Microbot (MBOT) Inks a New Agreement to Begin Trial on LIBERTY

Microbot Medical Inc. MBOT recently signed a clinical trial agreement with the Baptist Hospital of Miami for its LIBERTY Endovascular Robotic Surgical System. The company has received the Institutional Review Board’s approval to begin the trial at this site.

The Baptist Hospital of Miami includes the Miami Cardiac & Vascular Institute and the Miami Cancer Institute.

The latest trial agreement should boost MBOT’s confidence and help it advance with the use of surgical robotics in endovascular interventional procedures.

About LIBERTY

LIBERTY is a single-use endovascular surgical robotic system designed to streamline endovascular procedures. It eliminates the need for large, cumbersome, and expensive capital equipment while reducing radiation exposure and physician strain.

More on the News

The Baptist Hospital is the second site that will participate in the clinical trial for Microbot’s LIBERTY as part of its Investigational Device Exemption (IDE). The company recently announced the Brigham and Women's Hospital as another participating site.

Image Source: Zacks Investment Research

Market Prospect

Per a Future Market Insights report, the robotic-assisted endovascular systems market size is expected to surpass $214.7 million by 2033, at a CAGR of 8.6% during the period. The market growth is influenced by the increasing need for cutting-edge treatment alternatives due to the rise of cardiovascular illnesses, peripheral artery diseases, and other vascular disorders. Also, the growing demand for innovative, minimally invasive surgical procedures that reduce patient trauma and recovery time drives the market’s growth.

Looking at the market potential, Microbot’s IDE for its LIBERTY system is perfectly timed.

Other Notable Developments

In June 2024, Microbot received the Food and Drug Administration’s (FDA) approval to proceed with its pivotal human clinical trial as part of its IDE application for its LIBERTY Endovascular Robotic Surgical System.

Earlier this year, Microbot announced the completion of its collaboration with Corewell Health. The collaboration demonstrated the LIBERTY System's technical capabilities and outlined potential applications in a range of endovascular interventions.

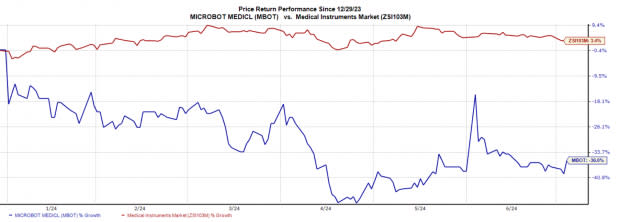

Price Performance

Year to date, shares of MBOT have lost 36% against the industry’s 3.4% growth.

Zacks Rank and Key Picks

Microbot currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are Hims & Hers Health, Inc. HIMS, The Joint Corp. JYNT, and Medpace Holdings MEDP. While Hims & Hers and The Joint currently sport a Zacks Rank #1 (Strong Buy) each, Medpace Holdings carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Hims & Hers Heath stock has surged 130.5% in the past year. Estimates for the company’s 2024 earnings have moved north by 5.6% to 19 cents per share in the past 30 days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for The Joint’s 2024 earnings per share (EPS) have remained constant at 21 cents in the past 30 days. Shares of JYNT have surged 38.8% year to date against the industry’s 5.3% decline.

In the last reported quarter, JYNT delivered an earnings surprise of 300%. It has a trailing four-quarter average earnings surprise of 18.75%.

Estimates for Medpace’s 2024 EPS have remained unchanged at $11.29 in the past 30 days. Shares of the company have soared 70.1% in the past year compared with the industry’s 4.6% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Joint Corp. (JYNT): Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP): Free Stock Analysis Report

Microbot Medical Inc. (MBOT): Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance