Marsh & McLennan (MMC) Expedites Expansion with Buyouts

After announcing three buyouts last week, Marsh & McLennan Companies, Inc. MMC has again announced a couple of acquisitions. Its wholly owned subsidiary Mercer has bought the business of Sirota Consulting LLC, a provider of business performance consulting, survey and employee engagement services. Another unit Marsh & McLennan Agency has acquired Benefits Resource Group (“BRG”), which is an employee benefits consulting firm.

The company is aggressively continuing on its inorganic growth path. Since 2009, the company has made more than 120 acquisitions and investments totaling over $5 billion. In each of the last six years, the company has grown consolidated underlying revenue in the 3% to 5% range. Acquisitions have added two percentage points on average over the same time period.

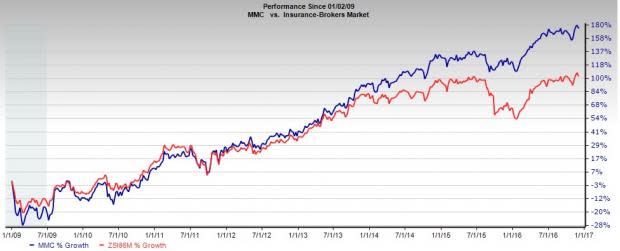

The synergistic effects of numerous acquisitions are reflected in the company’s share price. The stock is up 175.4% since 2009 to date, outperforming the gain of 102.4% logged by the Zacks categorized Insurance Brokers industry.

Coming back to the news, the acquisition of BRG will enhance the company’s employee benefits business. The acquisition of Sirota will fortify Mercer’s consulting strength and capabilities in talent management, enabling it to better serve its clients.

Last week, Mercer acquired Pillar Administration. Also, Marsh &McLennan Agency bought Presidio Benefits Group, a San Francisco-based employee benefits consulting firm providing an array of employee benefits and human resource services to employers in the Bay Area. Yet another unit, a global management consultancy Oliver Wyman, announced the purchase of LShift Limited, an independent software development company.

During the first half of 2016, the company used $168 million for acquisitions. It has completed the takeovers of New York-based insurance brokerage and human resource consulting firm Corporate Consulting Services Ltd; a leading aviation risk advisor Aviation Solutions LLC and one of Florida’s largest independent agencies Celedinas Insurance Group.

Last month the company inked a deal to acquire Bluefin Insurance Group Limited, a unit of AXA Group.

In October, the company acquired Vero Insurance, Inc., known for its insurance products and personal service to high net worth individuals, families and small businesses.

The company’s inorganic growth boosts investors’ confidence in the stock. Moreover, its investments are broad based and include geographic expansion, segmentation, and new capabilities and innovations. These poise the company for long-term growth.

Marsh & McLennan carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the insurance industry include Alleghany Corporation Y, First American Financial Corporation FAF and Arch Capital Group Ltd. ACGL. Each of these stocks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Alleghany Corporation deals with Property & Casualty reinsurance and insurance businesses in the U.S. and internationally. The company recorded positive surprises in three of the last four quarters, with an average beat of 20.52%.

First American Financial is a leading provider of title insurance and settlement services to the real estate and mortgage industries in the U.S. The company beat estimates in each of the trailing four quarters, with an average beat of 14.32%.

Arch Capital offers property, casualty, and mortgage insurance and reinsurance products worldwide. It posted positive surprises in all the last four quarters, with an average beat of 9.27%.

Zacks' Top Investment Ideas for Long-Term Profit

How would you like to see our best recommendations to help you find today’s most promising long-term stocks? Starting now, you can look inside our portfolios featuring stocks under $10, income stocks, value investments and more. These picks, which have double and triple-digit profit potential, are rarely available to the public. But you can see them now. Click here >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MARSH &MCLENNAN (MMC): Free Stock Analysis Report

FIRST AMER FINL (FAF): Free Stock Analysis Report

ALLEGHANY CORP (Y): Free Stock Analysis Report

ARCH CAP GP LTD (ACGL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance