Marimaca Oxide Drilling Encounters Higher than Expected Grades at Marimaca North; intersects 30m at 2.18% CuT from 46m, 464m at 0.45% from 4m

Figure 1:

Figure 2:

Figure 3:

Figure 4:

VANCOUVER, British Columbia, Nov. 21, 2022 (GLOBE NEWSWIRE) -- Marimaca Copper Corp. (“Marimaca Copper” or the “Company”) (TSX: MARI) is pleased to announce further results from the 2022 infill and extensional drilling campaign at the Marimaca Oxide Deposit (the “MOD”). Results reported are for a total of 7,102m across 35 reverse circulation (“RC”) drill holes.

The drilling intersected two higher grade green oxide zones located in the northern, Atahualpa, sector of the Marimaca Oxide Deposit (the “MOD”). Green oxides typically have higher acid solubilities and expected higher recoveries based on the results of the various phases of comprehensive metallurgical testing completed. Results from the 7,102m released today were received post the data cut-off for the 2022 Interim Mineral Resource Estimate (“MRE”) (see press release dated October 13, 2022) and will be captured in the updated MRE planned for Q1 2023.

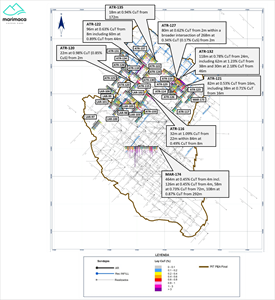

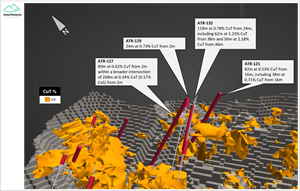

The Atahualpa sector, forming the northern extent of the MOD, was previously considered to be host to dominantly lower grade green and black oxide mineralization and today’s results highlight the potential for the definition of additional high-grade centers, similar to that found in the south-central MOD (see Figure 2).

Marimaca will host an Exploration Webinar and Live Q&A with Sergio Rivera, Vice President Exploration and Hayden Locke, President & CEO to discuss the takeaways of the 2022 exploration campaign on December 5th, 2022 at 11:00am EST / 4:00pm GMT / 1:00pm CLST / 8:00am PST. A webinar link will be available at marimaca.com/webinars and sign up is available via Investor Meet Company.

Questions can be submitted pre-event via the Investor Meet Company dashboard up until 9am the day before the meeting or at any time during the live presentation.

Highlights

Results from holes ATR-121, ATR-126, ATR-127, ATR-129 and ATR-132 demonstrate potential for a new, shallow, high-grade centre located in the north and north-eastern areas of the MOD

Grades significantly above interpolated grades in this area from previous MREs

ATR-132 intersected 118m at 0.78% CuT from 24m, including 62m at 1.23% CuT from 38m and 30m at 2.18% CuT from 46m

ATR-127 intersected 80m at 0.62% CuT from 2m within a broader intersection of 268m at 0.34% CuT from 2m

ATR-121 intersected 82m at 0.53% CuT from 16m, including 38m at 0.71% CuT from 16m

Results from ATR-116, ATR-120, ATR-122, ATR-124, ATR-130, ATR-135 and ATR-137 confirm extensions of higher-grade green oxide mineralization toward the northeast margins of the MOD

ATR-122 intersected 96m at 0.63% CuT from 8m including 60m at 0.89% CuT from 44m

ATR-116 intersected 32m at 1.09% CuT from 22m within 84m at 0.49% CuT from 8m

ATR-120 intersected 22m at 0.98% CuT from 2m

ATR-135 intersected 18m at 0.94% CuT from 172m

MAR-174, drilled in the central zone of the MOD, intersected shallow green oxide mineralization extending into higher grade MAMIX mineralization at depth

Highlight intercepts include 464m at 0.45% CuT from 4m, including 58m at 0.73% CuT from 72m, and 108m at 0.87% CuT from 292m

Drilling results from this release will be captured in the updated MRE, targeting conversion of Inferred Resources to Measured and Indicated categories, planned for early 2023

New higher grade centre expected to have positive implications for average grade in northern area of the deposit for the next MRE update and for the 2023 DFS mine-planning

Additional infill RC and diamond drilling to be released ahead of the planned Q1 2023 MRE

Sergio Rivera, VP Exploration of Marimaca Copper, commented:

“As with previous infill drilling campaigns at the MOD, we have been pleasantly surprised by this set of results, located towards the northern end of the MOD. Drilling has intersected broad zones of high-grade oxide mineralization, in most cases near or at surface. The grades are significantly above those interpolated for the northern area in previous MREs and, as such, we expect this drilling to have positive implications for the average grade of our Q1 2023 MRE update, which is targeting 90% of resources in the Measured and Indicated Categories.

The October 2022 MRE included infill drilling across the central high-grade core of the MOD, which is an important driver of the Marimaca Project’s strong project economics, with the results only improving our confidence in its continuity and grade. This new discovery complements and extends the high-grade core and, given its near surface nature, it will also likely form part of the early years of mine life. We, therefore, expect this drilling to lead to further improvement the Project’s already exceptional economics.

The final 2023 MRE will form the basis the Definitive Feasibility Study, which will be completed in 2023 and will contemplate production scenarios in the range of 50kt to 60kt of copper cathode per annum.”

Overview of Drilling Campaign Objectives

Marimaca’s 2022 drilling campaign consists of over 41,500m of RC and diamond drilling between the MOD infill and the MAMIX zone, the depth extension of the MOD. The 2022 MRE, announced on October 13, 2022 incorporates 19,580m of ~41,500m of drilling (reverse circulation (“RC”) + diamond) completed in 2022 for a total of over 110,000m of drilling completed since 2016. The balance of the 2022 infill drilling program, totalling approximately 28,000m including the 7,102m of drilling announced today, will be included in a subsequent MRE planned for early 2023 with the objective of converting the remaining Inferred Resources to the Measured and Indicated Categories to underpin the Definitive Feasibility Study (“DFS”) planned for 2023.

Figure 1: Plan View of Infill Drilling Results

https://www.globenewswire.com/NewsRoom/AttachmentNg/ea423d8a-041f-4795-bfb4-9cb1bc096b20

Figure 2: Plan View – 2022 MRE plan view with grade distribution

https://www.globenewswire.com/NewsRoom/AttachmentNg/9e98fc26-a9de-41f0-b6e4-d1b2b940f7b9

Figure 3: 3D View – Highlight Infill Results with 2022 MRE Pit Shell

https://www.globenewswire.com/NewsRoom/AttachmentNg/2650fedc-bd9f-4c7c-8a70-3eade474370d

Figure 4: 3D View – North-East High Grade Zone with Highlight Infill Results 2022 MRE 0.60% CuT Grade Shell

https://www.globenewswire.com/NewsRoom/AttachmentNg/3fbe7357-1f6c-488a-bf73-fef73ebb101e

Table 1. Summary of Drill Results

Hole | Depth (m) |

| From (m) | To (m) | Intercept (m) | CuT (%) |

ATR-114 | 260 |

| 14 | 40 | 26 | 0.21 |

| 86 | 144 | 58 | 0.21 | ||

including | 112 | 134 | 22 | 0.35 | ||

ATR-115 | 52 |

| 8 | 38 | 30 | 0.50 |

ATR-116 | 250 |

| 8 | 208 | 200 | 0.27 |

including | 8 | 92 | 84 | 0.49 | ||

including | 22 | 54 | 32 | 1.09 | ||

| 172 | 202 | 30 | 0.22 | ||

ATR-117 | 200 |

| 146 | 196 | 50 | 0.20 |

ATR-118 | 170 | including | 4 | 22 | 18 | 0.21 |

ATR-119 | 240 |

| 106 | 158 | 52 | 0.23 |

including | 118 | 130 | 12 | 0.37 | ||

ATR-120 | 250 |

| 2 | 132 | 130 | 0.28 |

including | 2 | 24 | 22 | 0.98 | ||

and | 86 | 124 | 38 | 0.26 | ||

ATR-121 | 250 |

| 2 | 250 | 248 | 0.31 |

including | 16 | 98 | 82 | 0.53 | ||

including | 16 | 54 | 38 | 0.71 | ||

and | 68 | 98 | 30 | 0.53 | ||

| 136 | 216 | 80 | 0.25 | ||

including | 136 | 182 | 46 | 0.24 | ||

and | 200 | 216 | 16 | 0.48 | ||

ATR-122 | 180 |

| 8 | 104 | 96 | 0.63 |

including | 12 | 24 | 12 | 0.38 | ||

and | 44 | 104 | 60 | 0.89 | ||

ATR-123 | 200 |

| 2 | 10 | 8 | 0.21 |

including | 106 | 126 | 20 | 0.28 | ||

ATR-124 | 150 |

| 2 | 96 | 94 | 0.28 |

including | 2 | 28 | 26 | 0.36 | ||

and | 54 | 96 | 42 | 0.36 | ||

ATR-125 | 210 | including | 80 | 112 | 32 | 0.20 |

ATR-126 | 200 |

| 16 | 28 | 12 | 0.20 |

| 100 | 142 | 42 | 0.42 | ||

including | 112 | 142 | 30 | 0.50 | ||

ATR-127 | 270 |

| 2 | 270 | 268 | 0.34 |

including | 2 | 122 | 120 | 0.46 | ||

including | 2 | 82 | 80 | 0.62 | ||

| 188 | 270 | 82 | 0.39 | ||

including | 210 | 270 | 60 | 0.49 | ||

ATR-128 | 200 |

| 76 | 120 | 44 | 0.25 |

including | 100 | 120 | 20 | 0.36 | ||

ATR-129 | 200 |

| 2 | 26 | 24 | 0.73 |

including | 68 | 84 | 16 | 0.30 | ||

ATR-130 | 200 |

| 2 | 84 | 82 | 0.30 |

including | 2 | 46 | 44 | 0.46 | ||

| 146 | 160 | 14 | 0.43 | ||

|

|

|

|

| ||

ATR-131 | 160 | No significant intercepts |

|

|

| |

ATR-132 | 200 |

| 24 | 142 | 118 | 0.78 |

including | 38 | 100 | 62 | 1.23 | ||

including | 46 | 76 | 30 | 2.18 | ||

and | 102 | 138 | 36 | 0.41 | ||

ATR-133 | 270 |

| 6 | 70 | 64 | 0.32 |

including | 18 | 46 | 28 | 0.48 | ||

ATR-134 | 160 | No significant intercepts |

|

|

| |

ATR-135 | 220 |

| 4 | 206 | 202 | 0.26 |

including | 4 | 118 | 114 | 0.24 | ||

including | 4 | 56 | 52 | 0.21 | ||

and | 62 | 118 | 56 | 0.30 | ||

| 146 | 206 | 60 | 0.38 | ||

including | 172 | 190 | 18 | 0.94 | ||

ATR-137 | 150 |

| 2 | 112 | 110 | 0.27 |

including | 2 | 28 | 26 | 0.42 | ||

and | 90 | 112 | 22 | 0.58 | ||

LAR-97 | 170 |

| 4 | 18 | 14 | 0.26 |

LAR-98 | 200 | No significant intercepts |

|

|

| |

LAR-99 | 200 |

| 4 | 72 | 68 | 0.24 |

including | 32 | 60 | 28 | 0.30 | ||

| 112 | 124 | 12 | 0.25 | ||

LAR-100 | 200 |

| 2 | 14 | 12 | 0.20 |

| 88 | 94 | 6 | 0.48 | ||

| 164 | 190 | 26 | 0.22 | ||

including | 164 | 172 | 8 | 0.39 | ||

LAR-101 | 160 |

| 6 | 28 | 22 | 0.21 |

| 132 | 160 | 28 | 0.25 | ||

including | 132 | 144 | 12 | 0.47 | ||

LAR-102 | 250 | including | 16 | 138 | 122 | 0.28 |

including | 16 | 34 | 18 | 0.31 | ||

and | 64 | 92 | 28 | 0.39 | ||

and | 98 | 138 | 40 | 0.24 | ||

| 238 | 250 | 12 | 0.28 | ||

LAR-103 | 200 |

| 2 | 104 | 102 | 0.31 |

including | 2 | 38 | 36 | 0.41 | ||

| 56 | 96 | 40 | 0.38 | ||

including | 56 | 74 | 18 | 0.70 | ||

LAR-104 | 90 (*) |

| 2 | 52 | 50 | 0.24 |

including | 28 | 52 | 24 | 0.32 | ||

LAR-105 | 120 (*) |

| 2 | 96 | 94 | 0.37 |

including | 2 | 16 | 14 | 0.38 | ||

| 32 | 96 | 64 | 0.48 | ||

including | 32 | 68 | 36 | 0.38 | ||

and | 76 | 96 | 20 | 0.64 | ||

LAR-106 | 200 |

| 12 | 32 | 20 | 0.20 |

| 68 | 86 | 18 | 0.22 | ||

| 164 | 174 | 10 | 0.23 | ||

MAR-173 | 200 |

| 6 | 18 | 12 | 0.32 |

including | 120 | 138 | 18 | 0.20 | ||

MAR-174 | 470 |

| 4 | 468 | 464 | 0.45 |

including | 4 | 130 | 126 | 0.45 | ||

including | 4 | 64 | 60 | 0.24 | ||

and | 72 | 130 | 58 | 0.73 | ||

| 144 | 280 | 136 | 0.21 | ||

| 222 | 244 | 22 | 0.28 | ||

| 260 | 468 | 208 | 0.64 | ||

including | 260 | 280 | 20 | 0.68 | ||

and | 292 | 400 | 108 | 0.87 | ||

and | 408 | 468 | 60 | 0.43 |

Table 2. Drill Collars and Survey

Hole | Easting | Northing | Elevation (m) | Azimuth | Inclination | Depth (m) |

ATR-114 | 375119.8 | 7435963.2 | 1144.8 | 310 | -60 | 260 |

ATR-115* | 374879.3 | 7436016.4 | 1014.2 | 310 | -60 | 52 |

ATR-116 | 374876.8 | 7436011.1 | 1014.5 | 220 | -60 | 250 |

ATR-117 | 375120.0 | 7435955.2 | 1144.8 | 220 | -60 | 200 |

ATR-118 | 374756.5 | 7436140.8 | 1014.3 | 310 | -60 | 170 |

ATR-119 | 375136.8 | 7436013.9 | 1153.7 | 310 | -60 | 240 |

ATR-120 | 374804.4 | 7436095.8 | 1016.2 | 220 | -60 | 250 |

ATR-121 | 375160.5 | 7436046.5 | 1150.6 | 310 | -60 | 250 |

ATR-122 | 374888.0 | 7436181.3 | 1028.7 | 310 | -60 | 180 |

ATR-123 | 375165.0 | 7436036.6 | 1151.1 | 220 | -60 | 200 |

ATR-124 | 374886.0 | 7436169.9 | 1028.8 | 220 | -60 | 150 |

ATR-125 | 374685.8 | 7436144.3 | 990.3 | 220 | -60 | 210 |

ATR-126 | 375106.8 | 7436067.1 | 1142.7 | 220 | -60 | 200 |

ATR-127 | 375095.7 | 7436107.2 | 1132.6 | 310 | -60 | 270 |

ATR-128 | 374722.6 | 7436210.8 | 995.8 | 220 | -60 | 200 |

ATR-129 | 375094.1 | 7436098.9 | 1133.0 | 220 | -60 | 200 |

ATR-130 | 374834.6 | 7436105.7 | 1028.3 | 310 | -60 | 200 |

ATR-131 | 374724.9 | 7436341.9 | 1014.3 | 220 | -60 | 160 |

ATR-132 | 375120.6 | 7436128.0 | 1129.8 | 220 | -60 | 200 |

ATR-133 | 374858.7 | 7435888.1 | 1020.2 | 220 | -60 | 270 |

ATR-134 | 374742.8 | 7436282.3 | 1023.7 | 310 | -60 | 160 |

ATR-135 | 374949.1 | 7436234.7 | 1061.5 | 310 | -60 | 220 |

ATR-137 | 374856.3 | 7436287.4 | 1060.9 | 220 | -60 | 150 |

LAR-97 | 374522.7 | 7435811.0 | 984.6 | 220 | -60 | 170 |

LAR-98 | 374704.1 | 7435883.0 | 1019.1 | 310 | -60 | 200 |

LAR-99 | 374692.7 | 7435932.1 | 1010.0 | 310 | -60 | 200 |

LAR-100 | 374689.9 | 7435923.6 | 1010.7 | 220 | -60 | 200 |

LAR-101 | 374642.2 | 7435957.6 | 992.1 | 220 | -60 | 160 |

LAR-102 | 374816.8 | 7435934.7 | 1010.8 | 310 | -60 | 250 |

LAR-103 | 374817.9 | 7435927.3 | 1011.2 | 220 | -60 | 200 |

LAR-104* | 374819.0 | 7435928.8 | 1011.1 | 270 | -60 | 90 |

LAR-105* | 374756.9 | 7435930.3 | 1021.1 | 310 | -60 | 120 |

LAR-106 | 374667.8 | 7435994.3 | 978.2 | 310 | -60 | 200 |

MAR-173 | 375211.8 | 7436015.1 | 1149.2 | 220 | -60 | 200 |

MAR-174 | 374950.1 | 7435617.8 | 1111.9 | 270 | -60 | 470 |

*Target depth not reached

Sampling and Assay Protocol

True widths cannot be determined with the information available at this time. RC holes were sampled on a 2m continuous basis, with dry samples riffle split on site and one quarter sent to the Andes Analytical Assay preparation laboratory in Calama and the pulps then sent to the same company laboratory in Santiago for assaying. A second quarter was stored on site for reference. Samples were prepared using the following standard protocol: drying; crushing to better than 85% passing -10#; homogenizing; splitting; pulverizing a 500-700g subsample to 95% passing -150#; and a 125g split of this sent for assaying. All samples were assayed for %CuT (total copper) and %CuS (acid soluble copper) by AAS. A full QA/QC program, involving insertion of appropriate blanks, standards and duplicates was employed with acceptable results. Pulps and sample rejects are stored by Marimaca Copper for future reference.

Qualified Person

The technical information in this news release, including the information that relates to geology, drilling and mineralization was prepared under the supervision of, or has been reviewed by Paola Kovacic, Exploration Manager, Marimaca Copper Corp, a geologist with more than 20 years of experience and a member of the Colegio de Geólogos de Chile and of the Society of Economic Geologist USA, , and who is the Qualified Person for the purposes of NI 43-101 responsible for the design and execution of the drilling program.

The QP confirms she has visited the project area, has reviewed relevant project information, is responsible for the information contained in this news release, and consents to its publication.

Contact Information

For further information please visit www.marimaca.com or contact:

Tavistock

+44 (0) 207 920 3150

Emily Moss / Adam Baynes

marimaca@tavistock.co.uk

Forward Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Marimaca Copper, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: risks related to share price and market conditions, the inherent risks involved in the mining, exploration and development of mineral properties, the uncertainties involved in interpreting drilling results and other geological data, fluctuating metal prices, the possibility of project delays or cost overruns or unanticipated excessive operating costs and expenses, uncertainties related to the necessity of financing, the availability of and costs of financing needed in the future as well as those factors disclosed in the annual information form of the Company dated March 28, 2022, the final short form base prospectus and other filings made by the Company with the Canadian securities regulatory authorities (which may be viewed at www.sedar.com). Accordingly, readers should not place undue reliance on forward-looking statements. Marimaca Copper undertakes no obligation to update publicly or otherwise revise any forward-looking statements contained herein whether as a result of new information or future events or otherwise, except as may be required by law.

Neither the Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Yahoo Finance

Yahoo Finance