirati Therapeutics has been a likely acquisition target ever since the FDA granted accelerated approval to its sole-marketed drug Krazati (adagrasib) last December. The Mirati drug is approved to treat KRASG12C-mutated locally advanced or metastatic non-small cell lung cancer (“NSCLC”) in adult patients, who received at least one prior treatment.

The rumored buyout news also comes a couple of months after Mirati reported encouraging data from clinical studies, which showed that treatment with the Krazati-Keytruda combination achieved an ORR of 63% in patients with KRAS G12C-mutated first-line NSCLC. This ORR was superior and favorable compared with the 39-45% ORR achieved by the current standard of care, i.e., Keytruda plus chemotherapy. Based on the above data, management intends to start a pivotal late-stage study on the Krazati-Keytruda combination in first-line NSCLC before 2023-end.

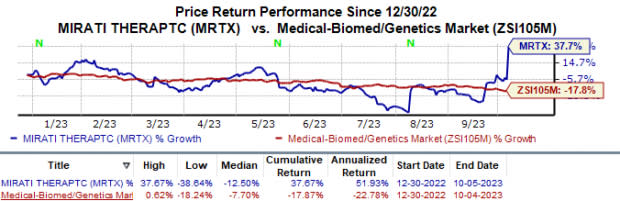

Year to date, shares of Mirati have rallied 37.7% against the industry’s 17.9% fall.

Image Source: Zacks Investment Research

The buyout will likely benefit Sanofi which has been exploring opportunities to expand its pipeline as well as portfolio of marketed drugs. In the year so far, Sanofi has completed the acquisition of Provention Bio (for $2.9 billion) that added diabetes drug Tzield to its portfolio of marketed drugs. Earlier this month, Sanofi signed a deal with Teva Pharmaceuticals to jointly develop and market TEV’574 for the treatment of ulcerative colitis and crohn's disease.

The timing of the article also benefits Mirati as it came on the same day when an FDA advisory committee was supposed to issue its recommendation on Lumakras, another KRASG12C inhibitor marketed by Amgen AMGN, also approved for an indication similar to Krazati. The committee members raised questions on the late-stage confirmatory study supporting Amgen’s regulatory filing on Lumakras and voted 10-2 stating that they cannot properly interpret the study’s primary endpoint.

Like Krazati, Amgen’s Lumakras was also granted accelerated approval in 2021 as the first FDA-approved therapy to target a KRASG12C-mutated cancer indication. An FDA filing is currently under review to convert this accelerated approval to a full one.

Despite a negative recommendation, the FDA did not suggest withdrawing the drug from the market. A final decision on Amgen’s Lumakras is still expected before this year’s end.

Mirati has been an ideal acquisition target since last year when a previous Bloomberg article suggested that several large-cap pharma giants eyed the company as an acquisition target. The rumored news never came to pass likely due to preliminary data from a mid-stage study on the Krazati-Keytruda combination in first-line NSCLC, which did not impress investors.

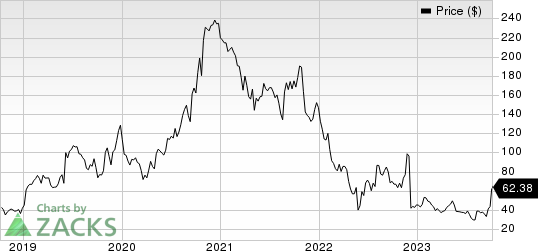

Mirati Therapeutics, Inc. Price

Mirati Therapeutics, Inc. price | Mirati Therapeutics, Inc. Quote

Zacks Rank

Mirati currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Mirati Therapeutics, Inc. (MRTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance