Update: Madison Square Garden (NYSE:MSG) Stock Gained 55% In The Last Three Years

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, the The Madison Square Garden Company (NYSE:MSG) share price is up 55% in the last three years, clearly besting than the market return of around 36% (not including dividends).

View our latest analysis for Madison Square Garden

We don't think that Madison Square Garden's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Madison Square Garden's revenue trended up 15% each year over three years. That's a very respectable growth rate. The share price gain of 16% per year shows that the market is paying attention to this growth. If that's the case, then it could be well worth while to research the growth trajectory. Of course, it's always worth considering funding risks when a company isn't profitable.

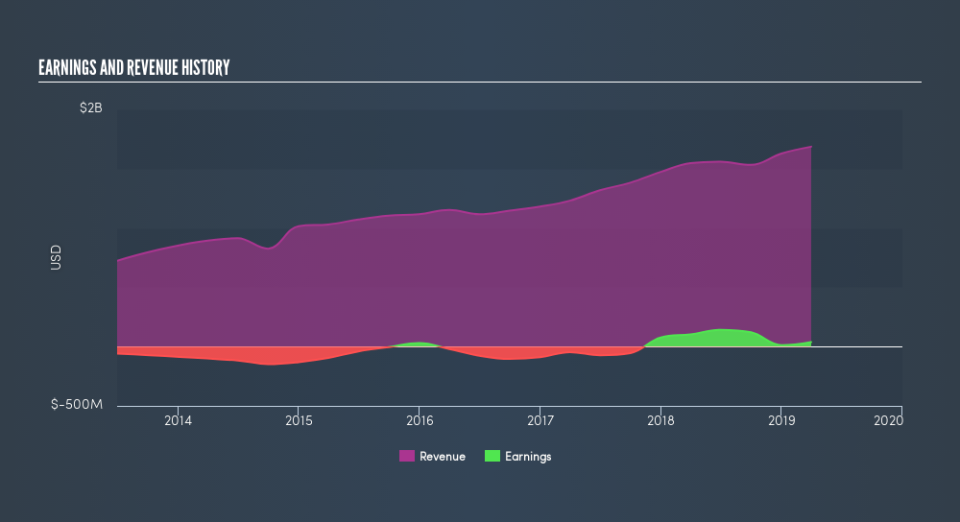

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Madison Square Garden has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Over the last year, Madison Square Garden shareholders took a loss of 13%. In contrast the market gained about 5.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 16% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance