May 2024 Insight Into Top Growth Companies With High Insider Ownership

As global markets exhibit resilience, with major indices like the Dow Jones and S&P 500 reaching new heights amid easing inflation concerns, investors are keenly observing trends that could influence their strategies. In such a climate, growth companies with high insider ownership are particularly compelling, as significant insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

Elliptic Laboratories (OB:ELABS) | 31.4% | 124.6% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

Nordic Halibut (OB:NOHAL) | 29.9% | 90.7% |

Vow (OB:VOW) | 31.8% | 99.3% |

EHang Holdings (NasdaqGM:EH) | 33% | 104.9% |

HANA Micron (KOSDAQ:A067310) | 19.8% | 67.2% |

Here's a peek at a few of the choices from the screener.

Daqo New Energy

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Daqo New Energy Corp., operating primarily in the People's Republic of China, engages in the manufacturing and sale of polysilicon for photovoltaic product manufacturers, with a market capitalization of approximately $1.26 billion.

Operations: The company generates its revenue primarily through the sale of polysilicon, amounting to $2.01 billion.

Insider Ownership: 28.7%

Daqo New Energy, a company with significant insider ownership, is navigating a challenging financial landscape. Despite a sharp decline in quarterly net income from US$278.8 million to US$15.47 million and reduced sales figures year-over-year, Daqo continues to expand its production capabilities. The company anticipates a substantial increase in polysilicon production volumes for 2024, projecting up to 300,000 MT—a roughly 50% increase from the previous year—highlighting its strategic growth focus amidst operational challenges.

Risen EnergyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Risen Energy Co., Ltd. is a Chinese company that specializes in designing, developing, manufacturing, and selling solar modules, with a market capitalization of approximately CN¥16.31 billion.

Operations: The company primarily generates its revenue from the design, development, manufacture, and sale of solar modules in China.

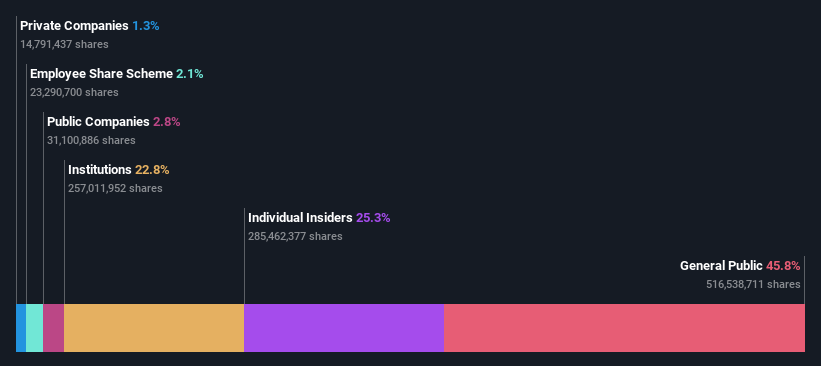

Insider Ownership: 25.3%

Risen EnergyLtd, with high insider ownership, faces financial challenges as evidenced by a significant year-over-year revenue drop to CNY 4.93 billion and a shift to a net loss of CNY 279.52 million in Q1 2024. Despite this, the company is valued attractively compared to industry peers and shows promising growth forecasts, with earnings expected to grow significantly over the next three years. However, its dividends are poorly covered by cash flow and debt concerns persist due to inadequate coverage by operating cash flow.

Shenzhen S.C New Energy Technology

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen S.C New Energy Technology Corporation specializes in the research, development, manufacturing, and sale of crystalline silicon solar cell equipment with a market capitalization of approximately CN¥24.51 billion.

Operations: The company primarily generates revenue from the development, manufacture, and sale of equipment for crystalline silicon solar cells.

Insider Ownership: 30.8%

Shenzhen S.C New Energy Technology has shown robust growth, with a 24.6% annual increase in revenue and significant earnings growth expected over the next three years. In Q1 2024 alone, revenue surged to CNY 2.58 billion from CNY 1.93 billion year-over-year, while net income rose to CNY 578.37 million from CNY 336.4 million. Despite these strong financials, the company's Return on Equity is projected to be low at 16.3%, and it has an unstable dividend track record, complicating its attractiveness despite high insider ownership.

Summing It All Up

Embark on your investment journey to our 1507 Fast Growing Companies With High Insider Ownership selection here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NYSE:DQ SZSE:300118 and SZSE:300724.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance