Is Magellan Aerospace Corporation (TSE:MAL) An Attractive Dividend Stock?

Is Magellan Aerospace Corporation (TSE:MAL) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

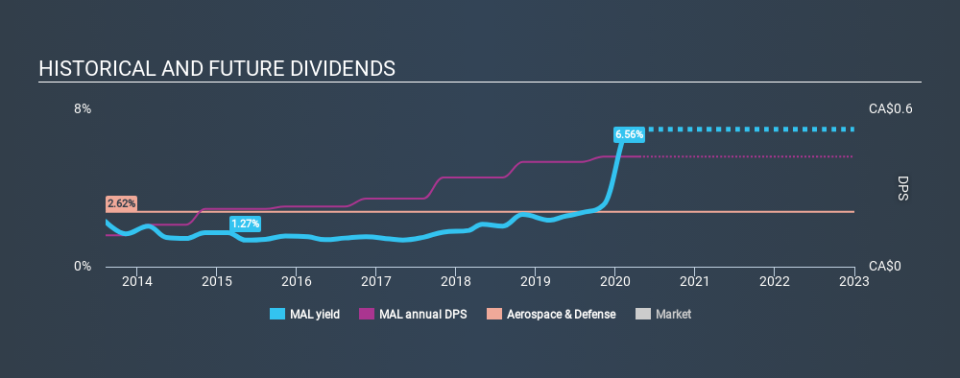

With a seven-year payment history and a 6.6% yield, many investors probably find Magellan Aerospace intriguing. We'd agree the yield does look enticing. Remember though, given the recent drop in its share price, Magellan Aerospace's yield will look higher, even though the market may now be expecting a decline in its long-term prospects. Some simple analysis can reduce the risk of holding Magellan Aerospace for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Magellan Aerospace paid out 35% of its profit as dividends, over the trailing twelve month period. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. The company paid out 50% of its free cash flow, which is not bad per se, but does start to limit the amount of cash Magellan Aerospace has available to meet other needs. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

We update our data on Magellan Aerospace every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Magellan Aerospace has been paying a dividend for the past seven years. Its dividend has not fluctuated much that time, which we like, but we're conscious that the company might not yet have a track record of maintaining dividends in all economic conditions. During the past seven-year period, the first annual payment was CA$0.12 in 2013, compared to CA$0.42 last year. This works out to be a compound annual growth rate (CAGR) of approximately 20% a year over that time.

We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Earnings have grown at around 3.6% a year for the past five years, which is better than seeing them shrink! A payout ratio below 50% leaves ample room to reinvest in the business, and provides finanical flexibility. However, earnings per share are unfortunately not growing much. Might this suggest that the company should pay a higher dividend instead?

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Firstly, we like that Magellan Aerospace pays out a low fraction of earnings. It pays out a higher percentage of its cashflow, although this is within acceptable bounds. Second, earnings growth has been ordinary, and its history of dividend payments is shorter than we'd like. In sum, we find it hard to get excited about Magellan Aerospace from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 2 warning signs for Magellan Aerospace that investors need to be conscious of moving forward.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance