Masimo (MASI) Plans Consumer Business Spin-Off to Drive Growth

Masimo MASI recently announced that it is planning to separate its consumer business and will focus on its professional healthcare and telehealth products. The company’s management has already been authorized by its board of directors to evaluate the proposed structure of the separation.

The company’s planned separation will include its non-healthcare portfolio consisting of premium home sound integration technologies and accessories, high-performance in-vehicle audio systems, professional sound studios and audiophiles. The separation will also include the Stork baby monitor and the Freedom smartwatch and band from its healthcare portfolio. MASI’s current chairman, Joe Kiani, will chair both entities following the separation.

Masimo is planning to close the separation as soon as possible, subject to the completion of due diligence and regulatory obligations and approvals. However, the company has maintained its financial guidance for the first quarter and fiscal 2024, which implies that the spin-off may happen in the latter part of 2024 or beyond.

Rationale Behind Separation

Masimo expects the spin-off of its consumer business to help improve the profitability of the healthcare business, which includes noninvasive monitoring products for patients in hospitals. The proposed separation will help the company to focus on its growing business with better margins that will likely accelerate shareholders’ wealth growth.

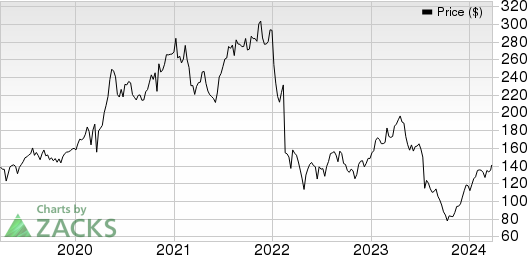

Masimo Corporation Price

Masimo Corporation price | Masimo Corporation Quote

In 2023, the company’s non-healthcare business faced a challenging macro environment, including an overall dip in demand for consumer audio products and lower consumer discretionary purchases, adversely impacting the market for high-end audio systems. Although reported non-healthcare revenue grew 11% for full-year 2023, it was primarily driven by favorable foreign currency movement. Sales were down 18% on a constant currency (cc) basis.

Meanwhile, MASI’s guidance for 2024 also implies flat to declining sales for non-healthcare business in 2024. The healthcare segment sales were down 4% at cc in 2023, while the company estimates sales to grow 5.5-8.6% in 2024.

The separation may also improve the gross margin for MASI going forward as its healthcare business has a significantly higher margin compared to non-healthcare. The company has projected an adjusted gross margin of 62% for the healthcare segment and 33% to 35% for non-healthcare segment in 2024.

Per Masimo’s guidance, non-healthcare business is likely to generate $700-$780 million in sales in 2024. The Stork baby monitor, and the Freedom smart watch and band will generate additional sales to the new entity. Currently, MASI is currently trading at a price to future 12-month sales multiple of 3.49X.

A weak outlook for the non-healthcare business may lead to a lower valuation multiple. The company may use the cash from the divestment to reduce its debt, which will eventually lower its interest outgo. A lower interest expense may help improve the company its net margin.

Masimo’s plan to separate its consumer business currently looks favorable for the company’s prospects. Its shares have gained 4.2% since the announcement of the proposed separation on Friday last week. However, the deal value will be a key factor for analyzing the gain from the proposed spin-off.

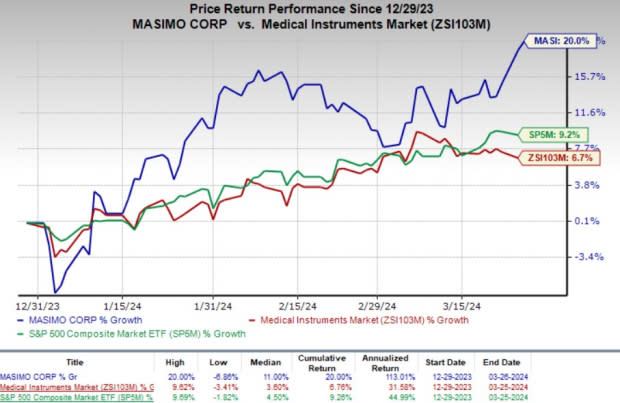

Shares of the company have risen 20% so far this year compared with the industry’s 6.7% increase. The S&P 500 Index has gained 9.2% during the same time frame.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Masimo currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader medical space are Cardinal Health CAH, Stryker SYK and DaVita DVA. While Cardinal Health and Stryker carry a Zacks Rank #2, DaVita sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cardinal Health’s stock has gained 55.8% in the past year. Earnings estimates for Cardinal Health have risen from $7.28 to $7.29 in fiscal 2024 and from $8.02 to $8.04 in fiscal 2025 in the past 30 days.

CAH’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 15.6%. In the last reported quarter, it posted an earnings surprise of 16.67%.

Estimates for Stryker’s 2024 earnings per share have remained constant at $11.86 in the past 30 days. Shares of the company have moved 26.2% upward in the past year compared with the industry’s rise of 5.2%.

SYK’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 5.09%. In the last reported quarter, it delivered an earnings surprise of 5.81%.

Estimates for DaVita’s 2024 earnings per share have moved from $8.97 to $9.23 in the past 30 days. Shares of the company have gained 74.7% in the past year compared with the industry’s 22% rise.

DVA’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 35.57%. In the last reported quarter, it delivered an earnings surprise of 22.22%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance