Maxim Integrated Products, Inc. (NASDAQ:MXIM) Insiders Have Been Selling

It is not uncommon to see companies perform well in the years after insiders buy shares. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So we'll take a look at whether insiders have been buying or selling shares in Maxim Integrated Products, Inc. (NASDAQ:MXIM).

What Is Insider Selling?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

Check out our latest analysis for Maxim Integrated Products

Maxim Integrated Products Insider Transactions Over The Last Year

The insider, Bruce Kiddoo, made the biggest insider sale in the last 12 months. That single transaction was for US$1.2m worth of shares at a price of US$60.00 each. So what is clear is that an insider saw fit to sell at around the current price of US$57.74. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. Given that the sale took place at around current prices, it makes us a little cautious but is hardly a major concern.

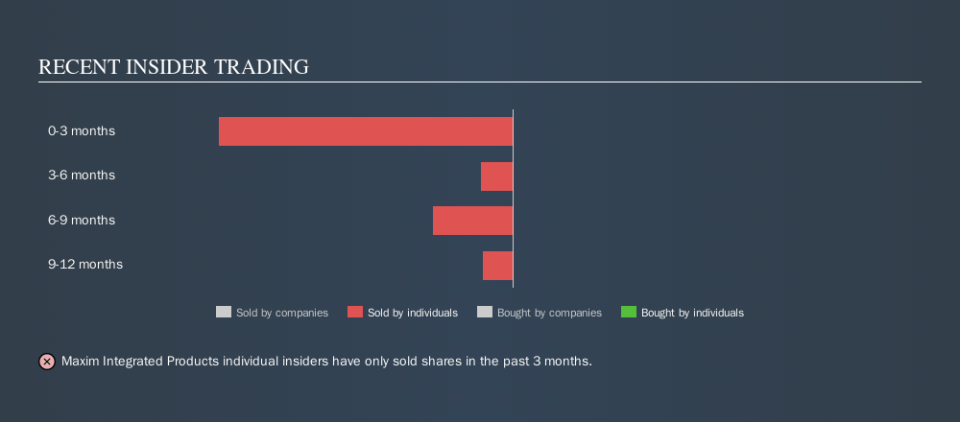

We note that in the last year insiders divested 125616 shares for a total of US$7.1m. Insiders in Maxim Integrated Products didn't buy any shares in the last year. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like Maxim Integrated Products better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insiders at Maxim Integrated Products Have Sold Stock Recently

The last three months saw significant insider selling at Maxim Integrated Products. In total, insiders dumped US$4.8m worth of shares in that time, and we didn't record any purchases whatsoever. In light of this it's hard to argue that all the insiders think that the shares are a bargain.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Maxim Integrated Products insiders own 0.7% of the company, worth about US$113m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Maxim Integrated Products Tell Us?

Insiders haven't bought Maxim Integrated Products stock in the last three months, but there was some selling. And there weren't any purchases to give us comfort, over the last year. On the plus side, Maxim Integrated Products makes money, and is growing profits. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. Of course, the future is what matters most. So if you are interested in Maxim Integrated Products, you should check out this free report on analyst forecasts for the company.

But note: Maxim Integrated Products may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance