France’s Snap Election Shakes Investor Confidence in Economy

(Bloomberg) -- French President Emmanuel Macron’s bid to block Marine Le Pen’s path to power by calling snap elections rattled investors, raising further questions about already stretched public finances and the future of his pro-business agenda.

Most Read from Bloomberg

Russia Is Sending Young Africans to Die in Its War Against Ukraine

Investment Bank Moelis Probes Incident After Video of Employee Appearing to Punch Woman

Macron Gambles on Snap French Election in Bid to Stop Le Pen

Stocks Eke Out Gains in Fed Run-Up as Euro Falls: Markets Wrap

New York Fed Is Losing Talent and ‘Street Cred’ Under John Williams

The nation’s assets sold off sharply on Monday, with investors demanding the highest yield to own French bonds rather than those of Germany since December. The euro sank to its weakest in a month, while the CAC 40 equity index in Paris slumped 2.4%, with shares in top French banks shedding as much as 9%.

The vote risks becoming the ultimate showdown over Macron’s trademark economic policies, which had largely reassured investors and businesses since he took office in 2017. In particular, plugging holes in the budget will become even more challenging if he loses control over parliament and the government.

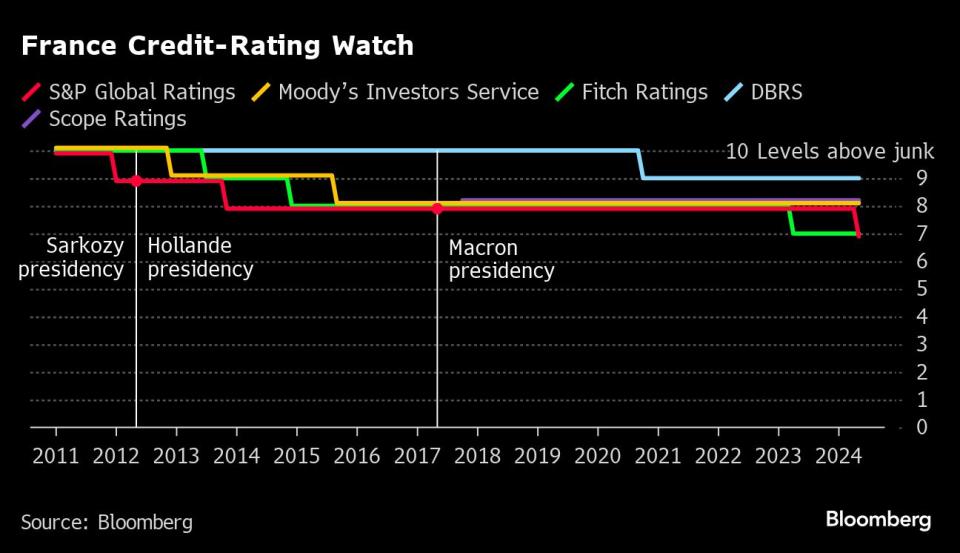

S&P Global Ratings last month downgraded the nation’s credit score, saying the deficit will remain above 3% of gross domestic product through 2027. France’s fiscal watchdog says the government’s deficit strategy lacks coherency and credibility, while the International Monetary Fund called for “substantial” additional efforts.

Listen to The Big Take daily podcast today

“Macron is taking a chance with domestic policy, which could backfire, leading to stalling of reform efforts,” said David Chappell, a senior fund manager at Columbia Threadneedle Investments, which has $652 billion of assets under management.

While Macron’s government spent vast sums to shelter households and companies from the Covid pandemic and energy transition, the president has preserved a focus on longer-term savings with growth-friendly reforms of pensions, labor laws and the welfare system. French unemployment has declined markedly during Macron’s time in office and economic growth proved more resilient to crises than in other European countries.

His approach has faced growing resistance, both in parliament and in street protests. After losing his absolute majority at the National Assembly in 2022, Macron was already struggling to get legislation through parliament without resorting to a constitutional tool to bypass votes.

A crushing defeat in the European Parliament election on Sunday was the latest warning shot.

But fresh elections at the end of the month are unlikely to deliver a clear majority to get back on track — barring an exceptional moment of unity between fractious political groups. More challenging still, it gives Le Pen the opportunity to win a majority that would definitively end Macron’s economic leadership.

“A right-wing majority in the Parliament would hamper any reform plans,” said Mohit Kumar, chief economist for Europe at Jefferies International, who maintains his bearish stance on France’s bonds. “The deficit picture in France is already weak.”

The rate on 10-year government securities rose as much as 13 basis points to 3.23% on Monday, widening the spread to equivalent German notes — the region’s safest — to 55 basis points.

The political turmoil also hit the euro, which fell as much as 0.6% to $1.0733 on Monday, its weakest in a month. The move pares an almost 2% rally since mid-April as traders added to bets of European Central Bank rate cuts this year.

While Macron’s outgoing team advanced €20 billion ($21.5 billion) of spending cuts to fight the deterioration in fiscal metrics caused by weaker growth at the end of last year, the measures were insufficient to avoid revising the longer-term plans for reducing the public debt burden. S&P said the budget deficit will remain above 3% of gross domestic product through 2027.

“The recent downgrade of the French sovereign rating could lead investors to question the capacity of European governments to support the economic recovery,” said Theophile Legrand, a rates strategist at Natixis SA.

Le Pen has described Macron’s management of public finances as “catastrophic,” but it’s not clear what kind of approach she would take to tax and spending. Her party has in the past proposed measures including cutting sales taxes and lowering levies on fuel.

The center-right Républicains, who could potentially be an ally for Macron’s party, have also slammed his fiscal policy and were already threatening to use a no-confidence vote to bring down the government.

Meanwhile, leftist parties have called for higher taxes on multi-national companies and the wealthiest to reduce the public debt burden — a move Macron’s government has repeatedly ruled out.

“We’ve got results on employment, industry, and attractiveness of the country. I don’t want these results to be thrown in a river by a bad mood or discontent three weeks from now,” Finance Minister Bruno Le Maire said on RTL radio Monday.

--With assistance from James Hirai, Greg Ritchie and Sujata Rao.

(Updates price moves throughout.)

Most Read from Bloomberg Businessweek

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

Sam Altman Was Bending the World to His Will Long Before OpenAI

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance