MDC Benefits from Solid Housing Demand, Industry Woes Persist

M.D.C. Holdings, Inc. MDC has been reaping benefits from a robust build-to-order process, relentless land acquisitions and efforts to provide affordable homes. Also, robust housing demand is working as a catalyst for its growth.

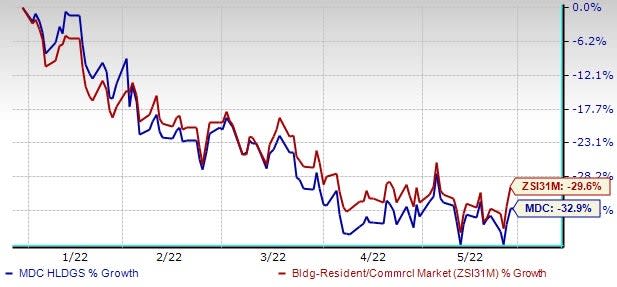

Although its shares have declined 32.9% compared with the Zacks Building Products - Home Builders industry’s 29.6% fall this year, earnings estimates for 2022 have moved up 0.4% in the past 30 days. The bottom-line estimate of $10.65 indicates 36% year-over-year growth. Also, the company currently has a VGM Score of B.

This positive trend signifies bullish analyst sentiments and indicates the company’s robust fundamentals and the expectation of outperformance in the near term.

Image Source: Zacks Investment Research

However, the industry has been grappling with supply chain disruptions as well as labor and raw material shortages. Also, rising inflation, particularly for materials and transportation, and the Fed’s interest rate hikes are adding to the woes.

Nonetheless, to mitigate these macro headwinds, MDC and other homebuilders like Lennar Corp. LEN, PulteGroup, Inc. PHM, D.R. Horton, Inc. DHI, have undertaken various price actions as well as cost-saving moves. These companies are currently observing price-cost neutrality, which will lower cost pressure on the bottom line.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Factors Supporting Growth

Customer Centric Approach: The build-to-order approach provides buyers with a vast range of choices in major aspects of their future home and personalized customer experience through in-house community teams. This approach is also known as “dirt sales.” It highly prioritizes customers by allowing them to customize their options according to their preferences and affordability.

MDC is also banking on the “spec homes” strategy, which enables it to improve efficiency and reduce inventory risk. Under this process, the company limits the number of homes started without a contract and initiates construction only after a purchase agreement has been executed. During first-quarter 2022, it witnessed strong sales growth and margin improvement, primarily driven by a robust build-to-order operating model.

Entry-Level Buyers, a Boon: This leading homebuilding company is focused on the growing demand for entry-level homes and addressing the need for lower-priced homes, given affordability concerns in the U.S. housing market. MDC has been rapidly benefiting from the successful execution of strategic initiatives to boost profitability, with a focus on entry-level homes.

Of late, the company has been closely observing the price appreciation of new homes across the country and is continuously trying to address the issue by providing housing options to new home buyers at a reasonable price.

Accretive Land Acquisitions: MDC’s growth strategy is largely dependent on land acquisitions. The company follows a systematic strategy of acquiring lots. In 2021, it spent $1.9 billion on land acquisition and development, up from $1.3 billion a year ago.

At 2021-end, the company supplied more than 38,000 lots, reflecting a 29% increase from the year-ago period. Also, it closed 5,304 lots in fourth-quarter 2021. The ongoing acquisition strategy eventually helped the company build and deliver homes in immediate demand.

Improved Housing Market: Lower mortgage rates are driving the U.S. residential market over the past few months. Furthermore, demand for new single-family homes has seen a V-shaped recovery throughout the country and MDC is not an exception. The rising work-from-home trend and fear of future interest rate hikes are prompting many families to choose new and spacious homes, thereby boosting demand.

Although the recent industry parameters that give a clear picture of housing market conditions are somewhat depressed, January’s solid job data and construction spending numbers are encouraging.

Discussion of the Above-Mentioned Stocks

Lennar: This well-known homebuilder is benefiting from effective cost control and focuses on making its homebuilding platform more efficient, leading to higher operating leverage.

Lennar’s earnings for fiscal 2022 are expected to rise 14.4% year over year to $16.33 per share.

PulteGroup: This Atlanta-based homebuilder is benefiting from a prudent land investment strategy and focusing on entry-level buyers and returning more free cash flow to shareholders. PulteGroup’s annual land acquisition strategies have been resulting in improved volumes, revenues and profitability for quite some time now. The company has been reaping benefits from the successful execution of strategic initiatives to boost profitability, focusing on entry-level homes.

Earnings for 2022 are expected to increase 46.9% to $10.72 per share.

D.R. Horton: This Texas-based prime homebuilder continues to gain from industry-leading market share, a solid acquisition strategy, a well-stocked supply of land, lots, and homes along with affordable product offerings across multiple brands.

D.R. Horton’s earnings are expected to rise 52.2% year over year to $17.37 per share in fiscal 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance