Meritage Homes Corp (MTH) Reports Strong Q1 2024 Earnings, Surpassing Analyst Expectations

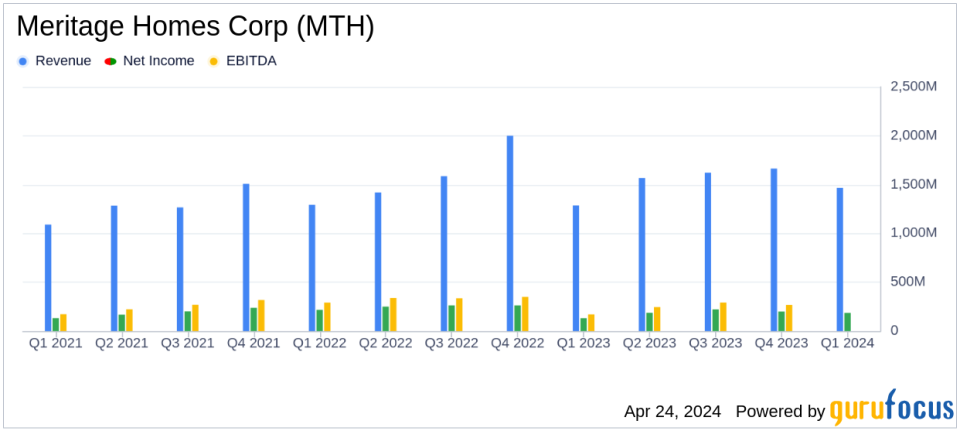

Diluted EPS: $5.06, marking a 43% increase year-over-year, significantly surpassing the estimated $3.52.

Net Earnings: Reported at $186.0 million, up 42% from the previous year, exceeding estimates of $129.62 million.

Revenue: Home closing revenue reached $1.47 billion, a 16% increase year-over-year, surpassing the estimated $1.29 billion.

Gross Margin: Home closing gross margin improved to 25.8%, up from 22.4% last year, reflecting efficient cost management and reduced incentive utilization.

Quarterly Dividend: Increased to $0.75 per share in Q1 2024 from $0.27 per share in Q1 2023, indicating strong financial health and commitment to shareholder returns.

Share Repurchases: Repurchased 362,419 shares for $55.9 million, demonstrating confidence in the company's value and a robust capital return strategy.

Guidance for Full Year 2024: Projects diluted EPS in the range of $19.20 to $20.70, with home closing revenue expected between $6.0 billion and $6.2 billion.

Meritage Homes Corp (NYSE:MTH), a prominent U.S. homebuilder, disclosed its first-quarter results for 2024, revealing substantial growth in key financial metrics and outperforming analyst expectations. The company released its earnings details in its 8-K filing on April 24, 2024, showcasing a notable increase in diluted EPS and home closing revenue.

Meritage Homes Corp is engaged in designing and building single-family attached and detached homes. Operating primarily through its homebuilding and financial services segments, the company has a significant presence across ten states, divided into three regions: West, Central, and East.

Financial Highlights and Operational Performance

For Q1 2024, Meritage Homes reported a 43% increase in diluted EPS, reaching $5.06, significantly higher than the estimated $3.52. Net earnings also rose impressively by 42% to $186.0 million, surpassing the forecast of $129.62 million. Home closing revenue increased by 16% year-over-year to $1.5 billion, outperforming the expected $1.287 billion.

The company achieved a record-high quarterly sales orders with 3,991 units, up 14% from the previous year, driven by a robust average absorption pace of 4.9 per month. The home closing gross margin improved to 25.8%, reflecting efficient cost management and favorable market conditions.

"Meritage has had a remarkable start to the year, generating an average absorption pace of 4.9 per month in the first quarter of 2024, which resulted in our highest quarterly sales orders," stated Steven J. Hilton, executive chairman of Meritage Homes.

Strategic Initiatives and Market Positioning

Phillippe Lord, CEO of Meritage Homes, highlighted the company's strategic execution, noting nearly 50% of the homes delivered in Q1 came from intra-quarter sales orders. The company's strategy focused on spec building and streamlined operations has evidently paid dividends, enhancing both revenue and profitability.

Meritage Homes also continued its aggressive land acquisition strategy, putting nearly 6,300 new lots under control, indicative of its growth-oriented outlook. The financial stability of the company is underscored by its strong balance sheet, with over $905 million in cash and a low net debt-to-capital ratio of 2.0%.

Updated Guidance and Investor Confidence

Based on the robust first-quarter results and positive market dynamics, Meritage Homes has updated its full-year 2024 guidance. The company now anticipates home closing volume between 14,500 and 15,000 units and projects diluted EPS in the range of $19.20 to $20.70.

The company's commitment to shareholder returns is evident from the increased quarterly cash dividend to $0.75 per share and the repurchase of 362,419 shares of stock for $55.9 million in the first quarter, significantly above the planned $15.0 million per quarter.

Conclusion

Meritage Homes Corp's Q1 2024 performance not only reflects its operational excellence and strategic foresight but also positions it well for sustained growth in the competitive homebuilding market. The company's ability to exceed analyst expectations and its optimistic outlook for the rest of the year should reassure investors of its potential for continued success.

For detailed insights and further information, you can access the full earnings report here.

Explore the complete 8-K earnings release (here) from Meritage Homes Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance