Microvast Holdings Inc (MVST) Surpasses Revenue Estimates with Strong Year-Over-Year Growth

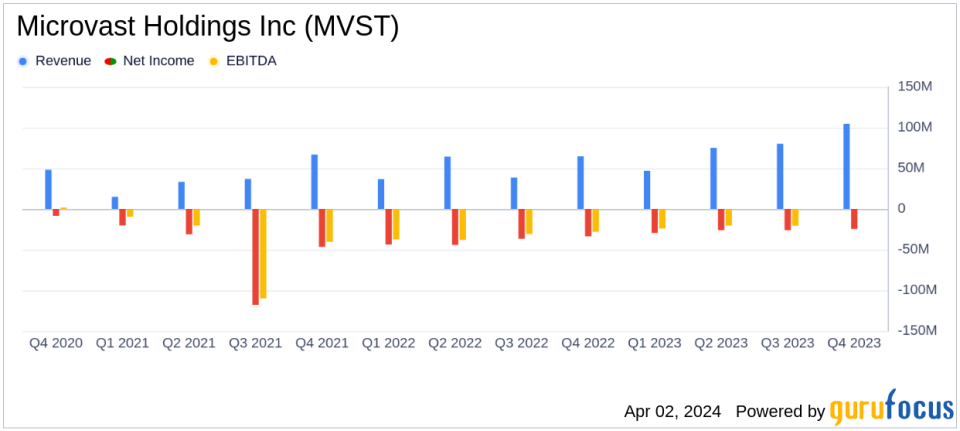

Revenue: Q4 revenue soared to $104.6 million, a 61.4% increase year over year, surpassing the estimated $107.4 million.

Gross Margin: Q4 gross margin improved dramatically to 22.0% from 3.4% in the previous year, indicating enhanced profitability.

Net Loss: Net loss narrowed to $24.6 million in Q4 2023 from $33.7 million in Q4 2022, though it missed the estimated net income of -$28.4815 million.

Earnings Per Share (EPS): Reported Q4 EPS of -$0.08, which is slightly better than the estimated EPS of -$0.07.

Full-Year Highlights: FY 2023 revenue hit a record $306.6 million, up 49.9% from 2022, with gross margin increasing to 18.7%.

Capital Expenditures: Investments in capacity expansions led to capital expenditures of $186.8 million, higher than the previous year's $150.9 million.

Liquidity Position: Cash and equivalents stood at $93.8 million as of December 31, 2023, down from $327.7 million the previous year.

Microvast Holdings Inc (NASDAQ:MVST) released its 8-K filing on April 2, 2024, detailing the company's financial performance for the fourth quarter and full fiscal year ended December 31, 2023. The company, known for its advanced lithium-ion battery solutions and vertical integration capabilities, showcased a significant year-over-year revenue increase of 49.9% to $306.6 million for FY 2023, with a record quarterly revenue of $104.6 million in Q4 2023, a 61.4% increase.

Microvast's gross margin saw a substantial improvement, rising from 4.4% to 18.7% year over year, with Q4 2023 gross margin reaching 22.0%. This margin expansion reflects the company's progress towards achieving targeted profitability levels. Despite these gains, the company reported a net loss of $106.4 million for the full year and $24.6 million for the quarter. However, these figures represent a significant reduction from the net losses of $158.2 million in FY 2022 and $33.7 million in Q4 2022, respectively.

The company's financial achievements, particularly in gross margin improvement and revenue growth, underscore its increasing efficiency and market penetration, especially in the EMEA region. Microvast's founder and CEO, Yang Wu, expressed optimism about the company's trajectory, citing revenue growth in EMEA as a positive sign for continued success in 2024. CFO Craig Webster emphasized the importance of maintaining strong revenue growth and gross margin profiles as the company seeks to improve its liquidity position and reduce operating losses.

Despite robust revenue growth, the company's liquidity position has weakened, with cash and equivalents decreasing significantly, largely due to capital expenditures for manufacturing capacity expansions in Huzhou, China, and Clarksville, Tennessee. Microvast's management is targeting financing solutions to complete the Clarksville Phase 1A expansion and secure long-term domestic customer contracts.

For Q1 2024, Microvast is targeting a revenue growth of 40% to 60% year over year and revenue guidance of $65 million to $75 million, with a gross margin target of 20% to 25%. These projections reflect the company's confidence in its operational efficiencies and market opportunities.

The detailed financial tables provided in the earnings report offer a granular view of Microvast's financial position, including balance sheet strength and cash flow movements. Notably, the company's capital expenditures reflect its commitment to scaling up production capabilities to meet growing demand.

Microvast's performance in FY 2023 demonstrates its resilience and strategic focus on innovation and market expansion. As the company navigates the challenges ahead, including securing necessary financing and managing capital expenditures, investors will be closely monitoring its ability to maintain momentum and achieve profitability.

For more detailed insights and analysis on Microvast Holdings Inc (NASDAQ:MVST) and its earnings report, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Microvast Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance