Macy's (M) Q1 Earnings Beat Estimates, Comps Decline Y/Y

Macy’s, Inc. M has reported first-quarter fiscal 2024 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate. However, total revenues and earnings declined from the year-ago quarter’s reported figures. Comparable sales fell on an owned basis and an owned-plus-licensed basis.

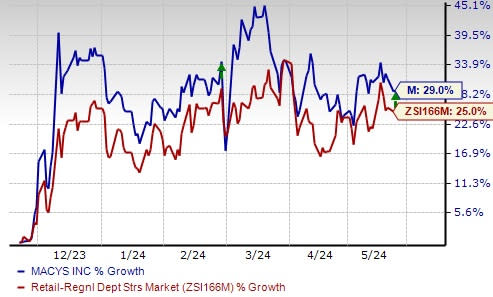

M shares have gained 29% in the past six months compared with the industry’s 25% growth.

Sales & Earnings Picture

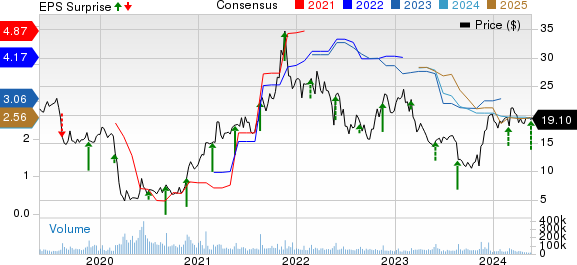

Macy’s, currently carrying a Zacks Rank #3 (Hold), reported adjusted earnings of 27 cents per share, surpassing the Zacks Consensus Estimate of 18 cents. However, the bottom line decreased from adjusted earnings of 56 cents per share in the year-ago period.

Net sales of $4,846 million beat the consensus estimate of $4,836 million. However, the top line dipped 2.7% from the year-ago quarter. Comparable sales fell 1.2% on an owned basis and 0.3% on an owned-plus-licensed basis from the prior-year quarter. We expected comparable sales to decline 3.5% on an owned basis and 3.4% on an owned-plus-licensed basis.

Macy's, Inc. Price, Consensus and EPS Surprise

Macy's, Inc. price-consensus-eps-surprise-chart | Macy's, Inc. Quote

Macy's comparable sales for its ongoing business, which includes physical locations and online sales, decreased 0.9% year over year on an owned basis but increased 0.1% when including owned, licensed and marketplace sales.

Net credit card revenues were $117 million, down 27.8% from the year-ago period. The metric represented 2.4% of sales, down 90 basis points from the year-ago quarter. This was due to the impacts of expected higher delinquency rates and net credit losses within the portfolio.

Details by Brand

Comparable sales across Macy’s declined 1.6% year over year on an owned basis and 0.4% on an owned-plus-licensed basis. At the Bloomingdale’s brand, comparable sales increased 0.8% on an owned basis and 0.3% on an owned-plus-licensed basis. Comparable sales at the Bluemercury brand rose 4.3% on an owned basis.

Image Source: Zacks Investment Research

Margins

The gross margin was 39.2% compared with our estimate of 39.6%. The metric decreased from 40% in the prior-year quarter. The merchandise margin fell 100 basis points mainly due to increased discounts on slow-selling warm-weather products. Delivery costs, as a percentage of net sales, increased 20 basis points from the previous year, reflecting continued efforts to enhance supply-chain efficiency.

The company reported selling, general and administrative (SG&A) expenses of $1.91 billion, down from $1.95 billion in the year-ago period. As a percentage of net sales, SG&A expenses increased 50 basis points year over year to 38.2% on lower net sales and credit card revenues. Our estimate for SG&A as a percentage of net sales was 40.9% for the quarter under review.

Macy’s reported an adjusted EBITDA of $364 million, down from an adjusted EBITDA of $468 million in the year-ago quarter. We note that the adjusted EBITDA margin was 7.5%, down 190 basis points year over year.

Other Financial Aspects

Macy’s ended the quarter with cash and cash equivalents of $876 million, long-term debt of $2.99 billion and shareholders' equity of $4.19 billion. Merchandise inventories rose 1.7% on a year-over-year basis. In the first quarter of fiscal 2024, Macy’s provided cash from operating activities of $129 million.

A Peek Into Guidance

Macy's continues to regard fiscal 2024 as a transition and investment year, reflecting its commitment to key customer-focused strategic initiatives, which are supported by its strong balance sheet. Per the outlook, customers will remain selective in their discretionary spending. The view also provides Macy's with the flexibility to adapt to changes in the competitive landscape and promotional environment.

Net sales are projected to be $22.3-$22.9 billion, suggesting a decline from the $23.1 billion reported in fiscal 2023. Comparable owned-plus-licensed sales on a 52-week basis are expected between a 1% decrease and an increase of up to 1.5% from that reported in 2023.

The gross margin is anticipated to be 39-39.3% for the fiscal year. The adjusted EBITDA margin is estimated to be 8.7-9% of the total revenues. The SG&A expense rate is expected to be 36.3-36.4%. Adjusted earnings per share are envisioned to be $2.55-$2.90 for fiscal 2024, implying a decline from the $3.50 earned in the prior year. Capital expenditure is anticipated to be $875 million.

Key Picks

Some better-ranked stocks are The Gap, Inc. GPS, Casey's General Stores, Inc. CASY and Abercrombie & Fitch Co. ANF.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GPS’s current fiscal-year earnings and sales indicates declines of 0.3% and 4.2%, respectively, from the year-ago reported figures. GPS has a trailing four-quarter average earnings surprise of 180.9%.

Casey's offers a comprehensive range of products and services to meet the needs of its customers. It currently has a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Casey's current financial-year earnings indicates growth of 10.4% from the year-earlier reported levels. CASY has a trailing four-quarter average earnings surprise of 12%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. It currently has a Zacks Rank of 2. ANF has a trailing four-quarter average earnings surprise of 715.6%.

The Zacks Consensus Estimate for Abercrombie’s current fiscal-year earnings and sales indicates growth of 20.9% and 5.9%, respectively, from the prior-year actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance