Meesho GMV tops $5B; app grows faster than Flipkart, Amazon India

India's Meesho is rapidly gaining user traction, challenging entrenched leaders Flipkart and Amazon.

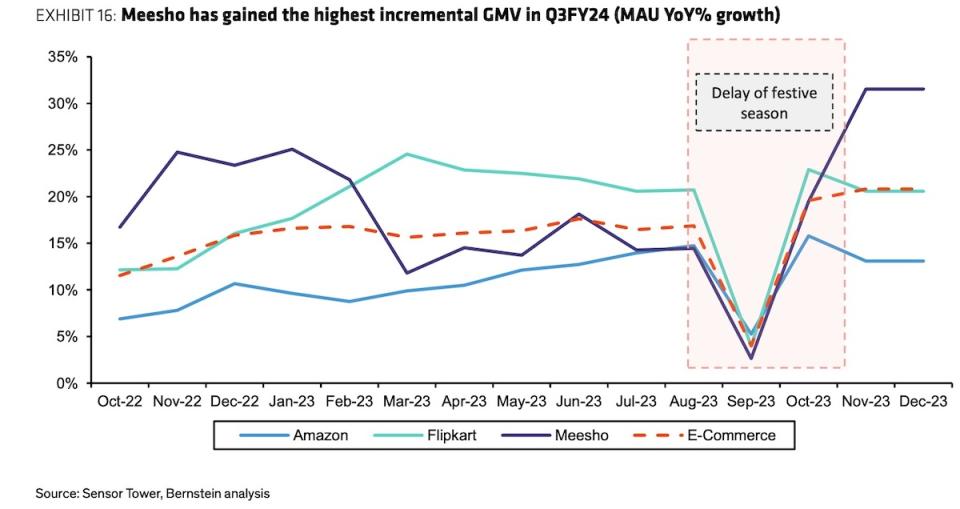

The Bengaluru-headquartered startup, which operates a social commerce platform, is currently at a GMV run rate of over $5 billion and its eponymous app grew 32% year-over-year in December 2023, far outpacing Flipkart's 21% growth and Amazon's 13% user growth over the same period, analysts at AllianceBernstein said in a note Wednesday.

Meesho's strategic prioritization of small towns and focus on mass-market, value-conscious customer base is paying dividends, according to AllianceBernstein. Over 50% of Meesho's sales come from Tier 2 and below cities, allowing it to effectively target a demographic largely overlooked by Flipkart and Amazon so far, the report reviewed by TechCrunch said.

Meesho, valued at nearly $5 billion, counts Meta, SoftBank, Fidelity, B Capital and Prosus among its backers.

Image Credits: AllianceBernstein

Additionally, Meesho's positioning as a platform for small, unbranded sellers combined with zero seller commissions seem to be driving rapid adoption. "Amazon India growth lags as Tier 2+ users drive 80% of e-commerce," AllianceBernstein analysts wrote.

In the last 12 months, Meesho’s order volume has grown by 43% YoY with revenue growth at 54% through healthy take rates, the report added. Apparel and fashion comprise 50% of Meesho’s GMV. The startup has amassed 120 million monthly active users, according to AllianceBernstein. Meesho's MAU base is growing at 29% YoY, and retention rates remain strong at 85% repeat customers, the report added.

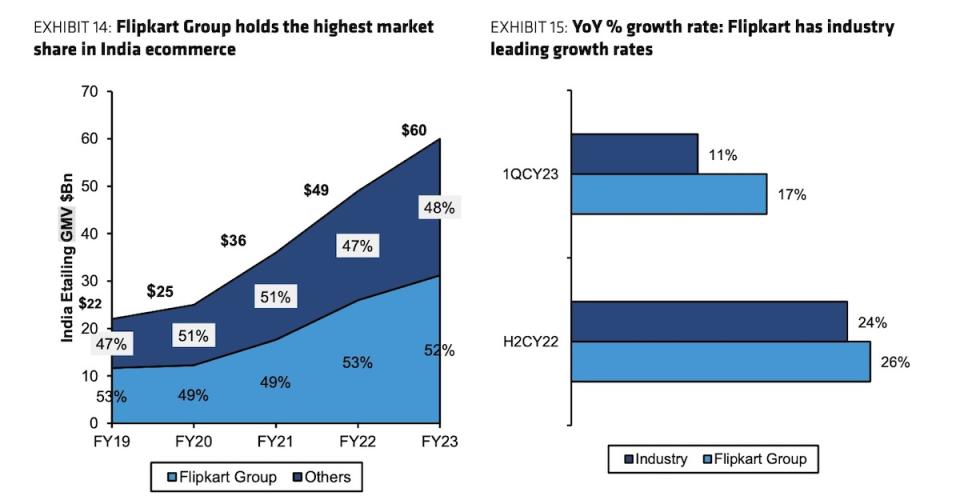

The report estimates Flipkart currently holds 48% gross merchandise value (GMV) share of India's online retail industry, with its GMV reaching around $29 billion in FY2023.

Image Credits: AllianceBernstein

Yahoo Finance

Yahoo Finance