Michael Dell's MSD Capital Exits Dine Brands With Notable Portfolio Impact

Insight into Michael Dell (Trades, Portfolio)'s Latest Investment Moves and Portfolio Adjustments

Michael Dell (Trades, Portfolio), renowned for founding Dell Computer Corporation, has made significant changes to his investment portfolio through MSD Capital in the fourth quarter of 2023. MSD Capital, established to manage the Dell family's assets, is known for its rigorous investment approach, aiming for superior risk-adjusted returns and a commitment to excellence and integrity. The latest 13F filing reveals strategic exits and adjustments reflective of MSD Capital's dynamic investment strategy.

Portfolio Exits: Dine Brands and Peloton Interactive

Michael Dell (Trades, Portfolio)'s recent 13F filing indicates a strategic move to exit two significant holdings in the fourth quarter of 2023:

Dine Brands Global Inc (NYSE:DIN): The complete sale of 740,545 shares had a -10.76% impact on the portfolio.

Peloton Interactive Inc (NASDAQ:PTON): The liquidation of 1,889,231 shares resulted in a -2.8% impact on the portfolio.

Portfolio Overview: Concentration in Key Industries

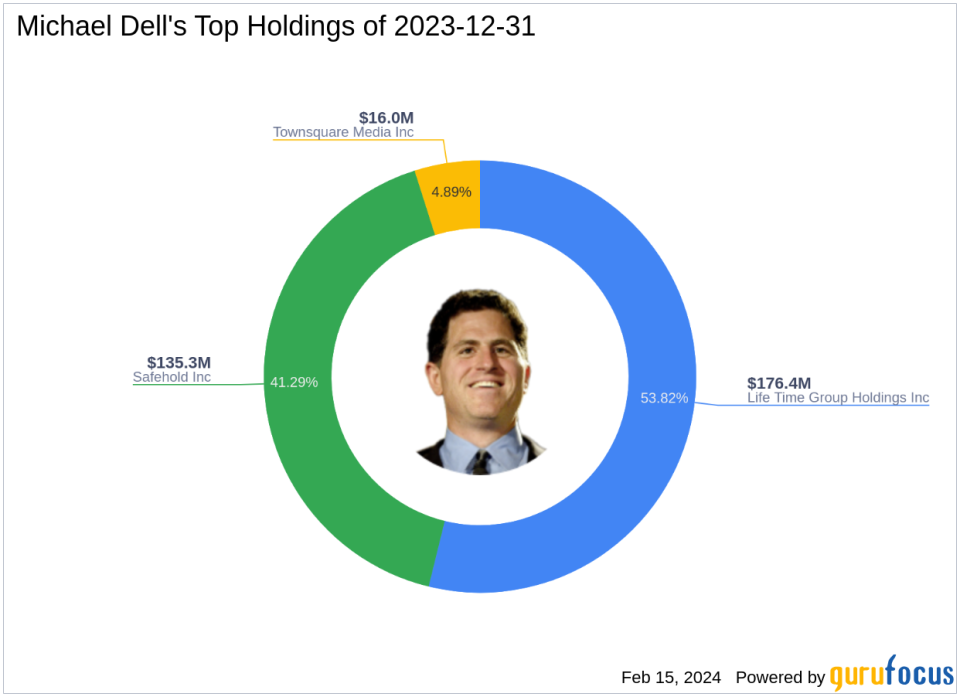

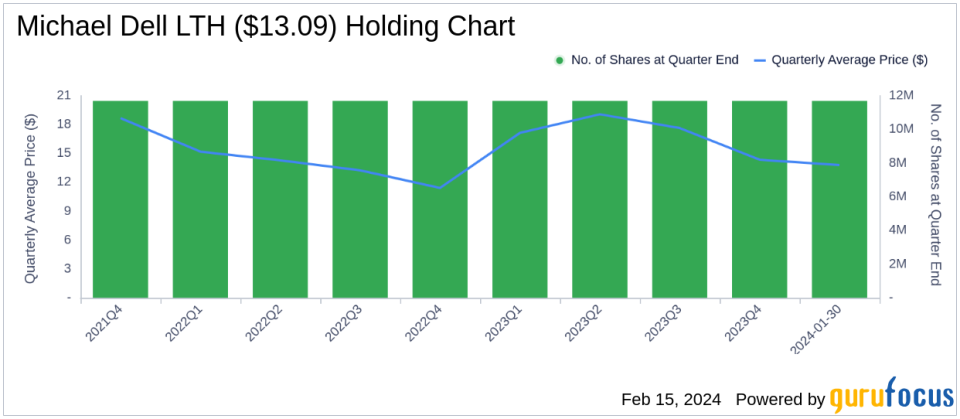

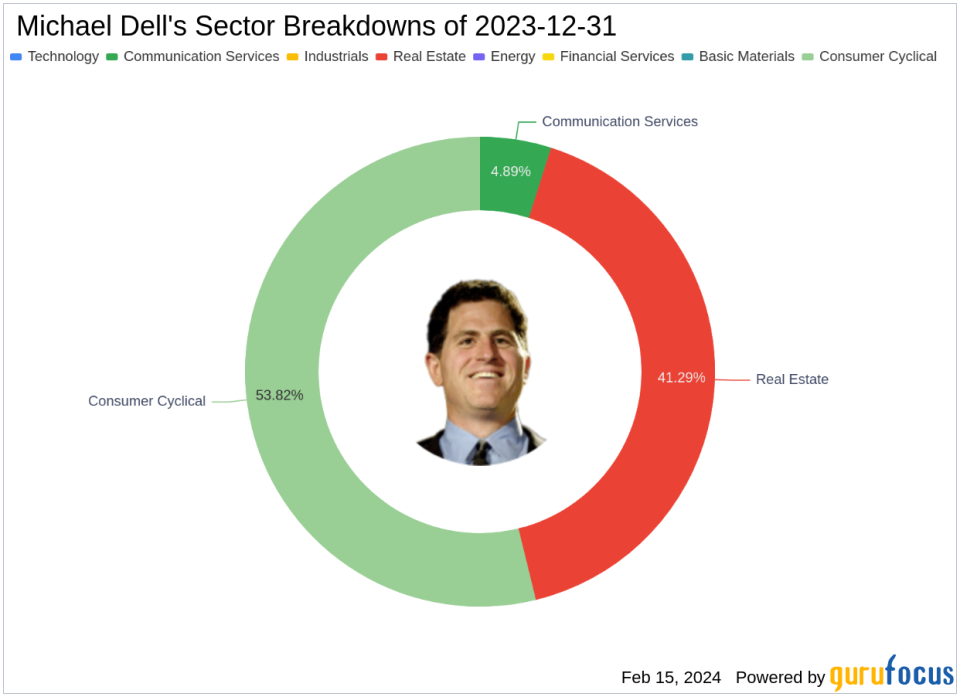

As of the fourth quarter of 2023, Michael Dell (Trades, Portfolio)'s investment portfolio comprises 3 stocks. The top holdings are 53.82% in Life Time Group Holdings Inc (NYSE:LTH), 41.29% in Safehold Inc (NYSE:SAFE), and 4.89% in Townsquare Media Inc (NYSE:TSQ). These investments are primarily concentrated across three industries: Consumer Cyclical, Real Estate, and Communication Services, showcasing a focused approach to sector allocation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance