Man wants to ‘gift’ his teen son a house but is worried it’s a bad move. Dave Ramsey had a surprising response

American baby boomers are expected to pass on an astronomical $84 trillion in inheritances to their heirs over the next 20 years in what’s being dubbed “the great wealth transfer.”

However, offering monetary gifts to adult kids can be tricky. On one hand, many parents likely want to do everything they can to offer their kids an advantage in this inhospitable economy. On the flip side, some may worry whether their kids are ready for a sudden influx of wealth.

Don't miss

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

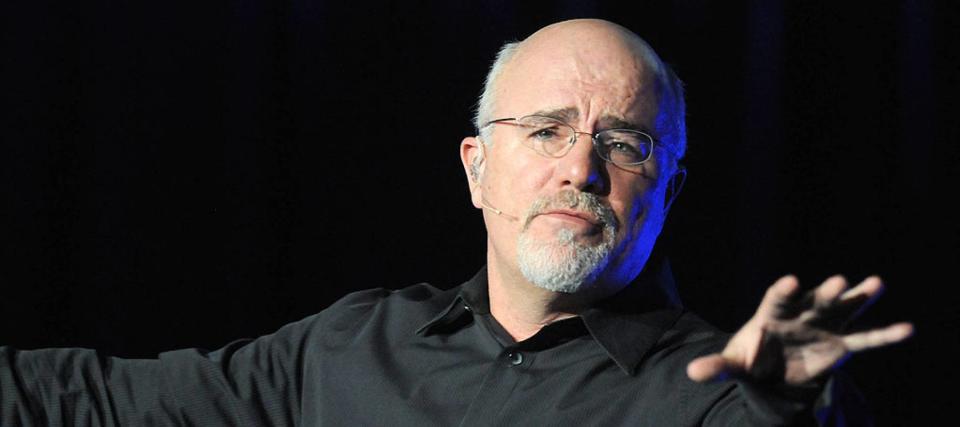

A caller on The Ramsey Show was grappling with this exact dilemma. He told personal finance guru Dave Ramsey that he wanted to “gift” his childhood home to his 18-year-old son — but he wasn’t sure if it was a “bad idea.”

The caller went on to sing his son’s praises, saying he “couldn’t ask for a better kid.” He added that his son has always excelled at school and now holds down a job at a factory. However, he worries his son is too young to handle the responsibilities that come with homeownership.

Ramsey was surprisingly open to the idea, albeit with a few caveats.

Gifts with strings attached

“Yeah I’d give it to him,” Ramsey confirmed after listening to the caller speak highly of his son. “But I’d put some terms on it.”

Parents who offer early inheritances or large cash gifts to their adult kids is hardly unusual. According to a poll conducted by YouGov, 79% of first-time homebuyers —between the ages of 18 and 29 — had some financial assistance for down payments from their parents.

In general, 65% of parents admitted to providing some sort of financial assistance to their adult kids between the ages of 22 and 40, according to a USA Today study.

As of 2024, the federal lifetime gift and estate tax exemption amount is $13.61 million per person, so transferring a property to your adult child as a gift should have minimal tax consequences depending on the property’s market value.

Such a transfer could be a game-changer for young adults. The ongoing housing crisis has made homeownership unattainable for many young Americans who are just getting their careers started or are trying to raise a family. The gift of a house — or enough money to cover a down payment — could be a serious advantage in this environment.

“He’s setting his son up for life by doing this,” wrote one viewer on Ramsey’s YouTube video.

“I wish more parents understood what this means for kids today,” wrote another.

However, Ramsey insisted that such a gift needs to have some strings attached. “I would put some terms on it,” he said, suggesting that the caller’s son should have solid plans for his life beyond owning a home.

Ramsey also recommended that the caller’s son consider any maintenance or renovations the property may need in the future and to have money set aside for that.

The biggest caveat, though, in Ramsey’s eyes, is that the son had to promise his dad that he would “never borrow any money” down the road. These conditions could help limit the risk that this inheritance will be squandered by the young adult.

Many young Americans could be poised to receive similar gifts — without any guardrails — in the coming years.

Read more: Generating 'passive income' through real estate is the biggest myth in investing —but here's one surefire way to do it without breaking the bank

The great wealth transfer

As the baby boomer generation ages, younger generations could be in line for a massive influx of wealth. Assets collectively worth $84 trillion could change hands within the next 20 years, according to estimates from Cerulli Associates.

Many of these assets are likely real estate, with Freddie Mac estimating a “silver tsunami” of nine million homes coming to market over the next decade.

It’s a situation that experts say could reset a historic divide when it comes to personal finance and homeownership for younger generations. As a result, millennials, in particular, will benefit the most, offering them opportunities to buy property, pay off student debt, invest and travel, according to Forbes.

Those who receive an early inheritance, passed down by their parents during their lifetime — like the caller’s son — are some of the first beneficiaries of this "great wealth transfer". It’s expected to make millennials the richest generation in American history.

What to read next

Jeff Bezos told his siblings to invest $10K in his startup called Amazon, and now their stake is worth over $1B — 3 ways to get rich without having to gamble on risky public stocks

Retire richer — why people who work with a financial advisor retire with an extra $1.3 million

The US dollar has lost 87% of its purchasing power since 1971 — invest in this stable asset before you lose your retirement fund

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance