Microsoft (MSFT) Unveils Innovative AI for Non-profits

Microsoft MSFT recently announced a suite of new AI solutions and enhancements to Microsoft Cloud for Non-profit, which will help fundraisers in interacting with donors, manage campaigns and optimize operations.

Microsoft also introduced a limited private preview for non-profits to experience an AI-powered fundraising propensity model.

The new AI tools provided in the preview enable fundraisers to conduct predictive forecasting of fundraising goals using data modelling. They can also identify potential donors who are most likely to contribute to a campaign, cause or major gift.

These advancements address the challenges faced by non-profits in current economic environment, where organizations need to achieve more with fewer resources. Now with AI non-profits can use data in a better way to attract, retain and grow their donor base.

Microsoft Cloud for Non-profit offers customisable industry solutions and workflows to help organizations achieve growth and value. These AI features offer enhanced scalability, reliability and security.

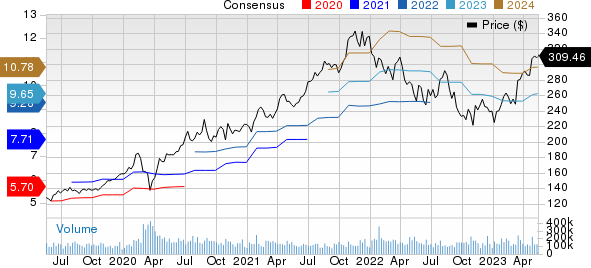

Microsoft Corporation Price and Consensus

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

Growing Competition in the Non-profit CRM Software Sectors

The Non-profit customer relationship management software is a type of donor management software that helps organizations understand and deepen their relationships with donors. With AI gaining popularity, this software will get a further boost in demand and efficiency.

Microsoft is looking to capitalize on this sector by integrating AI in its software solutions. It faces competition from Blackbaud BLKB Raiser’s Edge NXT, Oracle ORCL NetSuite and Salesforce CRM. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Blackbaud Raiser's Edge NXT is a multi-dimensional tool that can help non-profits grow their support base, generate more revenue and make a greater impact than ever before. It is designed to cater to small and medium-sized organizations.

NetSuite is a popular all-in-one cloud-based software suite that includes everything that a business needs for accounting, managing operations, customer relationships and online selling. It is designed to cater to small and medium-sized businesses.

Salesforce for non-profits is a reliable and widely accepted data model that simplifies the management of income streams, grants, and programs by offering a centralized platform. It is designed to cater to large and medium-sized organizations.

What Awaits Microsoft Shares in 2023?

This Zacks Rank #3 company’s shares have gained 30.6% year to date while the Zacks Computer and Technology sector gained 22.7% in the same period.

Microsoft’s top-line is expected to benefit from strong cloud growth. For Intelligent Cloud, it anticipates revenues in constant currency (CC) to increase between 15% and 16% to a range of $23.6-$23.9 billion. In Azure, Microsoft expects revenue growth to be 26% to 27% incc, including roughly 1 point from AI services, driven by Azure consumption business and the company expects the trends from third-quarter to continue into fourth-quarter.

The Zacks Consensus Estimate for MSFT’s 2023 earnings is pegged at a profit of $9.66 per share, indicating year-over-year growth of 4.89%. The consensus estimate for fourth-quarter 2023 revenues is pegged at $55.35 billion, indicating year-over-year growth of 6.73%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance