McDonald's (MCD) Loyalty Program & Comps Aid Amid Cost Woes

McDonald's Corporation MCD benefits from the robust loyalty program, menu innovation, expansion efforts and global comps growth. McDonald’s expects its velocity accelerators of Experience of the Future, digital and delivery to drive growth in the long term.

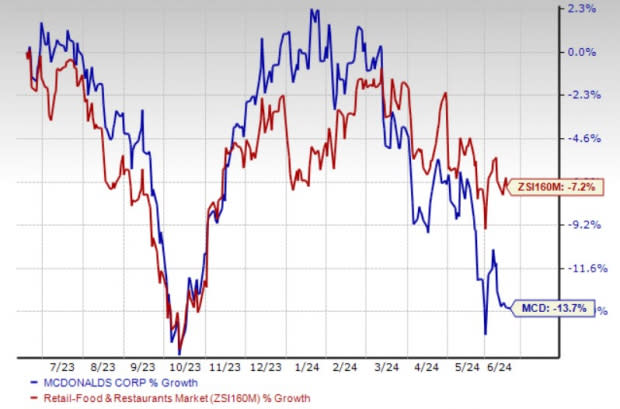

Despite the aforementioned factors, the company’s shares have lost 13.7% in the past year, compared with the industry’s decline of 7.2%. Inflationary pressures and macroeconomic woes are the reasons behind the decline. Let’s delve deeper.

Growth Drivers

Ever since the launch of the loyalty program in the United States, the company has been able to transform its offerings across drive-thru, takeaway, delivery, curbside pick-up and dine-in. The program has not only helped in retaining the existing customers but also in expanding the customer base. MCD has already introduced a loyalty program in more than 50 markets, including the United States, Germany, Canada, the U.K., Australia and France.

In the first-quarter 2024 earnings call, the company stated its notable improvements in digital penetration across markets thanks to increased loyalty sales and record mobile app orders, leading to greater frequency and increased spending by loyal customers. It also stated the success of McDonald's World-Famous Fries feature at the center of a digital campaign in Australia. The alignment of seamless digital experience with campaigning resulted in incremental customer acquisition and increased the market's loyalty sales.

Also, the U.K. market showcased loyalty results with the return of the Winning Sips digital experience, encouraging customers to add a drink to their order with a chance to win on every cup.

To boost its loyalty program participants and encourage customers to avail the digital platform, McDonald's is expecting to deploy “Ready on Arrival,” which is a digital enhancement initiative in the United States. This initiative will focus on enabling the crew to begin assembling a customer’s mobile order before their arrival at the restaurant and is expected to be launched across the top six markets by 2025 end.

McDonald’s believes that there is a huge opportunity to grow all its brands globally by expanding the company’s presence in existing markets and entering new ones. Its expansion efforts continue to drive performance. In the first quarter of 2024, the company opened 6,000th restaurant in China, on track to fulfill its global expansion plan.

MCD is planning to open more than 2,100 new restaurants globally in 2024, including 500 openings in the United States and IOM segment and 1,600 (including nearly 1000 in China) inaugurations in the IDL market. The new unit growth aim for 2024 showcases about 4% contribution to new unit growth (net of closures). Also, the company expects net restaurant unit expansion to contribute nearly 2% to 2024 systemwide sales growth. It targets to open 50,000 restaurants by 2027.

This Zacks Rank #3 (Hold) company continues to impress investors with robust comps growth. In the first quarter of 2024, global comps increased 1.9% compared with a rise of 12.6% reported in the prior-year quarter. In the quarter, the company’s comparable sales grew more than 30%, marking the 13th consecutive quarter of positive comparable sales growth, compared with the past four years.

The uptrend was backed by average check growth driven by strategic menu price increases, successful restaurant-level execution, effective marketing campaigns featuring the core menu and continued digital and delivery growth. Also, the effective implementation of the Accelerating the Arches strategy added to the uptick.

Image Source: Zacks Investment Research

Concerns

The persisting inflationary pressures are likely to hurt the company’s margins. In the first quarter of 2024, margins suffered due to continued pressure from elevated commodities and wages. In the first quarter, McDonald’s company-operated restaurant expenses were $2.04 billion, up 6% from $1.92 billion reported in the prior-year quarter. A challenging macro environment, including rising interest rates, remains headwinds. Given the ongoing inflationary headwinds, MCD expects the operating margin to remain pressurized in the near term. The company expects commodity and food and paper inflation to be at the higher end in 2024. Also, it expects labor inflation to be in the high single digits.

Key Picks

Wingstop Inc. WING sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

It has a trailing four-quarter negative earnings surprise of 21.4%, on average. The stock has surged 112% in the past year. The Zacks Consensus Estimate for WING’s 2024 sales and earnings per share (EPS) indicates a rise of 27.5% and 36.7%, respectively, from the year-ago levels.

Brinker International, Inc. EAT currently sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 213.4%, on average. EAT’s shares have risen 85.4% in the past year.

The Zacks Consensus Estimate for EAT’s 2024 sales and EPS indicates 5% and 41.3% growth, respectively, from the year-earlier actuals.

El Pollo Loco Holdings, Inc. LOCO currently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 19.4%, on average. LOCO’s shares have risen 5.2% in the past year.

The Zacks Consensus Estimate for LOCO’s 2025 sales and EPS indicates 3.8% and 9.9% growth, respectively, from the prior-year figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance