Million-Dollar TFSA: 1 Way to Achieve to 7-Figure Wealth

Written by Kay Ng at The Motley Fool Canada

Canadians should take full advantage of their Tax-Free Savings Accounts (TFSAs) by maximizing their TFSA contributions every year. One way to achieve to seven-figure wealth, or a $1 million portfolio, is by investing in a portfolio of growth stocks. These businesses are growing at a faster pace than the general market.

Canadian growth stock idea

One Canadian growth stock I have on my radar is goeasy (TSX:GSY), which is a leading provider of non-prime lending in Canada. The growth stock has grown investors’ money 11-fold over the last 10 years, equating to annual returns of almost 28%! It charges a high average interest rate. So, it also targets a high net charge-off rate of 8.5-9.5%. That said, it aims to reduce the interest rate and improve the credit score of its customers over time.

At $188.30 per share at writing, the credit services stock appears to trade at a fair valuation compared to its long-term historical normal valuation. To be sure, analysts think it has upside potential of about 19% over the next 12 months.

It’d be safer to diversify your capital across a basket of growth stocks.

Gain exposure to U.S. growth stocks

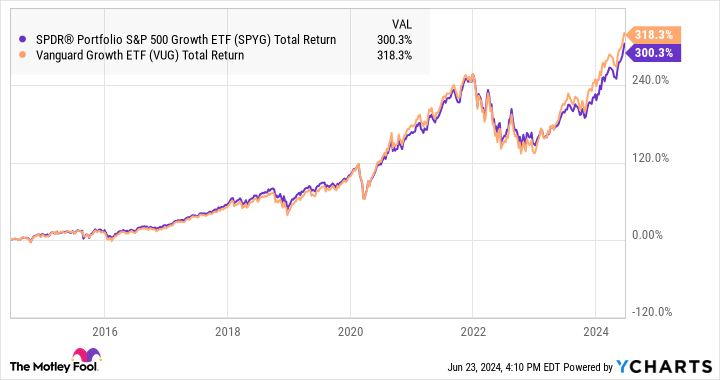

To gain exposure to a basket of U.S. growth stocks, investors can consider exchange-traded funds (ETFs) like SPDR Portfolio S&P 500 Growth ETF (NYSEMKT:SPYG) and Vanguard Growth Index Fund ETF (NYSEMKT:VUG). These two ETFs move in tandem with each other, which is not surprising given that their constituents are similar.

Below is a 10-year total return chart fueled by YCharts data. So, investors would have grown their money four-fold over 10 years, turning an initial investment of $10,000 into over $40,000, equating to annual returns of about 15%.

SPYG Total Return Level data by YCharts

Most of the time, investors don’t invest a lump sum and be done with it. Investors more often invest money periodically. If you’re able to save money every month, you can utilize the dollar-cost averaging approach, in which you’re investing, say, $500 a month in a growth fund. Your diversified portfolio could consist of cash and cash-like investments, fixed-income investments like Guaranteed Investment Certificates and bonds, dividend stocks or funds, and growth stocks or funds.

During market corrections, investors can target to invest more than they normally would to benefit from the long-term upside potential. As shown in the graph above, the growth funds tend to grow over time.

SPYG and VUG top holdings

SPYG’s top holdings are Microsoft (which makes up over 12% of the fund’s assets), Apple (over 11%), NVIDIA (11%), Amazon (over 6%), Meta Platforms (4%), Alphabet Class A (4%), Alphabet Class C (over 3%), Eli Lilly (over 2%), and Broadcom (over 2%).

VUG’s top holdings are Microsoft, which makes up over 12% of the fund’s assets, Apple (over 11%), NVIDIA (over 10%), Amazon (almost 7%), Meta Platforms (4%), Alphabet Class A (4%), Alphabet Class C (over 3%), Eli Lilly (almost 3%), and Tesla (2%).

Notably, VUG slightly outperformed SPYG over the last one-, three-, five-, and 10-year periods.

How long will it take to achieve a $1,000,000 portfolio?

Assuming you’re starting from scratch today and investing $1,000 a month (or $12,000 a year) compounded at a 12% rate of return, it would take a little over 21 years to hit $1,000,000.

All else equal, but if you already have $100,000 invested, it’d require a little more than 15 years to hit $1,000,000. Similarly, if you have $200,000 invested, you’ll only need about 11.5 years to arrive at seven figures.

The post Million-Dollar TFSA: 1 Way to Achieve to 7-Figure Wealth appeared first on The Motley Fool Canada.

Should you invest $1,000 in Spdr Series Trust - Spdr Portfolio S&p 500 Growth Etf right now?

Before you buy stock in Spdr Series Trust - Spdr Portfolio S&p 500 Growth Etf, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Spdr Series Trust - Spdr Portfolio S&p 500 Growth Etf wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $16,110.59!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 29 percentage points since 2013*.

See the 10 stocks * Returns as of 6/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Fool contributor Kay Ng has positions in Alphabet, Amazon, and Goeasy. The Motley Fool recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance