What Is Match Group's (NASDAQ:MTCH) P/E Ratio After Its Share Price Tanked?

Unfortunately for some shareholders, the Match Group (NASDAQ:MTCH) share price has dived 33% in the last thirty days. Even longer term holders have taken a real hit with the stock declining 13% in the last year.

Assuming nothing else has changed, a lower share price makes a stock more attractive to potential buyers. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that long term investors have an opportunity when expectations of a company are too low. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

See our latest analysis for Match Group

Does Match Group Have A Relatively High Or Low P/E For Its Industry?

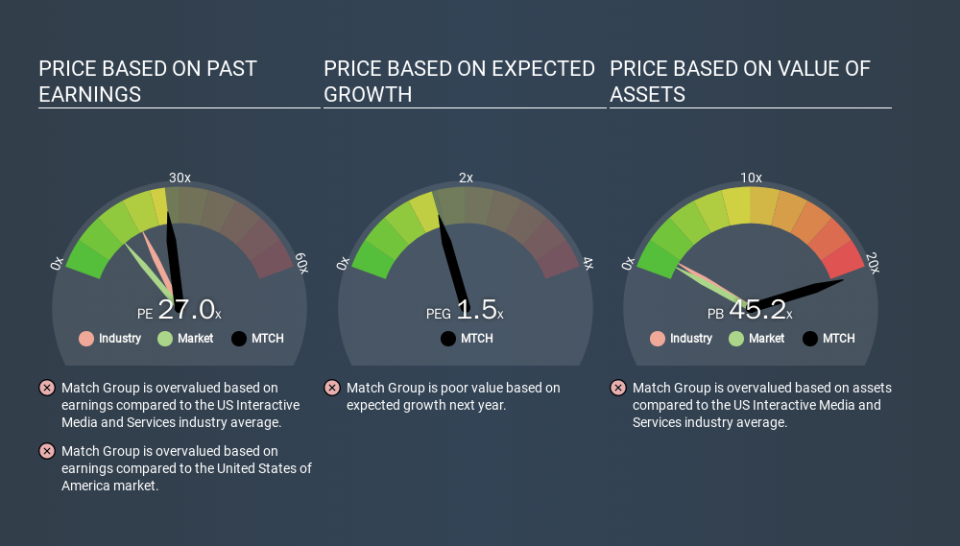

We can tell from its P/E ratio of 27.02 that there is some investor optimism about Match Group. You can see in the image below that the average P/E (19.0) for companies in the interactive media and services industry is lower than Match Group's P/E.

Match Group's P/E tells us that market participants think the company will perform better than its industry peers, going forward. Shareholders are clearly optimistic, but the future is always uncertain. So further research is always essential. I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. When earnings grow, the 'E' increases, over time. That means unless the share price increases, the P/E will reduce in a few years. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

It's great to see that Match Group grew EPS by 10% in the last year. And its annual EPS growth rate over 5 years is 16%. So one might expect an above average P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. That means it doesn't take debt or cash into account. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

How Does Match Group's Debt Impact Its P/E Ratio?

Match Group has net debt worth just 7.8% of its market capitalization. The market might award it a higher P/E ratio if it had net cash, but its unlikely this low level of net borrowing is having a big impact on the P/E multiple.

The Verdict On Match Group's P/E Ratio

Match Group's P/E is 27.0 which is above average (11.8) in its market. Its debt levels do not imperil its balance sheet and it is growing EPS strongly. So on this analysis it seems reasonable that its P/E ratio is above average. What can be absolutely certain is that the market has become significantly less optimistic about Match Group over the last month, with the P/E ratio falling from 40.2 back then to 27.0 today. For those who prefer to invest with the flow of momentum, that might be a bad sign, but for a contrarian, it may signal opportunity.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance