Macy's (NYSE:M) Reports Strong Q1

Department store chain Macy’s (NYSE:M) reported Q1 CY2024 results exceeding Wall Street analysts' expectations , with revenue down 3.3% year on year to $5 billion. The company expects the full year's revenue to be around $22.6 billion, in line with analysts' estimates. It made a non-GAAP profit of $0.27 per share, down from its profit of $0.56 per share in the same quarter last year.

Is now the time to buy Macy's? Find out in our full research report.

Macy's (M) Q1 CY2024 Highlights:

Revenue: $5 billion vs analyst estimates of $4.81 billion (3.9% beat)

EPS (non-GAAP): $0.27 vs analyst estimates of $0.17 ($0.10 beat)

The company slightly raised its revenue and EPS (non-GAAP) guidance for the full year at the midpoint and both are slightly above analyst estimates

Gross Margin (GAAP): 41.1%, down from 42.2% in the same quarter last year

Free Cash Flow was -$100 million compared to -$191 million in the same quarter last year

Same-Store Sales were down 1.2% year on year

Market Capitalization: $5.26 billion

“We are encouraged by our customers’ response to our Bold New Chapter strategy resulting in sales near the high end of our outlook. Our teams executed with discipline and efficiency, which contributed to first quarter earnings that exceeded our expectations,” said Tony Spring, chairman and chief executive officer of Macy’s,

With a storied history that began with its 1858 founding, Macy’s (NYSE:M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Department Store

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

Sales Growth

Macy's is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

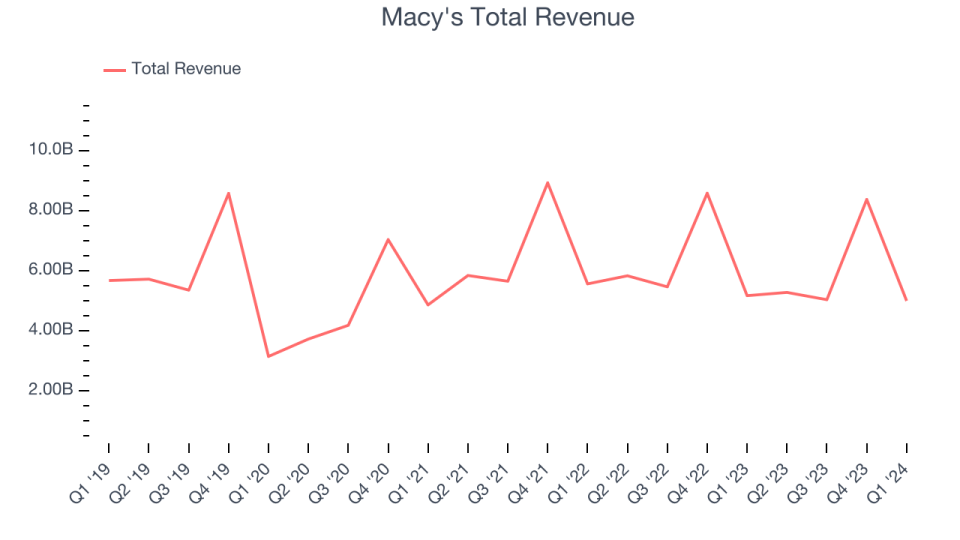

As you can see below, the company's revenue has declined over the last four years, dropping 1.6% annually as its store count and sales at existing, established stores have both shrunk.

This quarter, Macy's revenue fell 3.3% year on year to $5 billion but beat Wall Street's estimates by 3.9%. Looking ahead, Wall Street expects revenue to decline 6.2% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

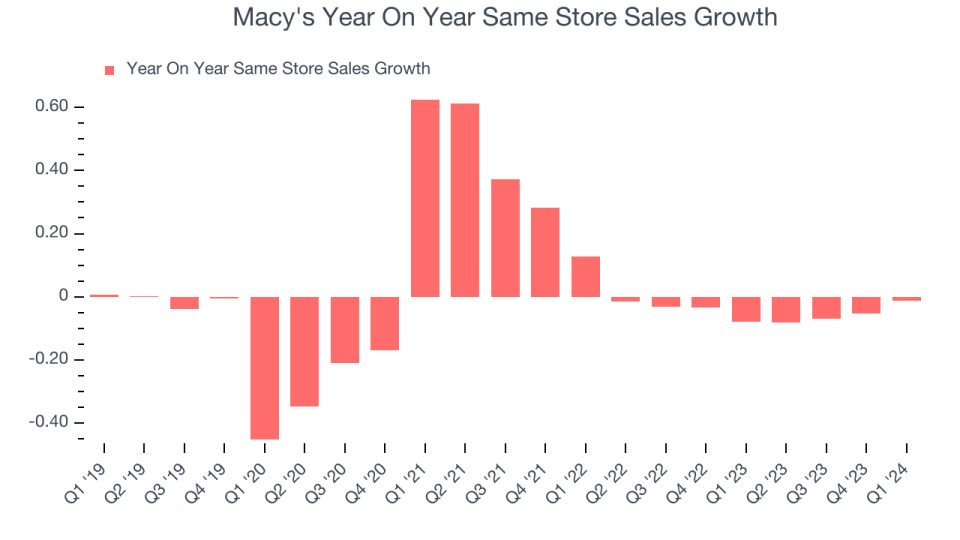

Macy's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 4.7% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Macy's same-store sales fell 1.2% year on year. This decrease was an improvement from the 7.9% year-on-year decline it posted 12 months ago. It's always great to see a business improve its prospects.

Key Takeaways from Macy's Q1 Results

Revenue beat on better same-store sales. Margins were solid and EPS beat as well. As a result, the company raised its full year EPS guidance, which came in above expectations. Zooming out, we think this was a solid quarter that shareholders will appreciate. The stock is up 1.5% after reporting and currently trades at $19.4 per share.

Macy's may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance