May Top Growth Stocks To Invest In

Robust, high-growth companies such as Interactive Brokers Group are appealing to investors for many reasons. They bring about a strong upside to your portfolio, and less downside risk as opposed to financially challenged companies. Investment in growth companies can benefit your current holdings, whether it be in established tech giants or undiscovered micro-caps. Here, I’ve put together a few companies the market is particularly optimistic towards.

Interactive Brokers Group, Inc. (NASDAQ:IBKR)

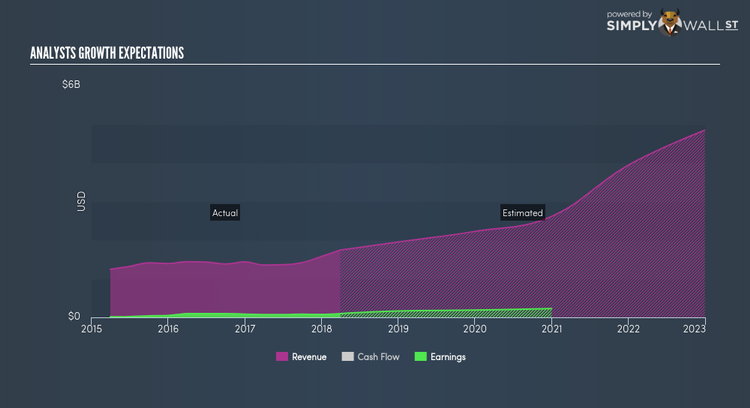

Interactive Brokers Group, Inc. operates as an automated electronic broker in approximately 120 electronic exchanges and market centers worldwide. Founded in 1977, and headed by CEO Thomas Peterffy, the company size now stands at 1,252 people and with the company’s market cap sitting at USD $32.02B, it falls under the large-cap group.

IBKR is expected to deliver a buoyant earnings growth over the next couple of years of 23.14%, driven by a positive revenue growth of 33.18% and cost-cutting initiatives. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. IBKR ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering IBKR as a potential investment? Check out its fundamental factors here.

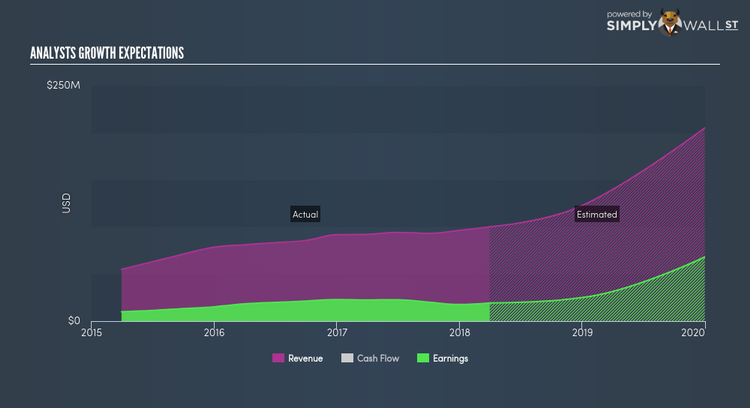

Allegiance Bancshares, Inc. (NASDAQ:ABTX)

Allegiance Bancshares, Inc. operates as the bank holding company for Allegiance Bank that provides a range of commercial banking services primarily to small and medium-sized businesses, professionals, and individual customers. Founded in 2007, and now run by George Martinez, the company currently employs 375 people and with the company’s market capitalisation at USD $570.81M, we can put it in the small-cap group.

Could this stock be your next pick? Take a look at its other fundamentals here.

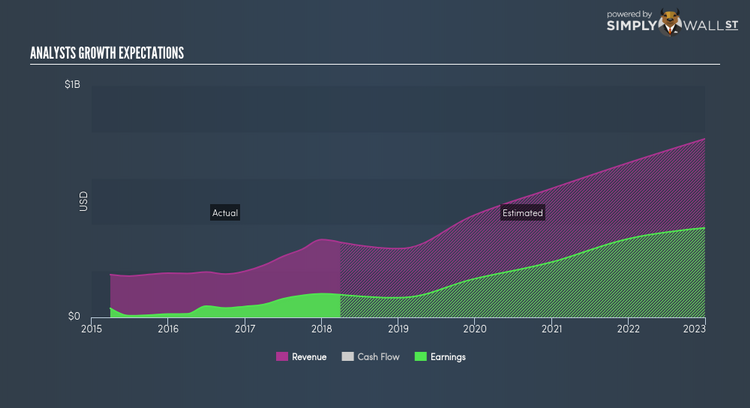

Universal Display Corporation (NASDAQ:OLED)

Universal Display Corporation engages in the research, development, and commercialization of organic light emitting diode (OLED) technologies and materials for use in flat panel displays and solid-state lighting applications. Established in 1985, and now led by CEO Steven Abramson, the company provides employment to 223 people and with the company’s market cap sitting at USD $4.69B, it falls under the mid-cap group.

OLED is expected to deliver an extremely high earnings growth over the next couple of years of 33.54%, driven by a positive double-digit revenue growth of 45.30% and cost-cutting initiatives. It appears that OLED’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 23.30%. OLED ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. A potential addition to your portfolio? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance