Methanex's (MEOH) Q1 Earnings & Revenues Surpass Estimates

Methanex Corporation MEOH logged a first-quarter 2024 profit (attributable to shareholders) of $53 million or 77 cents per share, down from $60 million or 87 cents per share in the year-ago quarter.

Adjusted earnings per share (barring one-time items) in the reported quarter were 65 cents, topping the Zacks Consensus Estimate of 30 cents.

Revenues fell roughly 11.8% year over year to $916 million in the quarter. The top line beat the Zacks Consensus Estimate of $908.5 million.

Adjusted EBITDA in the reported quarter fell around 23.4% year over year to $160 million. The results were hurt by lower year-over-year average realized prices.

Methanex Corporation Price, Consensus and EPS Surprise

Methanex Corporation price-consensus-eps-surprise-chart | Methanex Corporation Quote

Operational Highlights

Production in the quarter totaled 1,721,000 tons, up 3.7% year over year, below our estimate of 1,994,000 tons. Production was, however, lower than the prior quarter, owing primarily to reduced production in New Zealand, which was slightly offset by increased production in Egypt.

Total sales volume in the first quarter totaled 2,670,000 tons, down 4.8% year over year. The figure is above our estimate of 2,628,000 tons.

The average realized price for methanol was $343 per ton in the quarter, down from $371 per ton in the prior-year quarter. The figure is below our estimate of $349 per ton.

Financials

Cash and cash equivalents were $407 million at the end of the quarter. Cash flow from operating activities was $91 million in the quarter.

The company returned $12.5 million to shareholders through dividends in the reported quarter.

Outlook

MEOH expects production for 2024 to be roughly 7 million tons. The company's production projection for the year has been reduced principally due to the Geismar 3 start-up delay. This predicted production estimate is based on the midpoint of Chile and New Zealand production guidance, with G3 starting up in the third quarter and working at full rates in the fourth quarter, the restart of Egypt in the first half of February and all other plants functioning at full capacity. Quarterly production may vary depending on turnaround timing, gas supply, unforeseen outages and unanticipated events.

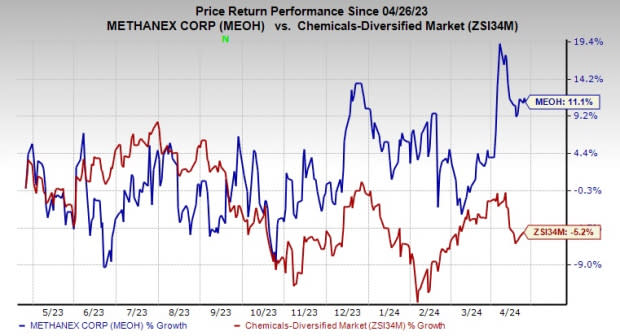

Price Performance

Shares of Methanex have gained 11.1% in the past year against a 5.2% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Methanex currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Denison Mines Corp. DNN, Carpenter Technology Corporation CRS and Ecolab Inc. ECL.

Denison Mines sports a Zacks Rank #1 (Strong Buy). DNN beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 300%. The company’s shares have soared 91.3% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology currently carries a Zacks Rank #2 (Buy). CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have soared 67.8%% in the past year.

The Zacks Consensus Estimate for Ecolab current-year earnings is pegged at $6.43 per share, indicating a year-over-year rise of 23.4%. ECL, a Zacks Rank #2 stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.7%. The company’s shares have rallied roughly 34.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance