McDonald's and Starbucks Offer Good Value

Investment advisory service Morningstar recently issued a recommendation on what it says are two wide-moat stocks trading at a rare discount. The two stocks are McDonald's Corp. (NYSE:MCD) and Starbucks Inc. (NASDAQ:SBUX). They are both trading in what Morningstar considers four-star territory (Morningstar rates stocks between one star and five stars depending on value). In this analysis, I will take a look at both companies using GuruFocus data to see if they offer good value.

Morningstar employs over 150 independent analysts to analyze stocks. Unlike banks and broker research, these analysts are independent and do not seek investment banking work from the companies they cover. Thus, I feel that their research is less conflicted than that of bank and brokerage analysts and is more believable. However as President Ronald Reagan said about the Soviet Union following an arms control agreement - "Trust but verify."

McDonald's

Everyone is familiar with the Golden Arches. McDonald's (NYSE:MCD) is world's largest restaurant chain and is ubiquitous around the world. It serves over 69 million customers daily across more than 40,000 outlets in over 100 countries. The company is renowned for its iconic hamburgers, french fries and name-brand sandwiches like the Big Mac, Quarter Pounder and Egg McMuffin. Additionally, the Happy Meal has contributed to its widespread recognition.

McDonald's began in the 1940s as a drive-in restaurant and has since undergone transformative eras marked by pioneering innovations, milestones and occasional controversies. It is not only a fast-food chain, but also one of the world's largest real estate companies, owning or having long-term leases on the land and buildings for each franchised location.

Of the fast-food company, Morningstar said, "We expect comparable sales to exceed 3% over the next five years as the company generates leverage from its massive global loyalty program of 150 million membersand counting. These customers spend twice what nonmembers spend and are forecast to grow to 14% of total customers in 2028 from just 8% today. We think McDonald's stock is worth $312."

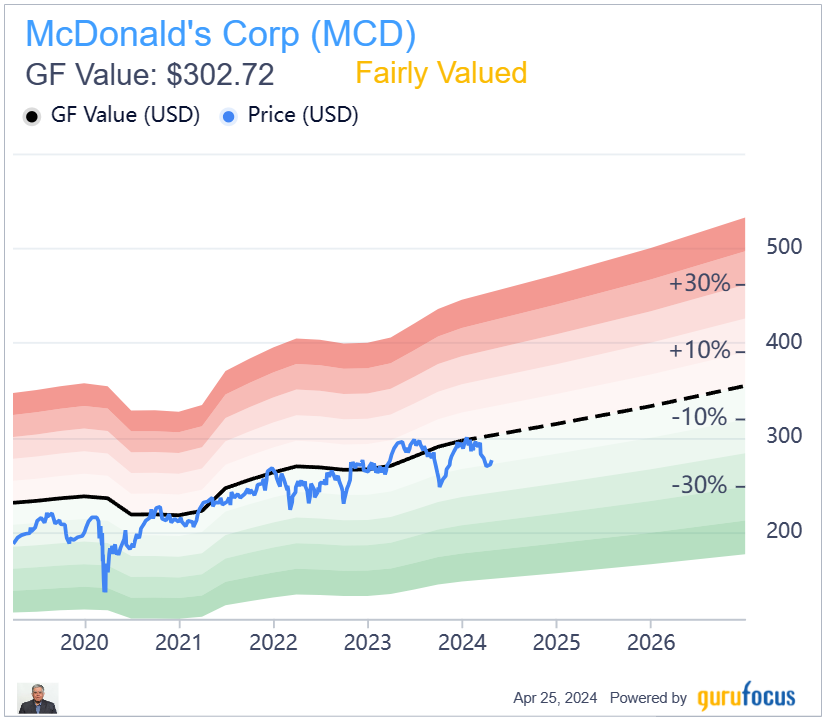

GuruFocus appears to agree with that assessment. According to the GF Value Line, the stock trades at about fair value currently.

Further, McDonald's GF Score of 87 out of 100 is quite strong with good ratings across the board.

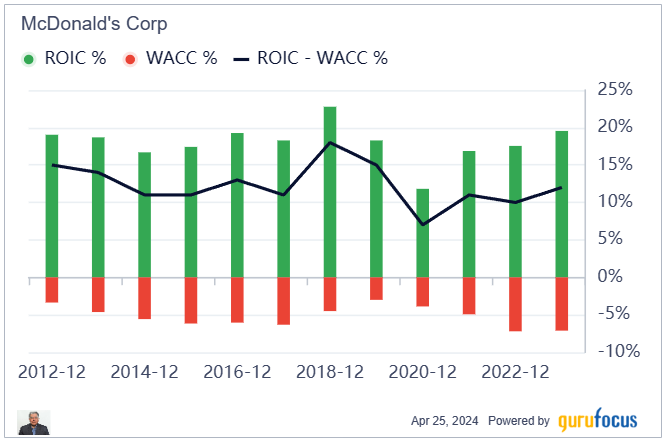

The company is also very profitable with the return on invested capital consistently exceeding the weighted average cost of capital.

McDonald's price-earnings ratio of 23 is on the high side, but I think you have to pay up for quality. The company may sell hamburgers, but to investors, it is a filet mignon. Looking at past results, I think we can expect 5% growth in earnings going forward. While I wish it was a little cheaper, all in all this is not a bad place to enter a starting position.

Professional stock analysts tracked by GuruFocus are also bullish on McDonald's. Notably even the most pessimistic analyst target of $290, at the time of writing, is higher than the current stock price.

Starbucks

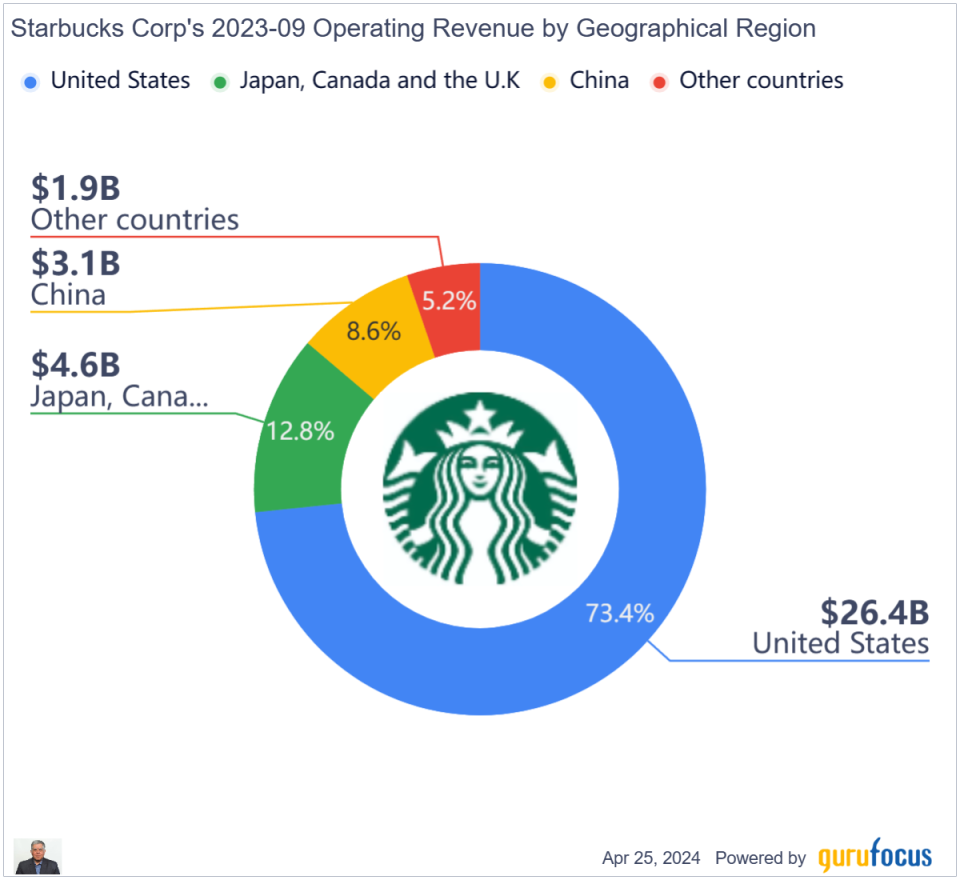

Starbucks (NASDAQ:SBUX) is the world's second-largest restaurant chain with over 38,500 outlets. Starting from its homebase in Seattle, it has spread across the globe. Its major market is the U.S., but it is also growing rapidly in China.

Starbucks revolutionized the coffee industry by promoting coffee as more than just a beverage. It became a holistic experience that combined ambiance, community, function and lifestyle. Its cafes are not merely places to grab a cup of coffee; they are social hubs and cozy retreats. The company has embraced technology to enhance customer engagement. Its mobile app, loyalty program and seamless ordering process have set new standards for the industry.

Morningstar said the following about Starbucks: "The largest global coffee chain provides exposure to a quickly growing category and two attractive end markets: the United States and China. Morningstar thinks investors overestimate unionization threats and the company's sensitivity to China, with one US store worth 3.4 stores in China. We're forecasting double-digit earnings per share growth for the coming decade. We think Starbucks stock is worth $105."

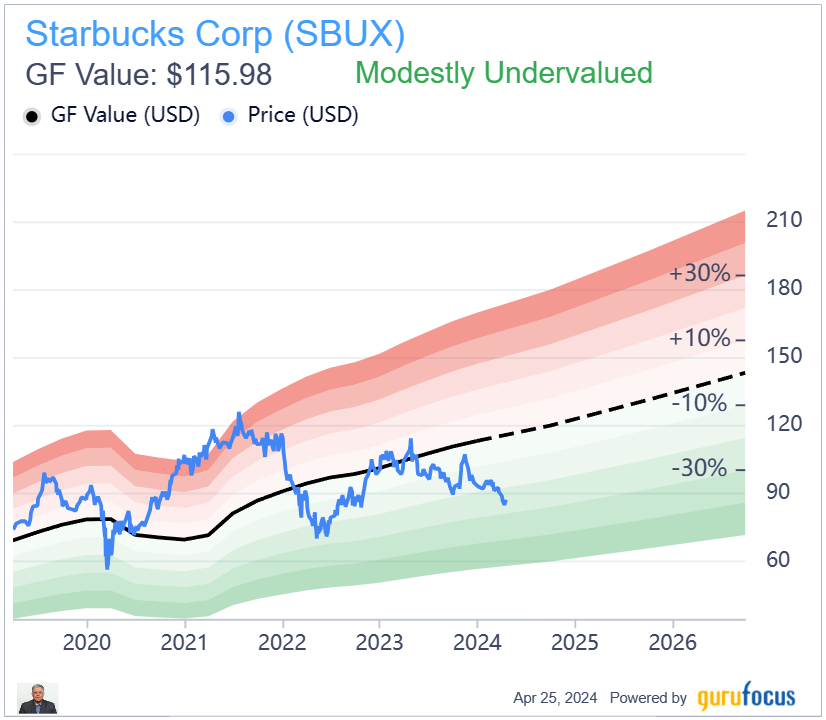

GuruFocus appears to be in agreement as the GF Value Line shows the stock as modestly undervalued. This is indeed a rare discount for this iconic coffee powerhouse. It has a fantastic business model, selling a mildly addictive beverage at premium prices in an attractive setting and beloved by younger generations. It has become a daily habit for millions of people.

Starbucks GF Score is strong at 89 with good ratings all around except for momentum.

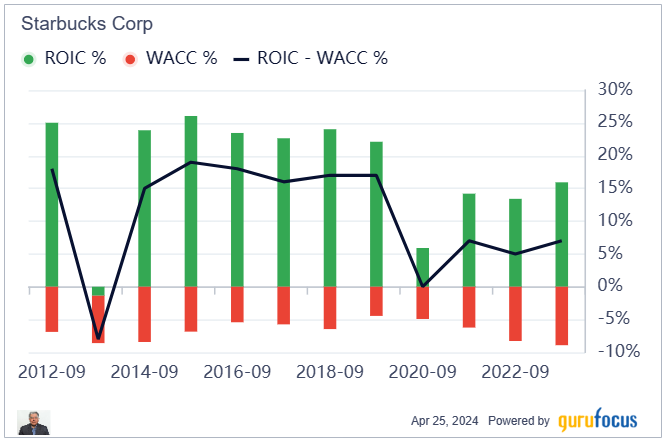

A look at the chart below shows that Starbucks' ROIC is not as impressive as McDonald's. Its ROIC suffered during the Covid-19 pandemic, but it looks like it bouncing back slowly.

Starbucks' price-earnings ratio is about 24, which is on the high side, but its growth is a bit more than McDonald's. Looking at the past results, I think we can expect 7% growth in income going forward. This is good growth for such a large operation.

The following chart provides analyst target stock prices for 12 months from now. The most pessimistic analyst is predicting the stock will remain flat while the average target implies a upside of 17.32% from the current price of $87.84.

Conclusion

Both iconic restaurant chains are good buys at current values. Simply put, they are good businesses at fair prices. While it is not too hard to open a hamburger joint or cafe, it is the brand name and system which matters. It is very difficult for competitors to match both. Both companies have massive global reach and scale, marketing, network effect and great loyalty programs, all of which consiture the wide moat which protects the business from intruders . The digital apps and loyalty programs give them a massive advantage over smaller and independent rivals as well.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance