Medical Product Earnings Lineup for Aug 2: ABC, BDX & More

The second-quarter earnings season is in full swing, with 265 members of the S&P 500 index having reported their financial numbers till Jul 27.

Per our latest Earnings Preview, performances of these index participants indicate a 23.6% increase in total earnings on 10.1% higher revenues. The beat ratio is also impressive, with 80.8% companies surpassing bottom-line expectations and 72.1% outperforming on the top-line front.

By the end of the season, second-quarter earnings for the S&P 500 companies, as a whole, are expected to grow 23.6% from the year-ago quarter on 8.8% rise in revenues.

Medical Products Earnings So Far & Expectations

Medical— one of the broader among the 16 Zacks sectors — is expected to record earnings growth this season. For the quarter under review, the projected earnings growth rate for the sector is 13.2% on 6.9% revenue improvement.

Meanwhile, a few MedTech majors have already reported solid earnings this season. Of the notable ones, Intuitive Surgical ISRG reported adjusted earnings of $2.76 per share in the second quarter of 2018, which beat the Zacks Consensus Estimate of $2.48.

Stryker Corporation SYK reported adjusted earnings per share of $1.76, beating the Zacks Consensus Estimate by 1.7%. Earnings improved 15% year over year and also exceeded the high end of the company’s guidance.

With majority of bigwigs yet to report results, the upcoming week will be crucial in deciding whether this quarter will turn out to be a game changer for the sector.

Medical Products in Q2

Strong R&D focus is likely to be the key driver of the Medical Product space, which is part of the broader Medical sector.

Medical Products sector has been hogging the limelight on the back of encouraging demographics, changing market dynamics toward Artificial Intelligence (AI) & big-data applications, an upbeat consumer sentiment and increased business investments.

Additionally, a bipartisan two-year suspension of a 2.3% excise tax on Medical Product and Medical Device manufacturers at the beginning of 2018 has been a temporary relief. It will be put into effect on Jan 1, 2020. The ratification of the tax-repeal amendment has encouraged massive investments in the sector, which is likely to drive the quarterly results.

However, at the onset of the earnings season, a series of geo-political tensions rattled the U.S. economy, the Medical Products space being no exception. While ties between the United States and North Korea have strengthened, the ongoing trade war with China is a concern.

Although it is too early for these issues to dampen second-quarter results, analysts believe that these might have minor effect on the earnings of Medical Product companies.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or #3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Sell-rated stocks (Zacks Rank #4 or 5) are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

So, considering the above factors, we take a look at four Medical Products companies that are set to release results on Aug 2.

Cerner Corporation’s CERN second-quarter 2018 results are scheduled to release after market close. The company is likely to witness a soft quarter due to decline in the core Support, Maintenance and Services segments. However, growth in the company’s EHR (Electronic Health Record) platform is encouraging (read more: What's in Store for Cerner This Earnings Season?).

In the last reported quarter, Cerner reported adjusted earnings per share of 58 cents, in line with the Zacks Consensus Estimate. However, earnings inched down 1.7% from the year-ago quarter’s tally. Revenues of $1.29 billion rose 2.6% year over year but missed the Zacks Consensus Estimate of $1.34 billion.

For the second quarter, the Zacks Consensus Estimate for earnings is pegged at 60 cents, reflecting a year-over-year decline of 1.6%. The same for revenues is pinned at $1.33 billion, showing year-over-year growth of 2.7%.

Notably, our quantitative model does not conclusively show a beat for Cerner this earnings season. Earnings ESP for Cerner is 0.00%. Cerner carries a Zacks Rank #3.

Cerner Corporation Price and EPS Surprise

Cerner Corporation Price and EPS Surprise | Cerner Corporation Quote

AmerisourceBergen Corporation’s (ABC) third-quarter fiscal 2018 results are scheduled to release before market opens. While the company’s core Pharmaceutical Distribution unit is likely to drive growth, stiff competition is expected to mar prospects (read more: What's in Store for AmerisourceBergen in Q3 Earnings?).

In the last reported quarter, the company posted adjusted earnings of $1.94 per share beating the Zacks Consensus Estimate by 6% and improving 9.6% year over year. Revenues improved almost 10.5% to $41.03 billion, surpassing the Zacks Consensus Estimate of $40.48 billion.

For the quarter to be reported, the Zacks Consensus Estimate for revenues is pegged at $42.96 billion, reflecting year-over-year growth of 11%. The same for earnings is pinned at $1.45, showing year-over-year growth of 1.4%

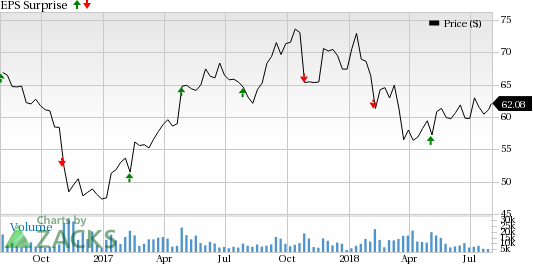

Our model does not conclusively show earnings beat for AmerisourceBergen. The company has an Earnings ESP of -0.32%. The stock carries a Zacks Rank #3.

AmerisourceBergen Corporation Price and EPS Surprise

AmerisourceBergen Corporation Price and EPS Surprise | AmerisourceBergen Corporation Quote

Becton, Dickinson and Company’s (BDX), popularly known as BD, third-quarter fiscal 2018 results are scheduled to release on Aug 2, before the market opens. While the results are likely to show steady growth in the core BD Medical segment, decline in other segments are apprehended (read more: Can BD Medical Drive Becton, Dickinson's Q3 Earnings?).

In the last reported quarter, BD reported earnings of $2.65 per share which beat the Zacks Consensus Estimate of $2.61. Earnings improved 7.8% at constant currency (cc). The New Jersey-based medical technology company posted revenues worth $4.22 billion, surpassing the Zacks Consensus Estimate of $4.12 billion. Revenues rose 5.7% at cc.

For the quarter to be reported, the Zacks Consensus Estimate for earnings is pegged at $2.85, reflecting growth of 15.9%. The same for revenues is pinned at $4.24 billion, showing an increase of 39.8%.

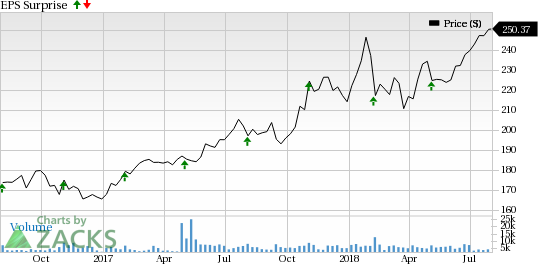

Our quantitative model expects earnings beat for BD this quarter. Earnings ESP for BD is 0.12%. BD carries a Zacks Rank #3.

Becton, Dickinson and Company Price and EPS Surprise

Becton, Dickinson and Company Price and EPS Surprise | Becton, Dickinson and Company Quote

ResMed Inc (RMD) is slated to report fourth-quarter and fiscal 2018 results after market close. ResMed is expected to gain from a strong performance on the domestic as well as international front and sustain the momentum from the preceeding quarter (read more: Can Overall Growth Drive ResMed's Q4 Earnings?).

In the last reported quarter, the company delivered a positive earnings surprise of 10.84%. Moreover, the company surpassed estimates in all the trailing four quarters with an average beat of 10.82%.

For the quarter to be reported, the Zacks Consensus Estimate for earnings is pegged at 92 cents per share, reflecting growth of 19.5%. The same for revenues is pinned at $616.4 million, reflecting an increase of 10.7%.

ResMed has a Zacks Rank #3 and an Earnings ESP of +3.97%, a combination that indicates estimates beat this reporting cycle.

ResMed Inc. Price and EPS Surprise

ResMed Inc. Price and EPS Surprise | ResMed Inc. Quote

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cerner Corporation (CERN) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance