Methanex (MEOH) Earnings and Revenues Lag Estimates in Q2

Methanex Corporation MEOH logged a profit (attributable to shareholders) of $125 million or $1.41 per share in second-quarter 2022 versus $107 million or $1.31 per share in the year-ago quarter.

Adjusted earnings per share (barring one-time items) in the reported quarter were $1.16, missing the Zacks Consensus Estimate of $1.85.

Revenues rose around 6.5% year over year to $1,137.2 million in the quarter. However, the top line missed the Zacks Consensus Estimate of $1,183 million.

Adjusted EBITDA in the reported quarter fell 7.3% year over year to $243 million.

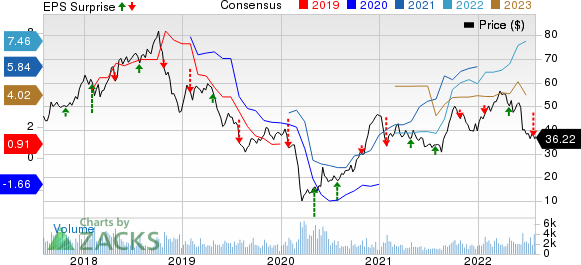

Methanex Corporation Price, Consensus and EPS Surprise

Methanex Corporation price-consensus-eps-surprise-chart | Methanex Corporation Quote

Operational Highlights

Production in the quarter totaled 1,551,000 tons, up around 3.1% year over year. Total sales volume in the second quarter totaled 2,692,000 tons, lower than the prior-year quarter’s figure of 2,830,000 tons.

The average realized price for methanol was $422 per ton in the quarter, up roughly 12.2% from $376 per ton in the prior-year quarter.

Financials

Cash and cash equivalents increased 15% to $878 million at the end of the second quarter from $763.8 million at the end of the year-ago quarter. Long-term debt at the end of the quarter was $2,142 million, almost flat year over year.

Cash flow from operating activities was $105 million, down around 56.8% year over year. The company paid out dividends worth $10 million during the reported quarter.

Outlook

Methanex forecasts production for 2022 to be roughly 1.3 million tons in New Zealand. The company projects production in 2022 to be roughly 1 million tons in Chile. The construction of the Geismar 3 project is progressing and is expected to be operational in the fourth quarter of 2023.

Price Performance

Shares of Methanex have increased 7.3% in the past year against an 8.7% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Methanex currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space are Albemarle Corporation ALB, Cabot Corporation CBT and Sociedad Quimica y Minera de Chile S.A. SQM.

Albemarle has a projected earnings growth rate of 247% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 7.8% upward in the past 60 days.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 22.5%, on average. ALB has gained around 15.9% in a year and currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cabot, currently sporting a Zacks Rank #1, has an expected earnings growth rate of 22.5% for the current year. The Zacks Consensus Estimate for CBT's earnings for the current year has been revised 6% upward in the past 60 days.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 34.7% over a year.

Sociedad has a projected earnings growth rate of 513.7% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 57.8% upward in the past 60 days.

Sociedad’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, the average being 28.2%. SQM has gained 102.9% in a year. The company sports a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance