Marsh & McLennan (MMC) Up 13.6% in a Year: More Room to Rally?

Shares of Marsh & McLennan Companies, Inc. MMC have jumped 13.6% in the past year against the 11.5% decrease of the industry, courtesy of greater exposure, strong segmental operations and an earnings beat streak. MMC is not only managing well to navigate the market volatility but also strengthening its position for better returns in the future.

Headquartered in New York, Marsh & McLennan is a leading insurance broker. MMC has a market cap of $76.5 billion and operates in 130 countries. Due to its vast presence in so many countries, foreign exchange rate movements play a crucial role in its top line.

Can It Retain Momentum?

The answer is yes and before we get into the details, let us show you how its estimates for 2022 appear. The Zacks Consensus Estimate for 2022 earnings per share currently stands at $6.82, indicating a 10.5% increase from the year-ago reported figure. MMC’s earnings beat estimates in each of the last four quarters, the average being 10.5%. The Zacks Consensus Estimate for 2022 revenues is pegged at $21.2 billion, indicating a 6.7% rise from the prior-year reported number.

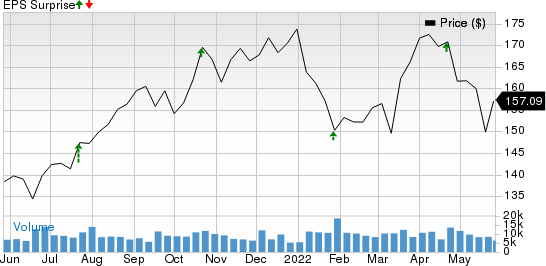

Marsh & McLennan Companies, Inc. Price and EPS Surprise

Marsh & McLennan Companies, Inc. price-eps-surprise | Marsh & McLennan Companies, Inc. Quote

Now let’s delve deeper into what’s driving the presently Zacks Rank #3 (Hold) stock.

Marsh & McLennan’s solid Risk and Insurance Services business is a major driver. This unit operates through Marsh and Guy Carpenter. It accounted for 61% of MMC's total revenues, last year. This business is expected to register exponential growth in the coming days, primarily on the back of its Marsh unit.

Marsh generated revenues worth $2.5 billion in first-quarter 2022 alone, up 11% year over year on an underlying basis. In international, the Asia Pacific region witnessed a 17% increase on an underlying basis, registering highest growth among the regions. In the United States and Canada, the unit witnessed 14% growth in the March quarter.

Strategic acquisitions are one of Marsh and McLennan’s major tailwinds. MMC made numerous purchases within its different operating units that enabled it to enter new geographical regions, expand within the existing ones, foray into new businesses, develop new segments and specialize within its existing businesses. MMC is expected to scale up and thrive on its inorganic growth opportunities.

With economies expected to witness rapid recovery in the coming days, MMC’s Consulting business is likely to flourish. Adjusted operating income from this unit improved 9% year over year to $402 million in the first quarter. Sales in the Career sub-segment are likely to rise as more people join the working population.

Its disciplined capital-allocation strategies and shareholder-value-boosting efforts are praiseworthy. Its dividend yield is higher than the industry average. In March 2022, its board of directors authorized an additional share buyback plan of $5 billion. With this new authorization, the repurchase fund value jumped to almost $6.3 billion. Marsh & McLennan has plans to deploy roughly $4 billion capital in 2022 to dividends, buyouts and share buybacks.

Risks

Despite the upside potential, a few factors are holding back the stock’s growth, lately. Rising operating expenses are eating into its profits. Also, a high debt load of $10.6 billion and low cash and cash equivalents of only $772 million remain a woe. Nevertheless, we believe that a systematic and strategic plan of action will drive long-term growth.

Key Picks

Some better-ranked stocks in the financespace are Assurant, Inc. AIZ, Cincinnati Financial Corporation CINF and Cigna Corporation CI. While AIZ sports a Zacks Rank #1 (Strong Buy), CINF and CI currently carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Assurant’s Global Lifestyle segment has been putting up an impressive performance for a while, backed by its higher net premium, and fee and other income, which saw a CAGR of 13.1% from 2016 to 2021. The Zacks Consensus Estimate for AIZ’s 2022 bottom line indicates a 37.6% increase from the year-ago reported figure. AIZ’s earnings beat estimates in each of the last four quarters, the average being 18.3%.

Based in Fairfield, OH, Cincinnati Financial’s consistent cash flow and sufficient cash balance continue to boost liquidity. The Zacks Consensus Estimate for CINF’s 2022 bottom line has witnessed one upward revision with no downward movement in the past 30 days. CINF’s earnings beat estimates in each of the last four quarters, the average being 32.6%.

Cigna has been growing its membership for many quarters now and we expect this trend to continue. The Zacks Consensus Estimate for CI’s 2022 bottom line indicates a 10.6% rise from the year-ago reported number. Headquartered in Bloomfield, CT, CI’s earnings beat estimates in each of the last four quarters, the average being 8.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Cigna Corporation (CI) : Free Stock Analysis Report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance